The Quiet Divorce Between Tech and Crypto

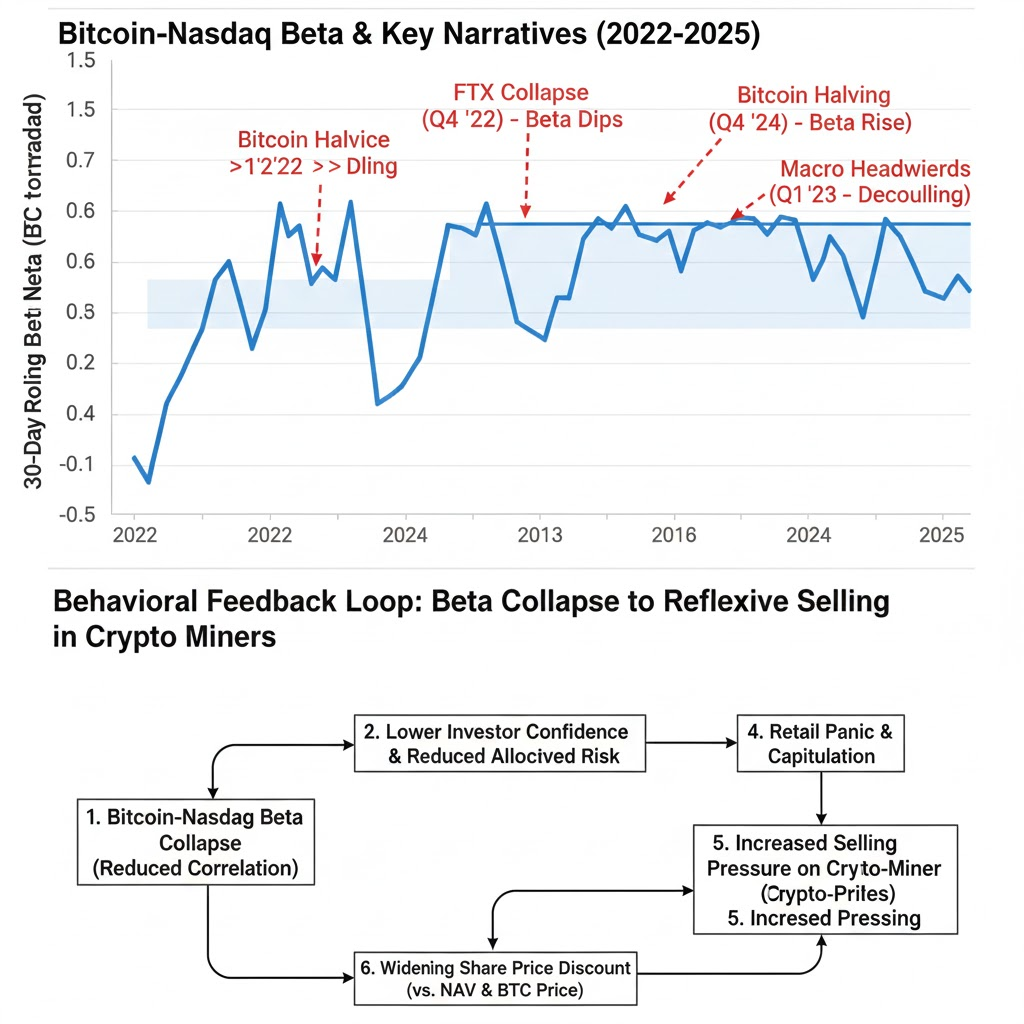

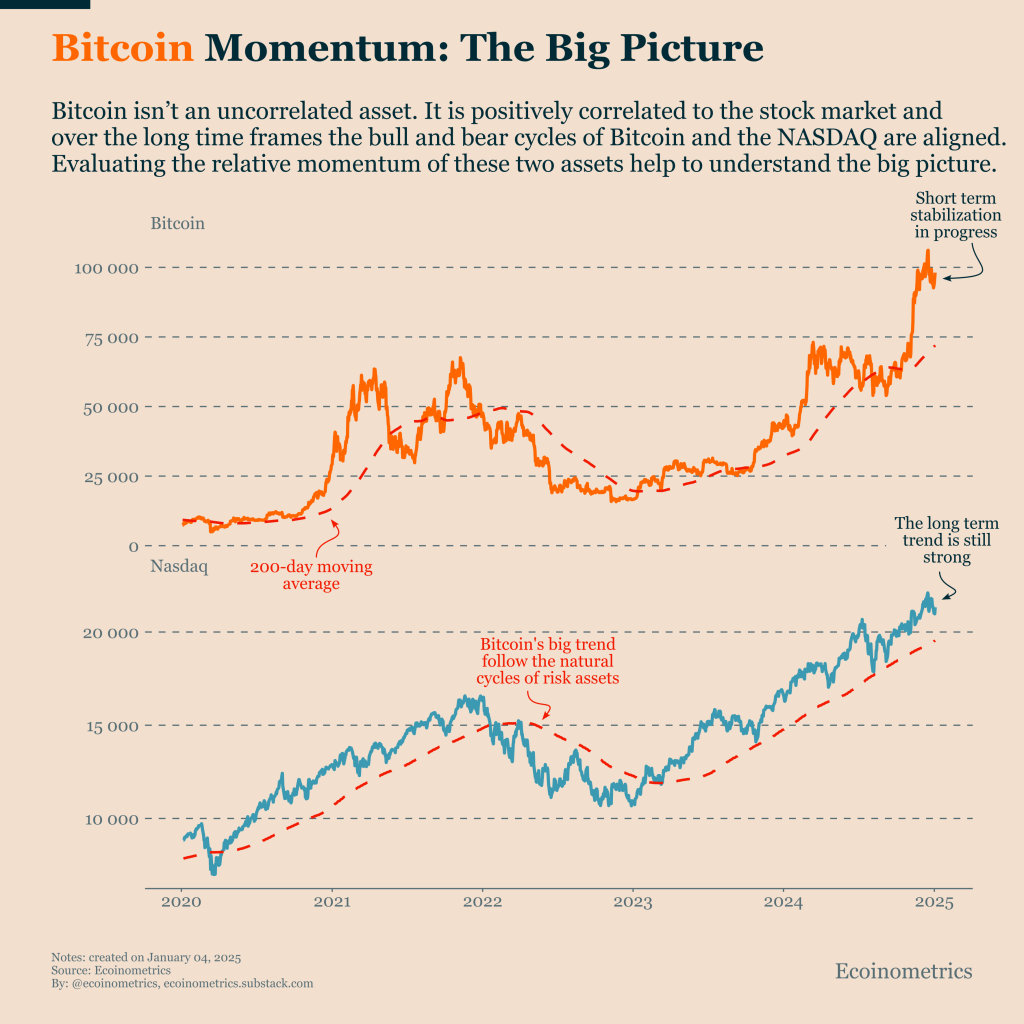

On the surface, Monday’s tape looked like another sleepy summer session: the Nasdaq-100 added 0.3 %, Bitcoin slipped 1 %, and the VIX hovered just below 14. Beneath the calm, however, a structural break-up was being consummated. The 30-day rolling beta of Bitcoin to the Nasdaq has collapsed to 0.18, the lowest since the Fed’s 2022 hiking cycle began, according to Bloomberg data. Macro funds that rode the 2023 “crypto-is-tech” narrative are now dumping Coinbase (COIN) and rotating the proceeds into Super Micro Computer (SMCI), a server maker that suddenly trades like an AI utility. Crypto ETFs, meanwhile, saw their third consecutive week of net outflows, EPFR clocking $740 million redeemed since mid-June. The herd is moving, and it is leaving the digital frontier for the air-conditioned server room.

Why 0.18 Beta Feels Like Zero

Statistically, 0.18 is still positive, but behaviorally it lands like a margin call. For two years, portfolio architects used a beta of 0.6–0.8 to justify tucking Bitcoin or the ProShares Bitcoin ETF (BITO) inside the same risk sleeve as Nvidia and Meta. That shortcut—an act of narrative-driven anchoring—allowed relative-value funds to treat crypto as a high-octane Nasdaq stub. With correlation now beneath the five-year Treasury note, the mental account is shattered. Loss-aversion kicks in: the same managers who celebrated COIN at $280 are unloading at $210 because the position no longer “hedges the tech book.” Reflexivity does the rest; selling begets selling until the story, not the spreadsheet, changes.

