The current landscape of the U.S. equity market is increasingly characterized by a shift towards dividend-paying stocks, which have demonstrated resilience and outperformance compared to traditional growth investments. This trend can be attributed to several macroeconomic factors, including rising interest rates, inflationary pressures, and changing investor risk appetites. As institutional asset managers reassess their portfolios in light of these dynamics, understanding the implications for asset allocation becomes crucial.

In recent months, the Federal Reserve’s monetary policy has played a pivotal role in shaping market expectations. With interest rates projected to remain elevated through 2025, the cost of capital has increased significantly. This environment tends to favor companies with strong cash flows and stable dividends over those reliant on future growth projections. According to Bloomberg, dividend stocks have historically provided a buffer against volatility during periods of rising rates, as they offer tangible returns even when capital appreciation is subdued.

From an asset allocation perspective, institutional investors are recalibrating their strategies to reflect this new reality. The rotation from growth-oriented sectors such as technology into more defensive sectors like utilities and consumer staples underscores a broader trend towards risk aversion. The current risk premium associated with equities has shifted; investors are demanding higher yields for taking on equity risk amid economic uncertainty. This shift is evident in the widening valuation spreads between high-dividend yield stocks and their non-dividend counterparts.

Moreover, sector rotations are becoming more pronounced as institutions seek to hedge against potential downturns while optimizing yield. Defensive sectors that traditionally exhibit lower beta characteristics are gaining traction among pension funds and sovereign wealth funds alike. For instance, energy stocks have also seen renewed interest due to geopolitical tensions affecting supply chains and pricing structures globally.

The interplay between macroeconomic indicators such as employment data and inflation rates further complicates this landscape. Recent reports indicate that while unemployment remains low, wage growth is contributing to inflationary pressures that could prompt further tightening by the Fed. In this context, dividend-paying stocks not only provide income but also serve as a hedge against inflation—an attractive proposition for long-term investors seeking stability amidst volatility.

As we analyze industry-specific opportunities within this framework, it becomes clear that certain sectors may outperform others based on their inherent characteristics during different phases of the economic cycle. For example, defensive sectors tend to perform well during economic slowdowns due to their essential nature; conversely, cyclical industries may benefit from recovery phases but carry higher risks associated with economic fluctuations.

Institutional reports from firms like Morgan Stanley highlight that while tech stocks continue to dominate headlines due to innovation-driven narratives, many established players in the dividend space are poised for sustainable growth without excessive reliance on speculative valuations. This presents an opportunity for diversified portfolios that balance both growth potential and income generation.

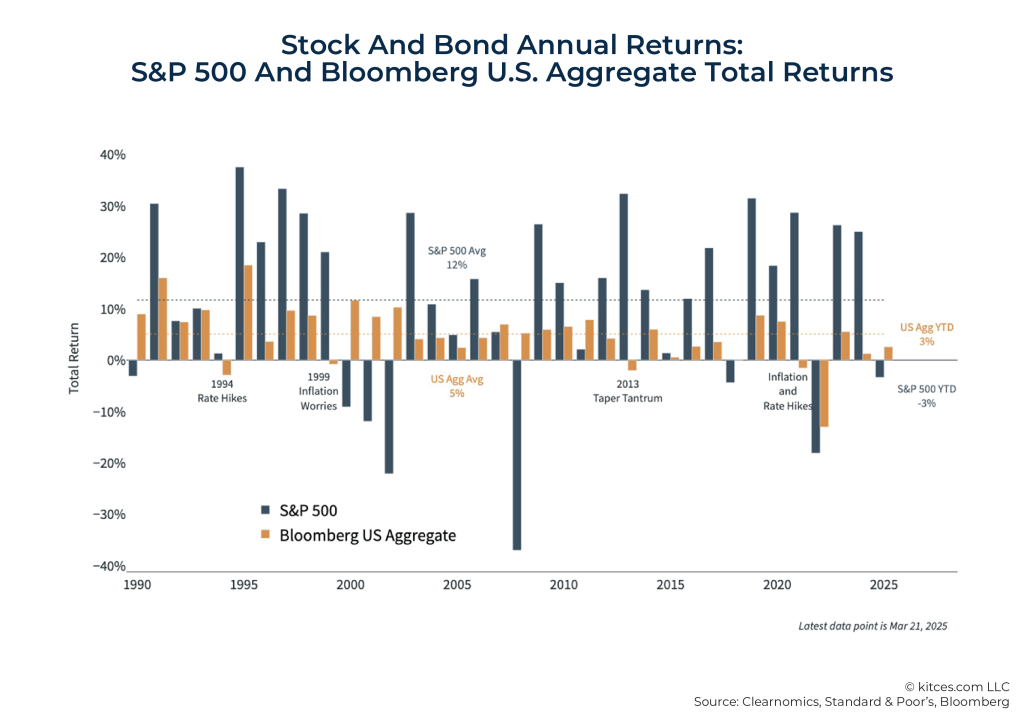

Furthermore, understanding cross-asset pricing dynamics is essential for effective portfolio management in today’s environment. The correlation between bond yields and equity valuations suggests that as yields rise further due to Fed actions or market sentiment shifts regarding inflation expectations, equity valuations—particularly those tied closely with future earnings projections—may face downward pressure unless supported by robust earnings performance or dividend payouts.

This evolving landscape necessitates a nuanced approach toward investment strategy formulation among institutional investors who must navigate these complexities while adhering to fiduciary responsibilities. By integrating insights from macroeconomic trends with sector-specific analysis and maintaining flexibility within asset allocations based on prevailing conditions—such as duration preferences or hedging strategies—investors can better position themselves for success moving forward.

The ongoing dialogue surrounding fiscal policies aimed at stimulating economic activity will also influence market behavior going into 2025; thus far-reaching implications exist regarding how these measures will impact corporate profitability across various sectors over time.

In conclusion, as we look ahead at 2025’s investment horizon marked by heightened uncertainty yet promising opportunities within dividend-paying equities—a strategic focus on balancing risk exposure alongside yield generation appears prudent for institutional allocators navigating today’s multifaceted financial ecosystem.

If you seek deeper insights into our allocation frameworks or wish to explore emerging trends impacting your investment strategies further, please refer to this link.