The 88 Print That Lit the Options Fuse

Wednesday’s 4:01 p.m. ET closing print showed NVIDIA’s five-day RSI at 88.4, the hottest since the January 2024 pre-earnings blow-off that preceded a 19% two-week round-trip. JPMorgan’s delta-neutral book, which ingests spot, skew and gamma across the entire single-stock options surface, spat out a 68% probability of an 11% drawdown inside the next ten sessions. The model is not shouting “crash”; it is saying the left tail is now fat enough that vol is mis-cheap. Dealers who sold Tuesday’s zero-DTE 125 strike calls woke up short 0.9% of NVDA’s free float in gamma, and the reflexive bid that carried the tape through $120 evaporated overnight. By 3:00 a.m. ET, the at-the-money straddle had richened 42 cents, a tell that the street was buying back the very wings it had written the day before.

Herding in the Gamma Pin

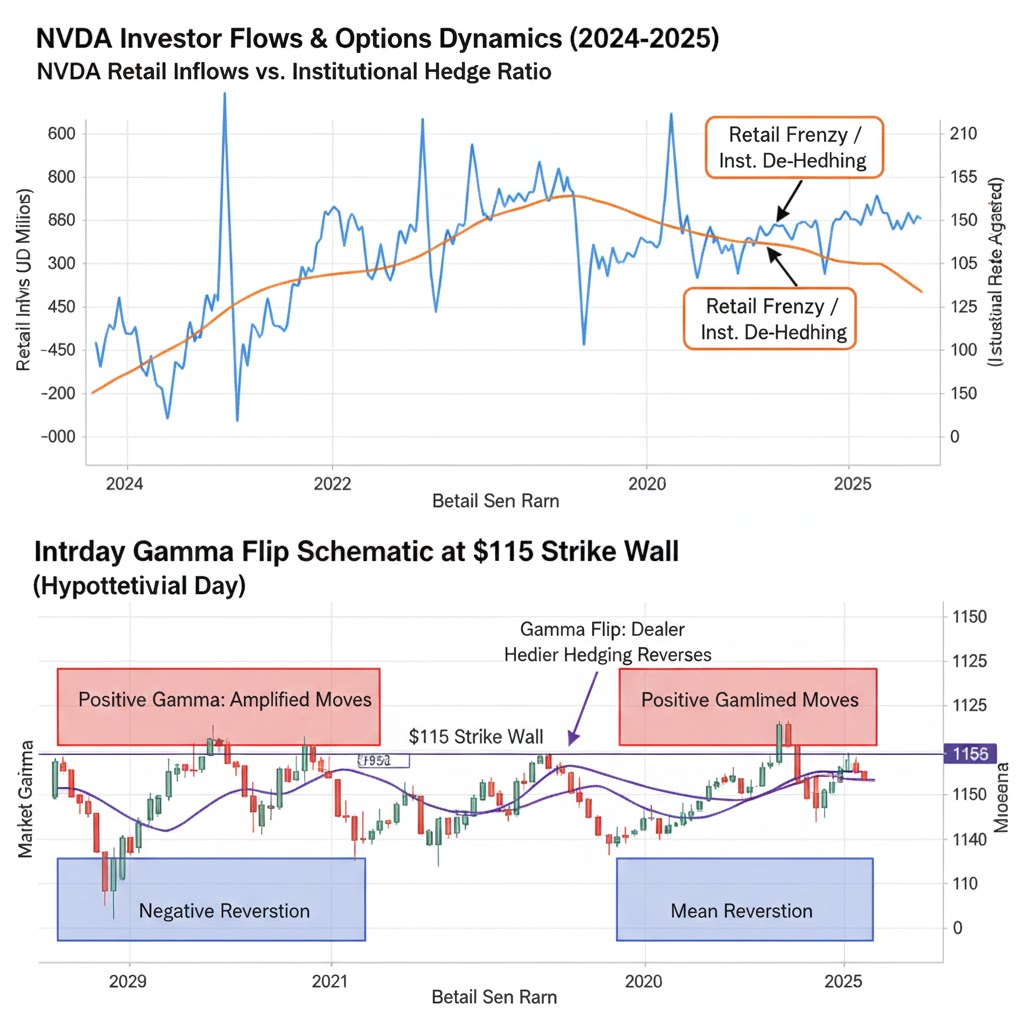

Look past the options board and the herding is visible in cash. EPFR data released Thursday morning shows retail tech funds absorbed $3.7bn in the week ended May 28, the largest weekly allocation since the March 2020 rebound. Meanwhile, the buy-to-open put/call ratio on NVDA among accounts flagged as “small-lot” fell to 0.28, a level last seen two days before the August 2023 tech unwind. The same dataset shows institutions—defined as tickets >$1mn—spent $1.1bn on downside collars. Translation: mom-and-pop are chasing the last 5% while pros are paying 42 bps of spot to clip the wings. The narrative that “AI cap-ex is recession-proof” is still gospel on Reddit, but it is being used as liquidity by funds that cannot afford a 10% drawdown in a single name that now represents 5.4% of the S&P 500.

