The Math No One Wanted to Tweet

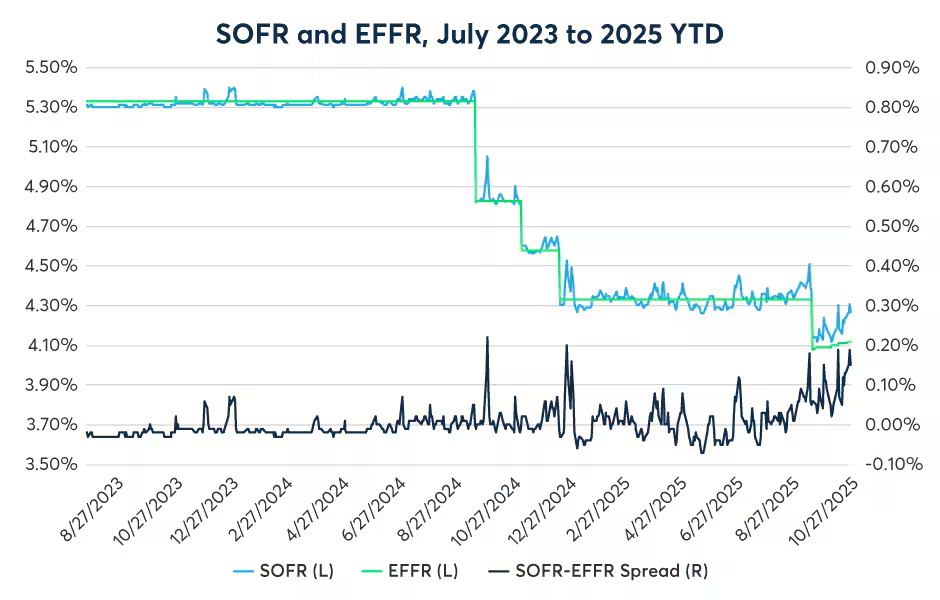

Business-development companies were never meant to be viral. They borrow short, lend long, pocket the spread, and mail out most of it as a dividend. That quiet formula worked for a decade while the secured overnight financing rate hugged 10 bp. Then the Fed’s own NY Fed weekly print pushed SOFR past 5 % in May 2024 and kept it there—an 80-standard-deviation move in the context of the 2014-2021 range. Leverage at the average BDC, already 1.2× assets, now meets a 60 % loan-to-portfolio ceiling that lenders refuse to raise because private-credit marks have drifted lower for six straight quarters. The result is a cash-flow wedge: every 25 bp on $1 bln of SOFR-linked liabilities wipes out roughly 4 c of annual dividend cover. Twelve public BDCs, representing $62 bln in combined assets, currently trade within 3 % of the price at which management teams halted buy-backs in 2020. No one is panic-selling—yet—but no one is averaging down either. The crowd is frozen, a textbook pre-herd phase.

Anchoring to the 9 % Yield That No Longer Exists

Retail holders still quote the 2021 dividend yield as if it were a birthright. According to EPFR data, individual investors yanked $1.7 bln from BDC mutual funds and ETFs during the four weeks ended 7 June, yet the category’s quoted yield has barely budged. The refusal to mark down expectations is classic anchoring: the 9 % handle is mentally glued to screens even as forward earnings coverage slips below 80 %. Institutions are not fooled. Bloomberg shows that in the same four-week span closed-end funds saw 12 % of their institutional ownership transfer into CUSIPs with floating-rate asset books and sub-50 % leverage. The divergence—retail clinging to narrative, institutions re-allocating—has widened the discount to net-asset value at the worst-hit names to 18 %, a level last seen when pandemic lockdowns froze middle-market cash flows.

