The U.S. stock market is currently navigating a complex landscape shaped by rising interest rates, which have become a crucial signal for investors, particularly those focused on Environmental, Social, and Governance (ESG) criteria. As the Federal Reserve continues to adjust its monetary policy in response to persistent inflationary pressures, understanding how these shifts impact investment opportunities is essential for investors looking to align their portfolios with sustainable growth trends.

Current Economic Landscape

As of late 2023, the Federal Reserve has indicated a commitment to combating inflation, which remains above its 2% target. The latest data shows that consumer prices have risen steadily, leading to a series of interest rate hikes aimed at cooling off an overheated economy. According to Bloomberg, the Fed’s actions are primarily driven by the need to stabilize prices while fostering employment growth. This dual mandate reflects a delicate balance that can influence various sectors differently.

The unemployment rate has remained relatively low at around 3.8%, suggesting that while inflation is a pressing concern, the labor market continues to show resilience. However, the strength of the dollar has fluctuated as higher interest rates attract foreign capital but also pose challenges for exporters. This dynamic creates a mixed bag for investors who must consider both macroeconomic indicators and sector-specific developments when making decisions.

Sector Rotation and Structural Changes

The rise in interest rates typically leads to a rotation among sectors within the U.S. stock market. Historically, higher borrowing costs can dampen growth prospects for high-flying tech stocks while benefiting sectors like financials and energy that thrive in a higher-rate environment. For ESG investors, this presents both challenges and opportunities.

For instance, renewable energy companies have been gaining traction due to heightened awareness of climate change and governmental support for green initiatives. Yet, as interest rates rise, financing costs can increase for these capital-intensive projects. On the other hand, established energy firms may see improved margins as they capitalize on increased demand and pricing power.

Institutional Perspectives

Leading financial institutions are closely monitoring these developments. Morgan Stanley recently highlighted that while tech stocks may face headwinds from rising rates, sectors aligned with sustainability could offer compelling investment opportunities. In particular, companies focusing on energy efficiency and carbon reduction technologies are poised for growth as consumers and regulators alike prioritize sustainability.

Moreover, Goldman Sachs has pointed out that ESG-focused funds have outperformed traditional indices during periods of economic uncertainty. This trend underscores the increasing importance of integrating ESG factors into investment strategies as more investors recognize the long-term value associated with responsible corporate behavior.

Investment Opportunities Amidst Rising Rates

With rising interest rates reshaping market dynamics, discerning where to invest becomes paramount. One area worth exploring is Exchange-Traded Funds (ETFs) that focus on renewable energy or companies with strong ESG ratings. These funds not only provide diversification but also align with broader societal goals of sustainability.

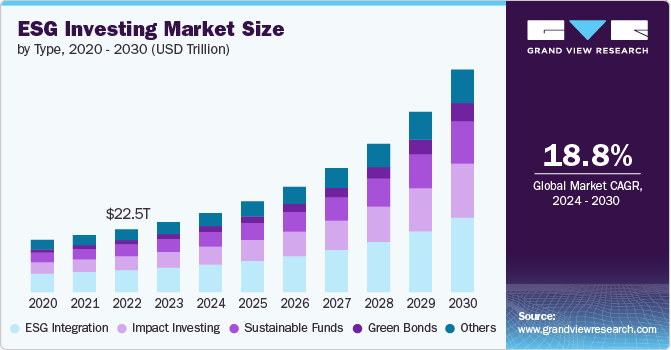

Furthermore, index funds tracking sustainable benchmarks may offer lower volatility compared to their traditional counterparts during turbulent times. As institutional flows increasingly favor ESG investments—evidenced by significant inflows into green bonds—investors should consider reallocating their portfolios accordingly.

Identifying Risks

However, it is crucial to remain vigilant about potential risks associated with rising interest rates. Higher borrowing costs could lead to reduced consumer spending and business investment if sustained over time. Additionally, geopolitical tensions and supply chain disruptions continue to pose threats that could exacerbate inflationary pressures or hinder economic recovery.

A Long-Term Perspective

Ultimately, while rising interest rates present immediate challenges for certain sectors within the U.S. stock market, they also create fertile ground for innovative companies focused on sustainability and responsible practices. Investors who embrace this shift may find themselves well-positioned for long-term success as societal values increasingly align with sustainable business models.

As we look ahead to 2024 and beyond, keeping an eye on macroeconomic indicators will be essential in navigating this evolving landscape effectively.