The allure of high-yield dividends has captivated many investors, particularly those in the middle-class workforce looking to maximize their returns while balancing time constraints. Yet, as we navigate through a complex economic landscape characterized by fluctuating interest rates and persistent inflation, experts are raising alarms about the potential risks associated with these seemingly attractive investments. The question looms: are high-yield dividends a ticking time bomb?

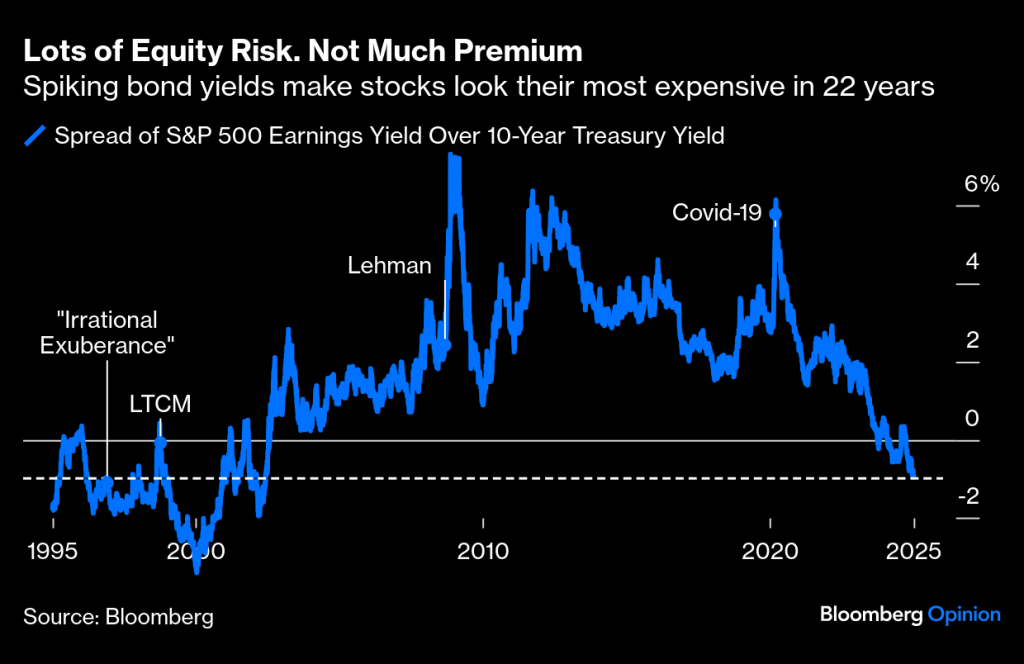

As of late 2023, the U.S. stock market has exhibited a notable shift in investor sentiment. According to Bloomberg, there is an increasing wariness among traders regarding the sustainability of high-yield dividend stocks. With the Federal Reserve’s ongoing battle against inflation leading to heightened interest rates, many companies that previously offered generous dividends may find themselves under pressure to maintain those payouts.

In essence, the macroeconomic backdrop plays a crucial role in this narrative. Inflation remains stubbornly high, prompting the Federal Reserve to adopt a more aggressive monetary policy stance. As noted by CNBC, the central bank’s commitment to curbing inflation could lead to further rate hikes, which would increase borrowing costs for companies and potentially impact their profitability. This is particularly relevant for sectors that rely heavily on debt financing—think utilities and real estate investment trusts (REITs)—both of which have historically been favored for their dividend yields.

The Sectoral Impact

While some sectors like technology have demonstrated resilience amid these challenges—largely due to their growth potential and robust balance sheets—others are beginning to show signs of strain. The energy sector, for instance, has witnessed a resurgence as global demand for oil and gas rebounds post-pandemic. However, as Morgan Stanley points out, even energy stocks can be vulnerable to external shocks such as geopolitical tensions or sudden shifts in regulatory policies.

Moreover, the tech sector’s recent performance raises questions about whether its high valuations can be justified in an environment where cost of capital is rising. Investors should be cautious; while tech stocks have been buoyed by advancements in artificial intelligence and digital transformation initiatives, they are not immune to volatility. As evidenced by recent market corrections, even blue-chip tech companies can experience significant downturns when investor sentiment shifts.

Institutional Perspective

Institutional investors are increasingly scrutinizing high-yield dividend stocks within this context. Reports from Reuters indicate that many hedge funds are reassessing their positions in these equities as they seek safer havens amidst economic uncertainty. The traditional belief that high dividends equate to low risk is being challenged; analysts caution that companies with elevated payout ratios may be signaling underlying financial distress.

This leads us to consider what constitutes a sustainable dividend policy. A company’s ability to generate free cash flow is paramount; without it, maintaining high dividends becomes problematic. As such, investors must delve deeper into financial statements and assess not just yield but also payout ratios and earnings stability.

The Risks Ahead

It’s hard to ignore how investors hesitate when inflation refuses to settle. Many are drawn into the trap of chasing yield without fully understanding the risks involved. Some analysts argue that today’s market dynamics may set the stage for what could be termed “dividend traps,” where stocks appear attractive due to high yields but ultimately fail to deliver sustainable returns.

Furthermore, with ETFs gaining popularity among retail investors seeking diversified exposure without extensive research efforts, there is a growing concern about herd behavior influencing market trends. As highlighted by recent analyses from Goldman Sachs, passive investment strategies can lead to overvaluation in certain sectors if not carefully monitored.

Investment Opportunities

So where does this leave today’s investor? For those who prioritize steady income streams while managing risk exposure, it may be prudent to diversify beyond traditional high-yield dividend stocks. Exploring sectors poised for growth—such as technology or renewable energy—might offer better long-term prospects despite their inherent volatility.

Moreover, considering fixed-income alternatives or lower-risk equity options could provide a buffer against potential downturns associated with high-yield equities. Investors should also keep an eye on macroeconomic indicators such as employment rates and consumer spending trends which can significantly influence market dynamics moving forward.

In conclusion, while high-yield dividends have their place in an investment portfolio, they come with hidden risks that cannot be overlooked in today’s volatile market environment. A balanced approach that incorporates both growth-oriented investments and income-generating assets will likely serve investors better as they navigate through these uncertain times.

For deeper insights into navigating today’s complex investment landscape and uncovering exclusive opportunities tailored for your portfolio strategy, consider joining our community: Connect Here.