The U.S. stock market is currently navigating a complex landscape shaped by macroeconomic factors, sector-specific dynamics, and institutional behaviors. As we approach November 2025, the interplay of inflationary pressures, interest rate adjustments, and employment trends will significantly influence investment strategies. Amidst this backdrop, Asia presents a compelling narrative for investors seeking robust opportunities beyond traditional markets.

Recent data indicates that inflation in the U.S. has shown signs of stabilization, with the Consumer Price Index (CPI) hovering around 3.2% as of October 2025. This moderation suggests that the Federal Reserve may adopt a more cautious stance regarding interest rate hikes in the near term. However, persistent wage growth and consumer spending could keep upward pressure on prices, complicating monetary policy decisions. Investors should remain vigilant as these factors can lead to volatility in equity valuations.

In this context, sectors such as technology and energy are poised for significant shifts. The tech sector continues to be driven by advancements in artificial intelligence and cloud computing technologies. Companies like NVIDIA and Microsoft have reported impressive earnings growth fueled by increased demand for AI-driven solutions. According to Bloomberg, institutional investors are increasingly reallocating funds towards tech stocks that demonstrate strong fundamentals and innovative capabilities.

On the other hand, the energy sector is experiencing a renaissance as global economies pivot towards sustainable practices. The recent surge in oil prices—now averaging $85 per barrel—has revitalized interest in both traditional energy companies and renewable energy firms alike. Analysts at CNBC suggest that investments in clean energy technologies could yield substantial returns as governments worldwide implement stricter emissions regulations.

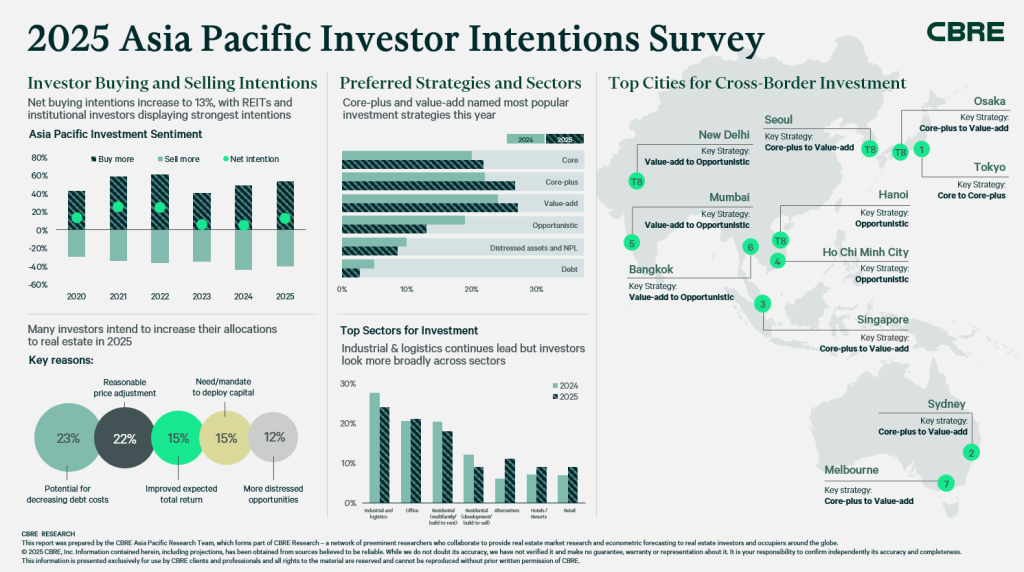

The dollar index has also played a pivotal role in shaping investment flows into Asia’s markets. A stronger dollar typically dampens foreign investment; however, recent trends indicate resilience among Asian currencies against dollar fluctuations. This stability enhances the attractiveness of Asian equities for U.S.-based investors looking to diversify their portfolios amidst domestic uncertainties.

Institutional allocation behavior reveals an increasing appetite for emerging market equities within Asia—particularly those linked to infrastructure development and technological innovation. High-profile firms like Morgan Stanley have highlighted opportunities in Southeast Asia where economic growth rates outpace those of developed nations.Reuters notes that countries such as Vietnam and Indonesia are becoming focal points due to their young populations and expanding middle classes.

As we analyze potential investment opportunities within Asia’s best-kept secrets, it is essential to consider specific sectors showing promise based on fundamental analysis rather than speculative trends alone. For instance, companies involved in semiconductor manufacturing are likely to benefit from ongoing supply chain adjustments post-pandemic while addressing global chip shortages.

The healthcare sector also warrants attention given its critical role during recent global health crises. Firms specializing in biotechnology and pharmaceuticals are positioned well due to increased R&D investments aimed at addressing both chronic diseases and emerging health threats.

Investors should also be mindful of geopolitical risks associated with investing in Asian markets; tensions surrounding trade policies or regional conflicts can introduce volatility into asset prices unexpectedly. Therefore, maintaining a diversified portfolio across various sectors while keeping abreast of macroeconomic indicators will be crucial for achieving stable returns.

In conclusion, November 2025 presents unique opportunities within Asia’s markets characterized by fundamental strength amid evolving economic landscapes globally. By focusing on sectors poised for growth—such as technology and renewable energy—investors can strategically position themselves to capitalize on these emerging trends while managing risk effectively.

For further market commentary on how these dynamics might affect your investment strategy moving forward, please visit our exclusive insights page here.