As institutional asset managers navigate the complexities of the current market landscape, the clean energy sector presents a compelling yet paradoxical investment opportunity. The promise of sustainable growth and technological advancement in this arena contrasts sharply with the realities of valuation pressures and shifting risk appetites among investors. This analysis aims to dissect these dynamics through an institutional lens, focusing on cross-asset pricing, risk premium variations, and macroeconomic influences.

Recent data indicates that while clean energy stocks have shown significant potential for long-term growth, their valuations have become increasingly sensitive to interest rate fluctuations. According to Bloomberg, rising rates have led to a recalibration of expected returns across various sectors, particularly impacting high-growth industries like clean energy. As the Federal Reserve signals a more hawkish stance on monetary policy, investors are reassessing their duration preferences and hedging strategies.

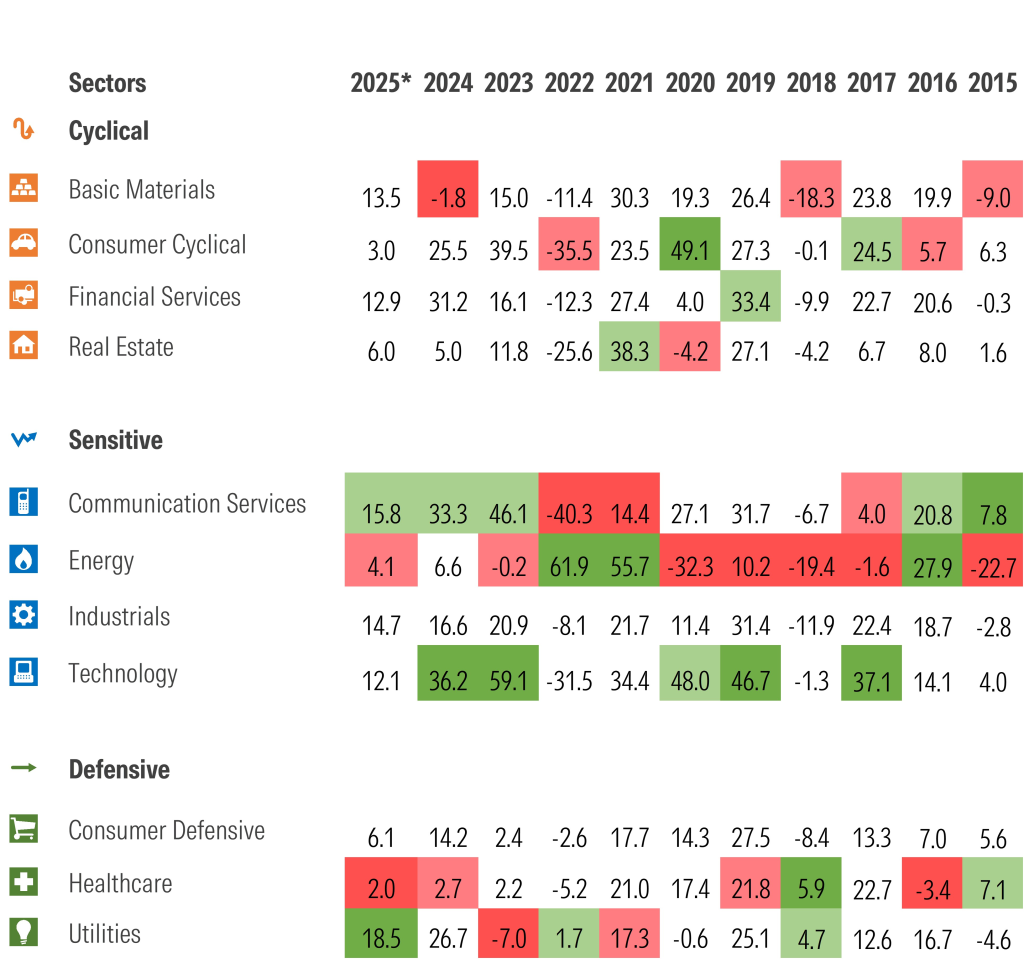

The interplay between inflation expectations and interest rates has created a challenging environment for clean energy investments. With inflationary pressures persisting, institutional investors are gravitating towards assets that offer stability and predictable cash flows. This shift is evident in the rotation from high-growth sectors into defensive equities as seen in recent reports by Reuters. Consequently, clean energy stocks—often characterized by elevated price-to-earnings ratios—are facing increased scrutiny regarding their valuation metrics.

Moreover, the ongoing geopolitical tensions and supply chain disruptions further complicate the investment landscape for clean energy assets. The reliance on critical minerals for battery production highlights vulnerabilities within this sector that could deter risk-averse investors seeking safety amidst uncertainty. As noted by CNBC, these factors contribute to heightened volatility in stock prices as market participants weigh potential regulatory changes against operational challenges.

From an asset allocation perspective, it is crucial for institutions to consider how these dynamics affect overall portfolio construction. The current environment necessitates a careful balance between exposure to growth-oriented sectors like clean energy and more stable investments such as utilities or consumer staples. Institutions must also evaluate their risk tolerance levels as they navigate this complex terrain where traditional valuation models may not fully capture future cash flow potentials.

In light of these considerations, we observe a notable divergence in risk appetite among different investor classes. While some hedge funds continue to pursue aggressive positions in clean energy based on long-term sustainability narratives, pension funds appear more cautious, favoring established companies with robust dividend yields over speculative growth plays. This divergence underscores the importance of tailoring investment strategies according to specific objectives and time horizons.

The structural opportunities within industry rotations cannot be overlooked either; sectors such as technology continue to attract significant capital inflows due to their perceived resilience against economic downturns. However, as we analyze cross-sector correlations, it becomes apparent that cyclical stocks may present attractive entry points given their relative undervaluation compared to growth counterparts like those found in renewable energies.

Looking ahead, macroeconomic indicators will play a pivotal role in shaping investor sentiment towards clean energy investments. Employment figures and consumer spending trends will provide insights into economic health that could influence central bank policies moving forward. Additionally, any shifts in fiscal policy aimed at promoting green technologies could catalyze renewed interest from institutional players seeking alignment with ESG mandates.

Ultimately, while the promise of clean energy remains intact amid global efforts toward decarbonization, investors must remain vigilant about underlying risks associated with valuation sensitivity and market volatility. A nuanced approach that incorporates both qualitative assessments of industry trends alongside quantitative analyses of financial metrics will be essential for navigating this evolving landscape effectively.

For deeper insights into our allocation frameworks and risk perspectives regarding emerging trends within the market cycle, please explore our detailed analysis via this link.