The U.S. stock market is currently experiencing a complex interplay of emotions and behaviors that are shaping investor sentiment. As we navigate through this landscape, it becomes crucial to understand how factors such as fear of missing out (FOMO), loss aversion, and herd behavior influence market dynamics. Recent reporting from Bloomberg highlights a notable shift in risk appetite among institutional investors, which may signal a broader trend affecting retail investors as well.

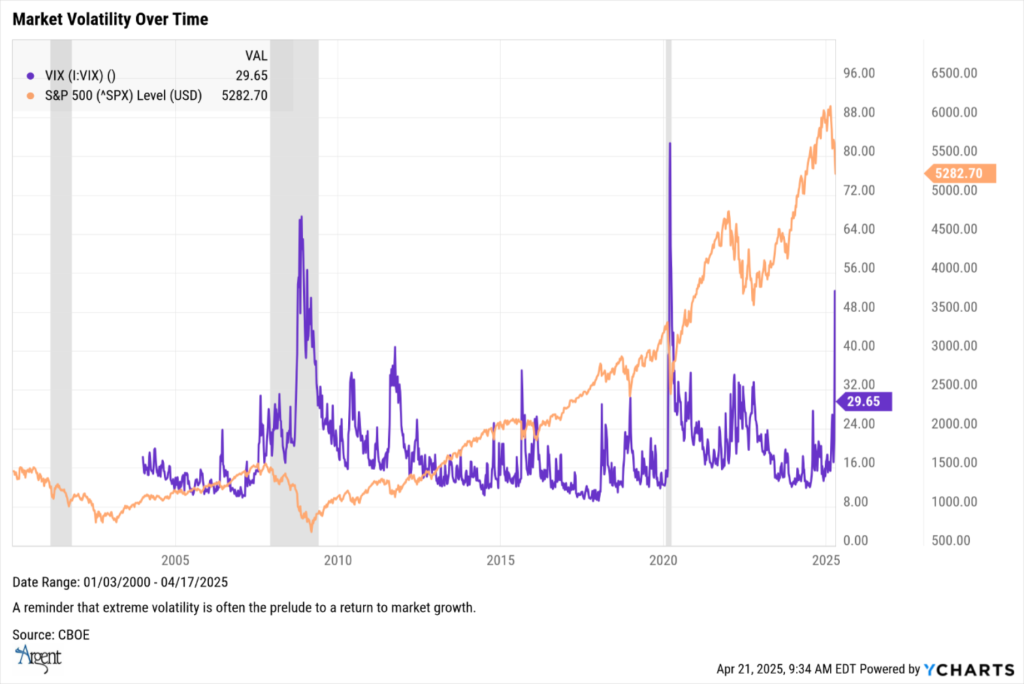

In recent weeks, the narrative surrounding inflation and interest rates has dominated discussions among market participants. The Federal Reserve’s stance on monetary policy remains pivotal; with inflation showing signs of persistence, the central bank’s decisions will likely impact liquidity conditions across various sectors. This backdrop creates an environment where investors are increasingly sensitive to macroeconomic indicators, leading to heightened volatility.

As we delve deeper into behavioral finance, it’s essential to recognize how emotional responses can lead to systematic biases in decision-making. For instance, loss aversion often causes investors to hold onto losing positions longer than they should, while simultaneously selling winning stocks too early due to fear of potential downturns. This phenomenon is exacerbated by confirmation bias—investors tend to seek information that supports their existing beliefs about certain stocks or sectors.

The technology sector has been particularly susceptible to these behavioral patterns. Companies within this space have seen significant price fluctuations driven not only by fundamental performance but also by prevailing narratives around innovation and growth potential. According to CNBC, many tech stocks have experienced sharp sell-offs recently as concerns over rising interest rates weigh heavily on future earnings projections.

Moreover, the divergence between institutional and retail investor behavior cannot be overlooked. Institutions typically possess more resources for data analysis and risk assessment, allowing them to make informed decisions based on comprehensive market insights. In contrast, retail investors often react emotionally to market movements—driven by FOMO during bull markets or panic selling during downturns—leading to pronounced volatility in asset prices.

This emotional rollercoaster is further complicated by the concept of reflexivity in pricing mechanisms. As prices rise due to positive sentiment or speculative buying, they can create a feedback loop that attracts even more investment—a classic case of self-fulfilling prophecies at play. Conversely, negative sentiment can trigger rapid sell-offs that exacerbate declines in asset values.

The current economic climate presents both challenges and opportunities for savvy investors who can navigate these psychological traps effectively. For example, energy stocks have shown resilience amid fluctuating oil prices driven by geopolitical tensions and supply chain disruptions. Investors who remain grounded in fundamentals while being aware of prevailing narratives may find value opportunities amidst the noise.

As we look ahead, understanding these behavioral finance principles will be critical for making informed investment decisions in an increasingly volatile environment. The ability to discern between genuine value shifts and emotional reactions will set apart successful investors from those who succumb to market whims.

For readers seeking broader behavioral-finance commentary, further analysis can be found via this link.