As we navigate through the complexities of the current U.S. stock market, a notable trend has emerged: tech-focused funds are experiencing a remarkable resurgence. This surge raises questions about whether we are witnessing the early signs of a new bull market, particularly as macroeconomic indicators continue to evolve. Recent data suggests that investors are increasingly gravitating towards technology stocks, driven by factors such as inflation dynamics, interest rate policies, and sector-specific growth narratives.

Macroeconomic Context

The backdrop against which this surge is occurring is characterized by fluctuating inflation rates and shifting monetary policy. The Consumer Price Index (CPI) has shown signs of moderation recently, with year-over-year increases easing to around 3%, down from peaks above 9% last year. This decline in inflation could provide the Federal Reserve with more leeway to adjust interest rates without stifling economic growth. As CNBC reported, expectations for rate cuts have begun to surface among traders, fueling optimism in equity markets.

Moreover, employment figures remain robust, with unemployment hovering near historic lows at approximately 3.5%. Such stability in the labor market often correlates positively with consumer spending and business investment—two critical drivers for technology companies poised for growth. The combination of these macroeconomic factors creates an environment ripe for tech investments.

Sector Dynamics and Investment Flows

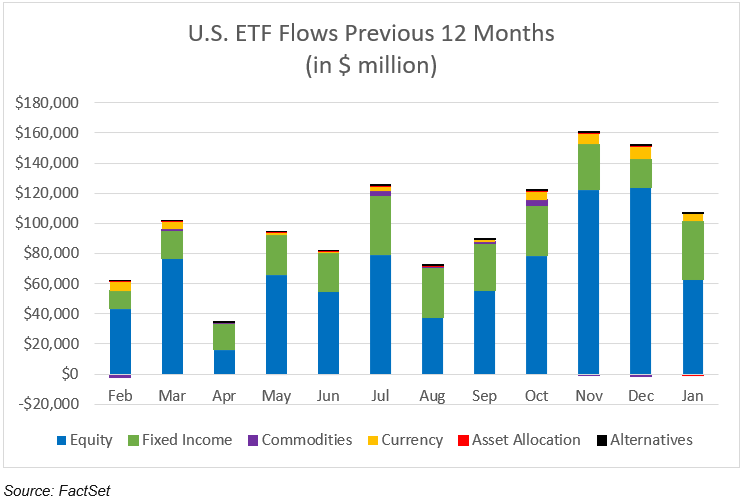

In recent weeks, capital flows into technology-focused exchange-traded funds (ETFs) have surged significantly. According to Bloomberg, inflows into tech ETFs reached nearly $10 billion in just one month—a stark contrast to outflows seen earlier this year. This shift indicates a growing confidence among investors regarding the long-term prospects of technology firms amid ongoing digital transformation across industries.

The AI sector stands out as a primary catalyst driving this renewed interest in tech stocks. Companies specializing in artificial intelligence solutions are not only attracting venture capital but also seeing their stock prices soar as businesses seek innovative ways to enhance productivity and efficiency. For instance, major players like NVIDIA and Microsoft have reported substantial earnings growth attributed to their AI initiatives—further solidifying investor sentiment towards tech equities.

Institutional Perspectives

Institutional investors appear increasingly bullish on technology stocks as well. Analysts from Morgan Stanley have noted that while traditional sectors like energy may face headwinds due to regulatory changes and fluctuating commodity prices, technology remains resilient due to its integral role in modern economies. High-profile investment firms are reallocating assets toward tech-focused strategies, reflecting a broader belief that technological innovation will drive future economic expansion.

This sentiment is echoed by Goldman Sachs analysts who emphasize that despite potential volatility ahead—stemming from geopolitical tensions or unexpected economic shifts—the long-term trajectory for tech remains positive. They argue that companies capable of leveraging advanced technologies will likely outperform their peers across various sectors.

The Road Ahead: Caution Amid Optimism

While there is palpable excitement surrounding the resurgence of tech-focused funds, it is essential for investors to approach this landscape with caution. Historical patterns suggest that rapid surges can sometimes precede corrections; thus understanding underlying fundamentals becomes crucial. As we look ahead, monitoring key indicators such as corporate earnings reports and global economic developments will be vital for gauging sustainability within this rally.

Furthermore, potential risks associated with overvaluation must not be overlooked. Many high-growth tech stocks currently trade at elevated price-to-earnings ratios compared to historical averages—a factor that could lead some investors to question whether current valuations accurately reflect future earnings potential.

In conclusion, while the recent surge in tech-focused funds may signal an optimistic outlook for growth-oriented investors seeking structural opportunities within the market, it is imperative to remain vigilant about both macroeconomic conditions and individual company performance metrics moving forward.

For further market commentary on emerging trends and insights into investment strategies tailored for today’s dynamic environment, visit this link.