As the U.S. economy continues to grapple with persistent inflation, the implications for employment are becoming increasingly complex. While inflation is often viewed through the lens of rising prices, its effects on the labor market can be less apparent but equally significant. Understanding these dynamics is crucial for new investors seeking to build a systematic investment framework and navigate the current market landscape.

Inflation and Its Ripple Effects on Employment

Inflation, defined as the rate at which the general level of prices for goods and services rises, erodes purchasing power. In recent months, inflation rates have hovered around 5% annually, according to data from the Bureau of Labor Statistics. This persistent rise in prices has led the Federal Reserve to adopt a more aggressive monetary policy stance, with interest rate hikes aimed at curbing inflationary pressures.

However, these measures carry implications for employment. Higher interest rates tend to dampen economic activity by increasing borrowing costs for consumers and businesses alike. As companies face higher operational expenses and reduced consumer spending, many may opt to cut back on hiring or even lay off workers. This creates a paradox where inflation intended to stimulate growth inadvertently leads to employment stagnation or decline.

The Current State of Employment

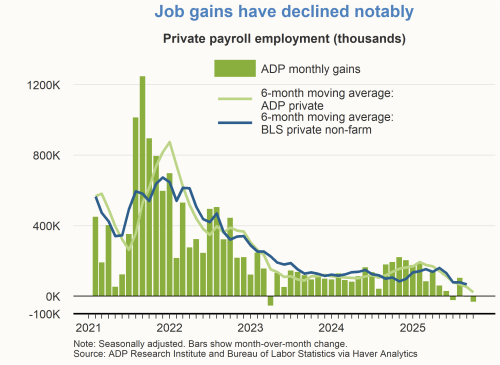

Despite these challenges, the U.S. job market has shown resilience. The unemployment rate remains low at approximately 3.8%, reflecting a tight labor market where employers compete for talent. However, wage growth has not kept pace with inflation, leading to a decrease in real income for many workers.

According to a report by Bloomberg, while job openings remain high, sectors such as retail and hospitality are experiencing increased turnover rates as employees seek better compensation elsewhere. This dynamic underscores the importance of understanding sector-specific trends when considering investment opportunities.

Investment Opportunities Amidst Economic Uncertainty

The interplay between inflation and employment presents both challenges and opportunities for investors. Sectors that tend to perform well during periods of high inflation include energy and consumer staples, as they provide essential goods and services that maintain demand regardless of economic conditions.

Additionally, exchange-traded funds (ETFs) focused on these sectors can offer diversified exposure without requiring deep individual stock analysis—ideal for novice investors looking to build their portfolios systematically.

Tech stocks also present an intriguing opportunity; despite their sensitivity to interest rates, many technology firms possess strong balance sheets and innovative capabilities that could allow them to weather economic fluctuations effectively.

The Role of Institutional Investors

Institutional flows have become increasingly relevant in shaping market trends. According to Reuters, large institutional investors are currently favoring sectors with strong pricing power that can pass on costs to consumers without sacrificing demand. This trend highlights the necessity for individual investors to align their strategies with institutional sentiment while remaining mindful of macroeconomic indicators such as inflation and employment figures.

Risk Factors in Current Market Conditions

While there are clear investment opportunities, risks abound as well. The potential for further interest rate hikes could dampen growth across various sectors, particularly those reliant on consumer discretionary spending. Additionally, geopolitical tensions and supply chain disruptions continue to pose threats that could exacerbate inflationary pressures.

Investors should remain vigilant about monitoring economic indicators such as wage growth, consumer sentiment, and corporate earnings reports—these will provide insights into how well companies can adapt to changing conditions.

Conclusion: A Forward-Looking Perspective

The current landscape reflects a delicate balance between managing inflation and fostering employment growth. For new investors aged 20-35 transitioning from personal finance into investing, understanding these dynamics is essential in making informed decisions that align with both short-term trends and long-term objectives.

The hidden impact of inflation on employment may seem daunting at first glance; however, by focusing on resilient sectors and leveraging institutional insights, investors can position themselves advantageously in this evolving market environment.

If you are keen on diving deeper into these insights or wish to connect with like-minded individuals navigating this complex landscape together, consider joining our community for exclusive discussions and valuable resources: Join Now!