The Quiet $47 Billion

At 15:00 New York time last Wednesday the Options Clearing Corp. printed 2.8 million new call contracts on the seven largest growth names—Apple through Nvidia—bringing gross dealer length to $47 billion in notional delta, the highest on record for a single expiry cluster, according to Bloomberg data. That is not a speculative footprint; it is inventory forced on banks because customers would rather own upside convexity than the underlying shares. The street’s short-gamma books have therefore flipped: dealers are synthetically long the market every Friday close, praying that Monday’s opening gap is smaller than the premium they have collected. The position is invisible in SEC filings, but it is the first domino in a chain that links option flows to price, narrative, and, ultimately, behaviour.

From Flow to Feeling

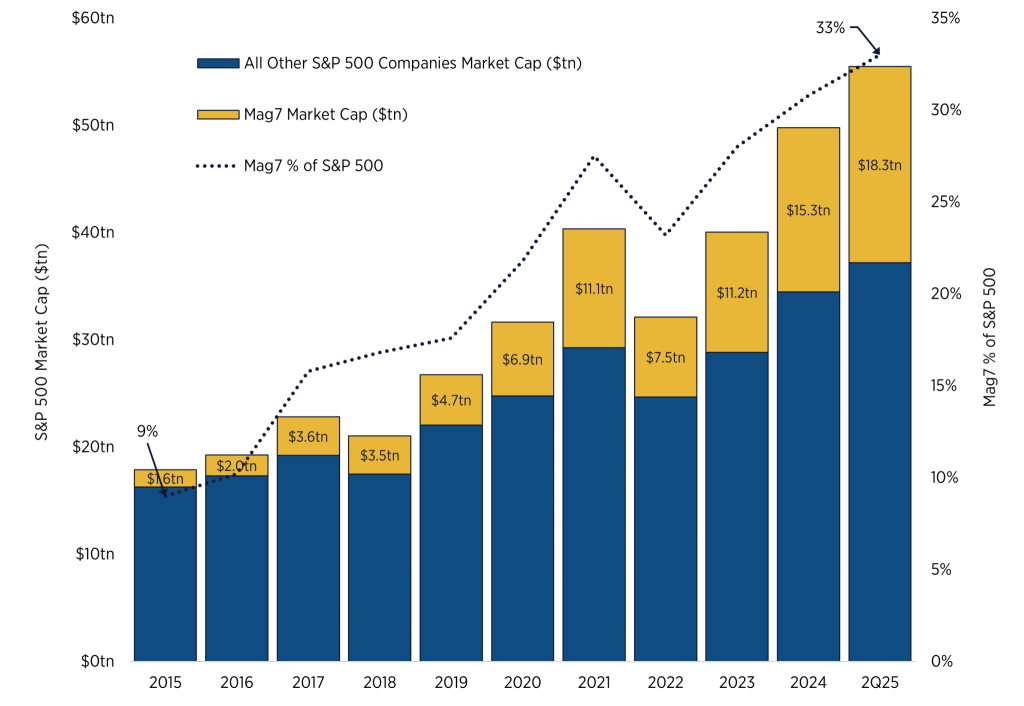

Behavioural finance rarely starts with a chart; it starts with a story someone is willing to pay for. The Mag-7 narrative—liquid, cash-rich, AI-adjacent—has become the default answer to every portfolio problem. EPFR Global reports that the cohort absorbed $112 billion of inflows since January, while the remaining 493 S&P 500 stocks lost $38 billion. That asymmetry is not valuation logic; it is herding under a tech banner that feels safe because everyone else is already there. When flows concentrate, the marginal buyer stops being a fundamental investor and becomes the options market maker who must hedge. Each 1% move up now forces an estimated $4 billion of delta purchases, a reflexive loop that compresses time: months of old-school appreciation arrive in hours.

Anchoring at 4,800

Loss-aversion literature shows that investors who rode the 2022 drawdown anchor to the last peak. The S&P 500 printed 4,796 in January 2022; this year’s grind toward 5,200 has therefore been experienced as “recovery” rather than “extrapolation,” a mental frame that encourages call buying instead of profit-taking. The CBOE’s new “Fear-of-Missing-Out” index—built from fund-flow momentum, retail option volume and social-media sentiment—hit 94 last week, its highest since the meme-coin summer of 2021. Anchoring plus FOMO is why customers keep lifting 0DTE calls struck 2% out-of-the-money: they need the market to prove them right immediately, because waiting feels like losing.

Dealer versus Client Clockspeed

Institutions and retail now operate on different time horizons within the same trade. Goldman Sachs’ prime desk calculates that 42% of current Mag-7 delta will expire inside five trading days, a horizon shorter than most earnings blackout windows. Dealers, meanwhile, manage balance-sheet risk to the millisecond. When spot rallies, they buy; when it falls, they sell. The resulting whip is what behavioural finance labels “sentiment reversal,” but in 2024 it is executed by algorithms that never feel sentiment at all. The human residue is the narrative: headlines attribute the rally to “AI optimism,” the crash to “rate shock,” even though the same gamma imbalance can explain both.

Macro as Permission Slip

None of the reflexive buying happens without a macro green light. The Federal Reserve’s weekly H.4.1 release shows bank reserves at $3.54 trillion, up $260 billion since the March facility tweak. Excess liquidity lowers the opportunity cost of chasing upside, a variable that the Reuters survey of family offices flags as the top reason for raising growth-factor exposure. At the same time, the Conference Board’s leading credit index has contracted for six straight months, a signal that normally coincides with widening high-yield spreads. Investors resolve the contradiction by assuming the Fed will provide liquidity if spreads gap, a moral-hazard narrative that validates ever-tighter risk management: buy calls, not stocks, and let the dealer absorb the tail.