SMCI Becomes the New FOMO Toy

While crypto bled, SMCI rallied 27 % in eight sessions on no fresh earnings guidance. What changed? A CNBC segment titled “The picks-and-shovels play no one’s watching” aired the same afternoon the Philadelphia Semiconductor Index hit a new high. Retail chat volumes exploded, options flow jumped to 350 % of the 20-day average, and the stock’s implied volatility skew flipped from negative to positive—classic signs of herding. Institutions followed, not because they love rack servers but because benchmark risk is rising and SMCI still carries a 14 % index weight gap versus Nvidia. The rotation is less about conviction than about staying close to the pack; underperformance is punished faster than outright losses.

Where the Cash Actually Went

EPFR shows macro funds cut crypto exposure by 1.8 %-pts in July, the steepest monthly drop since May 2022. Simultaneously, they raised industrial-tech allocations by 2.1 %-pts, the largest jump since the 2021 reopening trade. The Federal Reserve’s Senior Loan Officer Survey, released the same week, noted that banks tightened lending standards for “other financial products” (read: crypto collateral) to a net 42 %, a level last seen in Q1 2009. Liquidity is being rationed, and managers are rationing imagination. Even MicroStrategy’s premium-to-NAV has compressed from 55 % in March to 19 %, a behavioral tell that the “Bitcoin-as-treasury” meme has lost its halo.