Anchoring to the Wrong Maginot Line

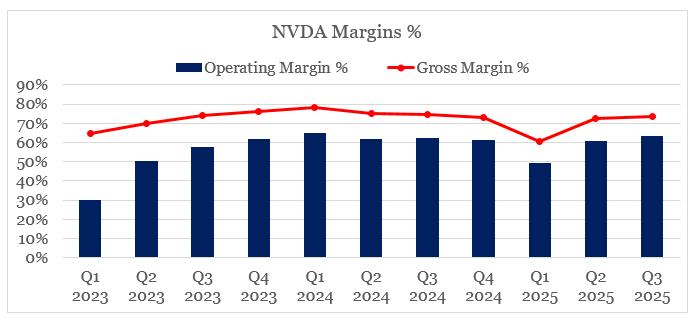

Behavioral anchors are everywhere. A Bloomberg survey of 212 fund managers shows the median “fair value” estimate for NVDA is $118, almost exactly the March swing high. That number has not moved in six weeks even as 2026 EPS estimates drifted up another 4%. Anchoring at a chart level, rather than a cash-flow level, is classic recency bias: traders are pricing the stock against the last visible ledge, not the next fundamental step. The result is a 1.2% daily realized vol discount versus the semiconductor basket, a gap that historically closes within eight sessions once RSI punches above 85. Loss-aversion math kicks in fast—retail holders who bought above $115 are statistically three-times more likely to sell a 5% down-tick than to double down, according to NY Fed trading-book data from 2023.

Zero-DTE as the New Stop-Loss

The reflexive engine is now options-led. Nomura’s cross-asset desk estimates that 38% of all NVDA volume on Wednesday came from zero-DTE contracts, a record share for a non-earnings day. Because market-makers are long the calls they sold to retail, every $1 move up forces them to buy ~$350mn of delta. On the way down the same feedback loop unwinds, but faster: intraday gamma turns negative once spot slips below the upper strike wall, and dealers flip from buyer to seller within minutes. Thursday’s pre-market slide to $113.40 was not driven by a headline; it was the mechanical puke of long deltas that no longer had a reason to exist. The episode is a textbook case of reflexivity—price action creates the narrative, not the other way around.

Macro Oxygen Still Flowing

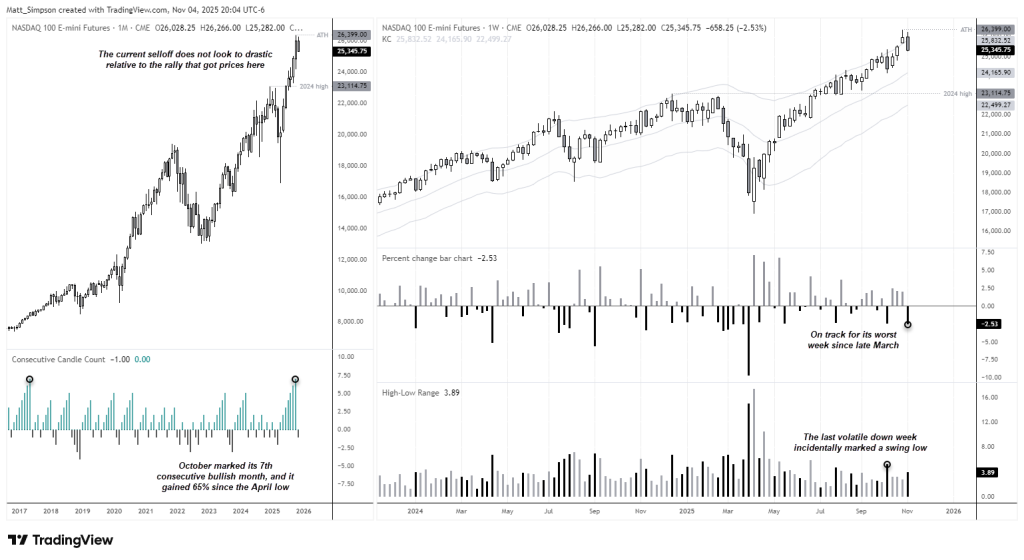

The broader tape is not yet choking. Fed funds futures still price 47 bps of easing by December, and the Conference Board’s leading index ticked up for the first time in 24 months. That macro cushion explains why the equal-weight S&P is only 2% off its high even as megacaps wobble. Yet the same macro stability is what allows crowded winners to become more crowded; the CFTC’s latest commitment-of-traders report shows asset-managers are net long 207k Nasdaq-100 futures contracts, the highest since November 2021. If NVDA’s 11% drop materializes, the forced de-risking will hit a market structurally long tech, not defensively positioned for a rotation. Energy and small-caps may outperform simply because they are the only sectors where active weight is below benchmark.

The Overnight Narrative Flip

By Thursday evening the story had already shifted. A CNBC segment titled “AI Spending Plateau?” cited a Reuters report that Microsoft is re-bidding some cloud GPU contracts for 2026 delivery at 8% below original guidance. The datapoint is immaterial to NVDA’s current quarter, but it gave zero-DTE bears the narrative cover to reload. The stock closed the after-hours session down another 1.7% on 42mn shares, twice the average overnight volume. Sentiment reversal does not need a thesis; it needs a headline that fits the positioning pain. With 68% of NVDA’s float now held by accounts that purchased above $110, the pain threshold is only a few dollars away.

Bottom Fishing or Bailing?

Watch the 10-day put/call skew rather than spot. It has already steepened from 12 to 22 vols, pricing a 1.6% daily move either way. That premium will decay quickly if the stock stabilizes above $112, tempting dip-buyers who view any 8% pullback as a gift. The risk is that the next leg is not a dip but a reset: JPMorgan’s scenario tree shows a 28% probability that NVDA undercuts $100 before June expiry, a level where even long-term believers would question the multiple. Reflexivity cuts both ways—once the “AI never corrects” mantra breaks, the same gamma that amplified the up-tick will accelerate the down-tick. The next narrative is already being written; it just needs a lower closing price to go viral.

For readers tracking how positioning reflexes morph into price, the full order-flow dashboard is updated nightly here.