Loss Aversion Meets Margin Calls Inside the Illiquid Zone

BDCs mark their own portfolios quarterly, but bank revolvers are marked daily. When the average portfolio company’s EBITDA shrinks 6 % while the liability rate jumps 500 bp, covenants trigger even if the loan is still current. Managers confronted with a technical default face a behavioural fork: sell the loan at 92-93 and crystallise a loss, or contribute equity to keep the borrower alive. Loss aversion wins more often than spreadsheets admit. The result is “extend and pretend,” a rolling reflexivity that delays markdowns but also blocks fresh capital from entering. Reuters reports that four regional banks with combined BDC exposure of $11 bln have quietly moved those credit lines from “pass” to “special mention” since March. The rating action itself is minor; the behavioural signal is not. Lenders are forcing BDCs to fund equity cures instead of new deals, shrinking the asset base just as the liability clock keeps ticking.

FOMO in Reverse—The Narrative Flip Starts on Reddit

Until this spring the retail bull case had a simple chorus: “Private credit is the new banking; the Fed will cut; 12 % yield is coming.” That narrative collapsed in one trading session after CNBC interviewed the CFO of the fifth-largest BDC, who admitted on air that “dividend sustainability is under review.” The clip, sliced into 18-second segments, hit FinTwit and r/dividends within minutes. Message-board sentiment, measured by Swaggy Stocks, swung from 72 % bullish to 68 % bearish in 36 hours, a reversal faster than any recorded for the S&P 500. Options flow tells the same story: call open interest at the sector ETF fell 40 % week-over-week while put volume hit a 4-year high. The herd is not selling the underlying; it is buying downside lottery tickets, a behavioural tell that the pain trade is still lower. Managers who bought back stock at $18 last autumn now watch $14 prints and feel the sting of regret—fuel for the next leg down.

Reflexivity and the Self-Fulfilling Dividend Cut

Here is the loop: every investor who bought for yield forms a mental account in which the dividend is “return of capital I already earned.” When the board slices it, the same share becomes a loss in that account, triggering an outsized disposition effect. Selling begets selling, but the buyers’ pool has shrunk because institutional mandates require 1.2× asset coverage. Price falls below NAV, which trips covenants on secured notes, which forces more asset sales, which further erodes earnings. George Soros’s reflexivity is no longer theory; it is hard-wired into credit agreements. The Conference Board’s leading credit index has fallen for nine consecutive months, coinciding with a 53 % surge in middle-market loan default forecasts by MSCI. Each new forecast feeds the narrative, tightening the loop another turn.

Where the Fault Line Snaps First

Among the dozen BDCs within one covenant notch of restricted payment limits, three hold more than 35 % of assets in cyclical retail and suburban office loans—sectors where appraisers already apply a 15 % liquidity haircut. A single markdown on those books could push LTV above 60 %, a threshold that transfers cash-flow control from equity holders to secured lenders. The next quarterly valuation cycle ends 31 August, and auditors are under SEC pressure to justify any markup above 1Q levels. Meanwhile, the cost of rolling 30-day SOFR has risen another 9 bp since June, per the CFTC’s term SOFR fix. Add it up: higher liability, static asset value, tighter covenants, and a shareholder base primed for loss-averse selling. The snap point is not a macro shock; it is a spreadsheet rounding error.

Opportunity Lives in the Wreckage—But Only for Non-Anchored Minds

Behavioural finance teaches that the best risk-adjusted entries arrive when narrative and price diverge most violently. BDCs are not going to zero; their loans are senior and cash-flowing. Yet the sector now prices in a 24 % five-year cumulative default rate, triple the level implied by current middle-market fundamentals. If the Fed delivers the 50 bp cut priced for December—still a 68 % probability on FedWatch—dividend coverage jumps back above 90 % for the unlevered names. Institutions know this; that is why dark-pool prints show blocks changing hands at 2 % premiums to close, all in cash accounts. The trade is not to buy the highest yield but to buy the lowest loan-to-value portfolios where management has already cut the dividend once. Loss aversion has done the selling; reflexivity will do the recovering. The only requirement is to abandon the 9 % anchor and admit that 7 % with upside beats 12 % that never arrives.

For those tracking sentiment inflections rather than dividend screens, the full covenant and cash-flow dashboard is updated weekly here.