Confirmation Bias Meets the Jobs Print

Friday’s non-farm payrolls added 206 k jobs, above the 190 k consensus, but the unemployment rate ticked to 4.1 % and May figures were revised down by 54 k. That mixed print was gasoline for narrative cherry-picking. Tech bulls saw a soft-landing confirmation; crypto diehards saw a Fed put; bond bears saw sticky wages. Each camp filtered the data through pre-loaded priors, a textbook case of confirmation bias. Prices reacted in rank order: SMCI up 4 %, Nasdaq futures up 0.7 %, Bitcoin flat, COIN down 2 %. The market’s internal ballot was counted in real time, and crypto lost.

Retail Still HODLing, Institutions Hedging

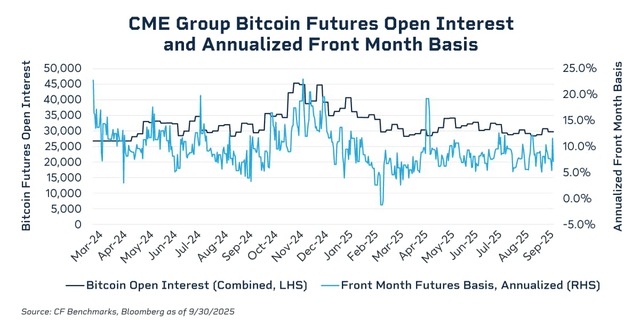

Coinbase’s order-book heatmap shows 62 % of retail accounts with open BTC positions remain buyers on 1 % dips, the same stubborn bid that held at $16 k in 2022. Institutions are less romantic. CFTC commitment-of-traders data reveals asset managers are net short 3.4 k CME Bitcoin futures contracts, the most bearished stance on record. The divergence—retail accumulation versus institutional hedging—mirrors the 2018 winter, but with one difference: spot ETFs now exist, so the sell-pressure lands immediately on the tape instead of lingering in grayscale trusts. The result is a visible bleed that erodes the “digital gold” story faster than the 2018 bear market grind.

The Dollar’s Quiet Veto

While headlines obsess over Fed dots, the trade-weighted dollar has risen 4 % since April, draining dollar-denominated liquidity from global risk assets. According to the IMF’s latest Global Financial Stability Report, a 1 % dollar appreciation historically coincides with a 0.9 % contraction in cross-border lending to emerging markets and a 30–40 bps widening in CCC credit spreads. Crypto, the most dollar-sensitive asset class, feels the chill first. Stablecoin supply has shrunk by $9 billion since May, Glassnode data show, equivalent to a 4 % reduction in synthetic USD cash inside the ecosystem. Less stablecoin, less leverage, less bounce.

New Narrative: AI Infrastructure as Regulated Utility

Wall Street’s sell-side has begun to recast SMCI, Dell and even HP Enterprise as the next regulated utilities, complete with moats built on DOE energy-efficiency grants and export-license backlogs. Reuters reports that the Department of Energy will allocate $2.5 billion in low-interest loans for domestic data-center construction before year-end. The story is seductive: predictable cash flows, government backstops, and a scarcity premium on U.S.-based power grids. Crypto, by contrast, faces an SEC enforcement overhang and a potential mining-tax proposal buried in the FY-2026 budget. One narrative offers subsidy; the other, subpoena. Capital flows where the story is warmest.

Reflexivity in Reverse

Lower crypto prices weaken the balance-sheet cushion at mining firms, forcing them to sell newly minted coins into a thinning order book, which depresses prices further. The loop is reflexive, but now in reverse. Public miners sold 92 % of July production versus the 50 % historical norm, Bloomberg calculates, raising cash to service rigs financed when hash-price was double today’s level. Each sale validates the bears’ thesis, inviting more shorts. Meanwhile, SMCI’s rally allows it to raise equity at a 40 % premium to its 200-day moving average, funding cap-ex without margin pressure. Reflexivity giveth, reflexivity taketh away.

Bottom Line: The Rotation Is the Message

Markets are not abandoning innovation; they are re-labeling it. The same dollars that once chased decentralized revolution now chase centralized air-conditioning. The beta collapse is not a mathematical glitch—it is a behavioral recoding. Crypto’s risk premium is being reset to its own idiosyncratic curve, while AI-linked hardware inherits the tech sector’s multiple. Until a new catalyst—halving, spot ETH ETF approval, or a weaker dollar—reignites the old narrative, the crowd will keep galloping toward the nearest subsidy. In markets, as in politics, the best story wins; the price just keeps score.

For those mapping how narrative shifts flow into factor performance, a deeper breakdown of flows and positioning is here.