The Energy Sector as Behavioural Hedge

While tech calls balloon, energy options open interest has fallen to a five-year low. That is not because oil is quiet—Brent 30-day implied volatility is 34%, above its ten-year average—but because the sector lacks a unifying story. Without narrative, herding cannot start; without herding, gamma is flat. The divergence creates a behavioural hedge: a long-dated straddle on an equal-weight energy ETF costs 5.6% of spot, half the price of a comparable Mag-7 straddle despite higher raw volatility. The setup appeals to investors who recognise their own confirmation bias: if the gamma trap reverses, liquidity will search for a new tale, and energy is one tweet away from becoming “national security critical infrastructure.”

Reflexivity in the Jobs Print

Friday’s non-farm payroll will be released two hours after the monthly Op-Ex close. A soft number would lower bond yields, trigger an automated rally in growth calls, and force dealers to cover deltas into illiquid Sunday futures. A hot number could gap the S&P below the 5,100 strike where $31 billion of puts rest, flipping the gamma profile negative. Either scenario validates George Soros’ reflexivity thesis: the indicator that is supposed to measure the economy will instead move the economy by dictating financial conditions. The feedback loop is now measured in minutes because the positioning is measured in gamma.

What Changes the Narrative

Eventually the story breaks. In March 2020 it took a global lockdown; in February 2021 it took a retail short squeeze. The catalyst is impossible to time, but the behavioural signature is knowable: a volume bar that dwarfs the 20-day average, a tick where the VIX rises with the market, a CNBC chyron that blames “technical factors.” When that happens, dealers will sell the $47 billion delta they were forced to buy, and the same reflexive engine that compressed upside into days will compress downside into hours. Investors who understand the loop can pre-assign action: reduce notional, roll calls into diagonal spreads, or simply exit the gamma theatre before the fire alarm rings.

The Aftermath Script

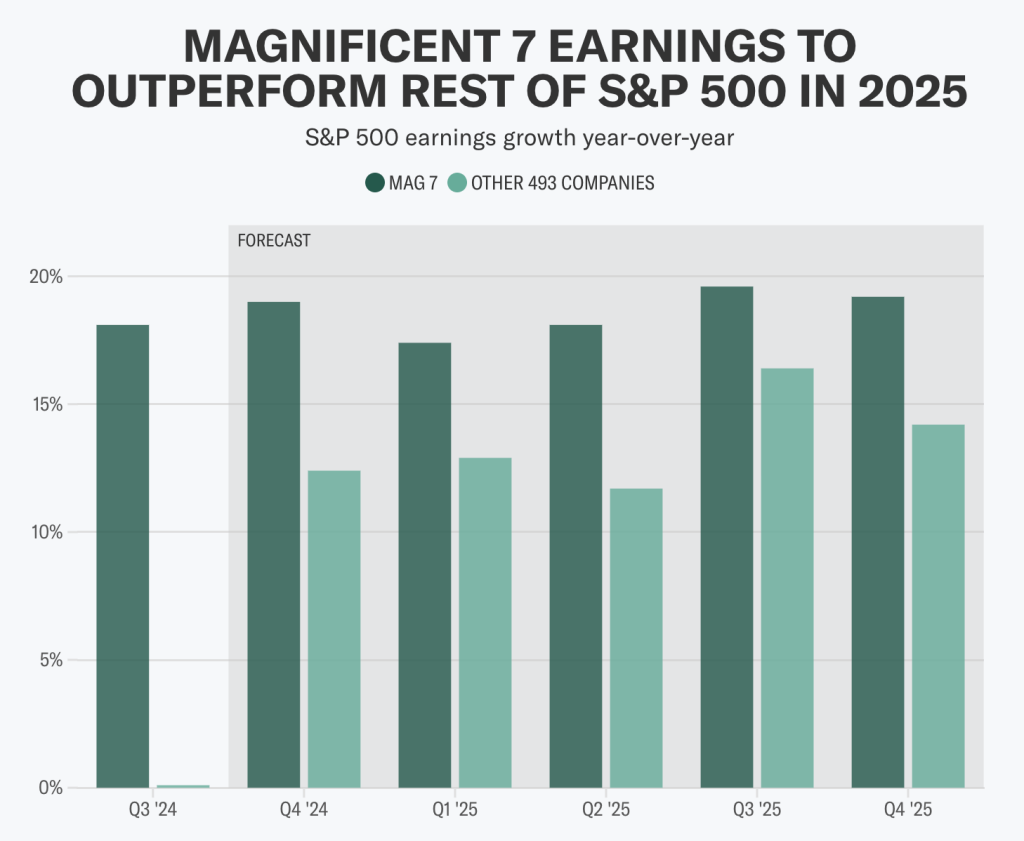

After the squeeze the narrative resets. Media will discover that Mag-7 earnings are still growing 19% annually, that net margins exceed 25%, that balance sheets carry more cash than the GDP of Australia. The dip will be called “healthy,” the rebound “rational,” and the cycle will begin again—this time with lower strike prices and fresher expiration dates. Behavioural finance does not predict direction; it maps the elasticity of belief. Right now belief is stretched, delta is long, and the clock is ticking toward 3:00 p.m. on a Friday that could turn $47 billion of calm inventory into a frantic bid for anything with a ticker.

Markets move fast, narratives faster. If you want to watch how gamma, liquidity and sentiment interact in real time, the desk shares intraday flow notes in this WhatsApp room. No spam, just signal.