The clean energy revolution is quietly reshaping the landscape of investment opportunities in the U.S. stock market, yet a recent survey indicates that approximately 70% of Americans remain unaware of its implications. This disconnect raises critical questions for investors, particularly those aged 25 to 45 who have been navigating the complexities of tech stocks and macroeconomic trends for several years. As we delve into this phenomenon, it becomes essential to analyze how this lack of awareness could impact market dynamics and investment strategies moving forward.

Understanding Market Dynamics Amidst Macroeconomic Changes

The current economic climate is characterized by rising inflation rates and fluctuating interest rates, which have created a challenging environment for many sectors. The Federal Reserve’s recent decisions to adjust interest rates in response to inflationary pressures have led to increased volatility in equity markets. According to Bloomberg, consumer prices rose by 6.8% year-over-year as of December 2021, marking the highest increase since 1982. Such macroeconomic indicators are crucial for understanding investor sentiment and behavior.

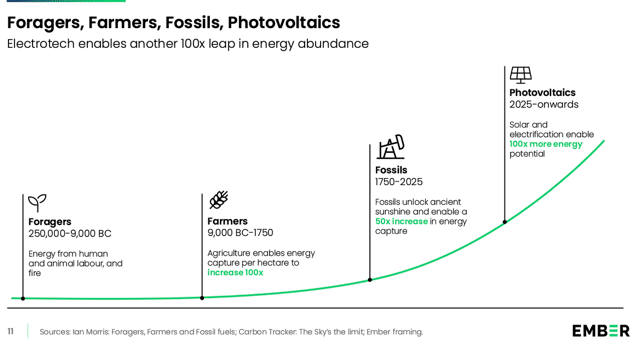

In this context, clean energy investments are gaining traction as they align with broader sustainability goals and government initiatives aimed at reducing carbon emissions. However, despite these favorable conditions, many retail investors seem oblivious to the potential growth within this sector. The question arises: how can investors capitalize on this opportunity while navigating an uncertain economic landscape?

The Role of Institutional Investors

Institutional investors are increasingly recognizing the value proposition presented by clean energy stocks. Firms like Goldman Sachs and Morgan Stanley have highlighted renewable energy as a key area for future growth amid global shifts towards sustainability. In fact, Goldman Sachs recently projected that global renewable energy investments could reach $16 trillion by 2030 as countries ramp up their commitments to combat climate change.

This institutional interest is reflected in fund flows toward exchange-traded funds (ETFs) focused on clean energy companies. Data from CNBC shows that inflows into clean energy ETFs surged over $10 billion in just one year, indicating a robust appetite among larger investors for exposure to this burgeoning sector.

Investment Opportunities Within Clean Energy

For retail investors looking to diversify their portfolios amidst macroeconomic uncertainties, clean energy presents compelling opportunities. Companies involved in solar power generation, electric vehicles (EVs), and battery technology are at the forefront of this revolution. Notably, firms like Tesla and NextEra Energy have demonstrated significant growth trajectories fueled by increasing demand for sustainable solutions.

The transition towards electric vehicles alone is expected to reshape not only automotive industries but also related sectors such as lithium mining and battery production. As per Reuters, EV sales are projected to account for nearly half of all new car sales globally by 2030—a trend that underscores the urgency for investors to consider their positions within these markets.

Navigating Risks While Seizing Opportunities

While the prospects appear promising, it is crucial for investors to remain vigilant about potential risks associated with investing in clean energy stocks. Regulatory changes, technological advancements, and competition from traditional fossil fuel industries can create headwinds that may affect stock performance.

Moreover, as inflation continues its upward trajectory alongside interest rate hikes from the Federal Reserve, some analysts caution against overexposure to high-growth sectors like clean energy without adequate risk management strategies in place.

I’ve observed phases where investor enthusiasm can lead to inflated valuations; thus maintaining a balanced approach remains paramount when considering entry points into these emerging markets.

A Call For Awareness Among Retail Investors

The staggering statistic revealing that 70% of Americans are unaware of the ongoing clean energy revolution serves as both a warning and an opportunity for savvy retail investors willing to educate themselves about market trends.

As institutional players continue pouring capital into sustainable ventures while navigating macroeconomic challenges effectively—retail investors must not miss out on what could be one of the most transformative investment themes of our time.