The current landscape of the U.S. stock market is heavily influenced by global inflationary pressures that have persisted through 2023. As we navigate through this intricate web of economic indicators, it becomes essential for mid-career investors to dissect these trends to identify viable investment opportunities while managing risks effectively.

Understanding the Macroeconomic Context

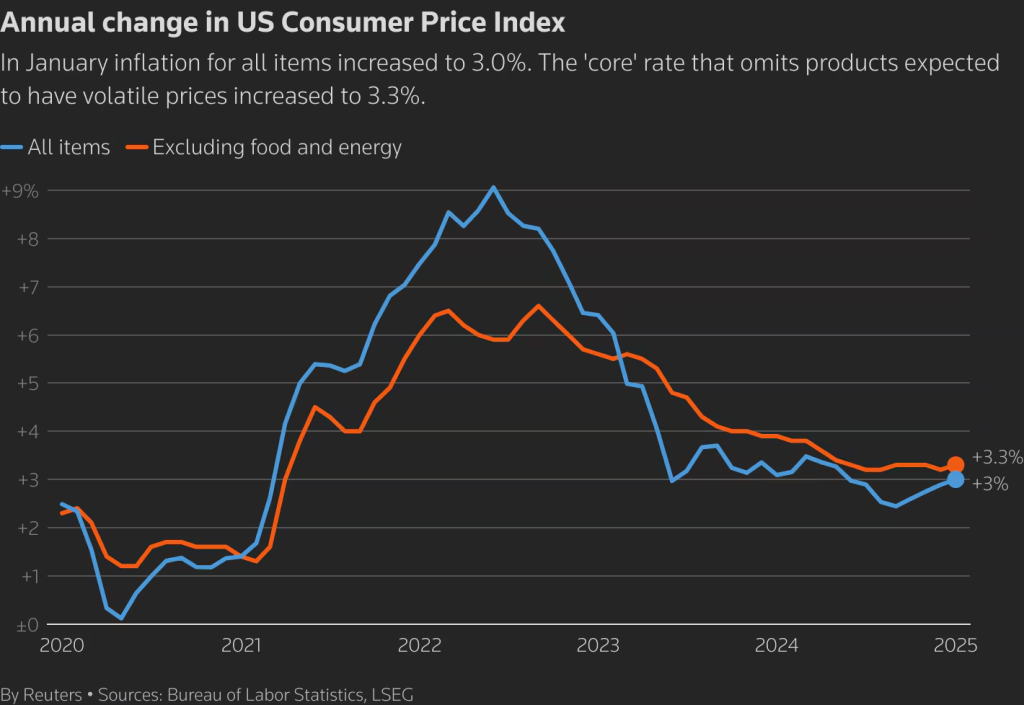

Inflation rates have surged across the globe, driven by supply chain disruptions, rising energy costs, and post-pandemic demand recovery. The Consumer Price Index (CPI) in the U.S. has seen fluctuations, with recent reports indicating an annual increase of approximately 4.2% as of September 2023. This persistent inflation has prompted the Federal Reserve to maintain a cautious stance on interest rates, with expectations for potential hikes looming over the market.

Employment figures remain robust, with unemployment rates hovering around 3.7%. However, wage growth has not kept pace with inflation, leading to decreased purchasing power for consumers. The dollar index has shown resilience against other currencies, but its strength could further complicate export dynamics and impact corporate earnings.

Sectoral Shifts and Industry Dynamics

The current environment has catalyzed significant shifts in sector performance within the U.S. stock market. Technology stocks, which previously led the rally during the pandemic, are facing headwinds as interest rates remain elevated. Conversely, sectors such as energy and consumer staples have gained traction due to their defensive nature amid rising costs.

Institutional investors are adjusting their portfolios accordingly; according to Bloomberg’s latest analysis, there has been a notable influx into ETFs focused on energy stocks and value-oriented index funds. This shift suggests a broader recognition that stability may be prioritized over growth in the near term.

Investment Opportunities Amidst Uncertainty

For mid-career investors seeking to optimize their portfolios under these challenging conditions, several strategies emerge as particularly relevant. First, diversifying into sectors that exhibit resilience against inflation—such as utilities and healthcare—can provide a buffer against volatility.

Additionally, exploring AI stocks presents an intriguing opportunity for those willing to embrace technological advancements while acknowledging associated risks. Companies leveraging artificial intelligence are expected to drive efficiency gains across various industries, potentially yielding significant returns despite market fluctuations.

Risks on the Horizon

However, it is crucial to approach these opportunities with caution. The risk of stagflation—a scenario where inflation remains high while economic growth stagnates—poses a serious threat to equity markets. If consumer spending declines further due to eroded purchasing power, corporate profits could suffer significantly.

Moreover, geopolitical tensions and supply chain uncertainties continue to loom large over market sentiment. Investors should remain vigilant about how these factors might impact specific sectors differently and adjust their strategies accordingly.

A Forward-Looking Perspective

As we look ahead into 2024 and beyond, it is imperative for investors to stay informed about macroeconomic trends and institutional flows that could shape market dynamics. The Federal Reserve’s policy decisions will be pivotal in determining whether inflation can be tamed without triggering a recession.

The interplay between rising interest rates and investor sentiment will likely dictate market direction in the coming months. For those who can adeptly navigate this landscape by leveraging data-driven insights and industry analyses, opportunities for stable returns remain within reach.

If you’re looking for exclusive insights into navigating today’s complex investment landscape while maximizing your portfolio’s potential amidst evolving economic conditions, consider joining our community for valuable discussions and expert analyses. Join us here!