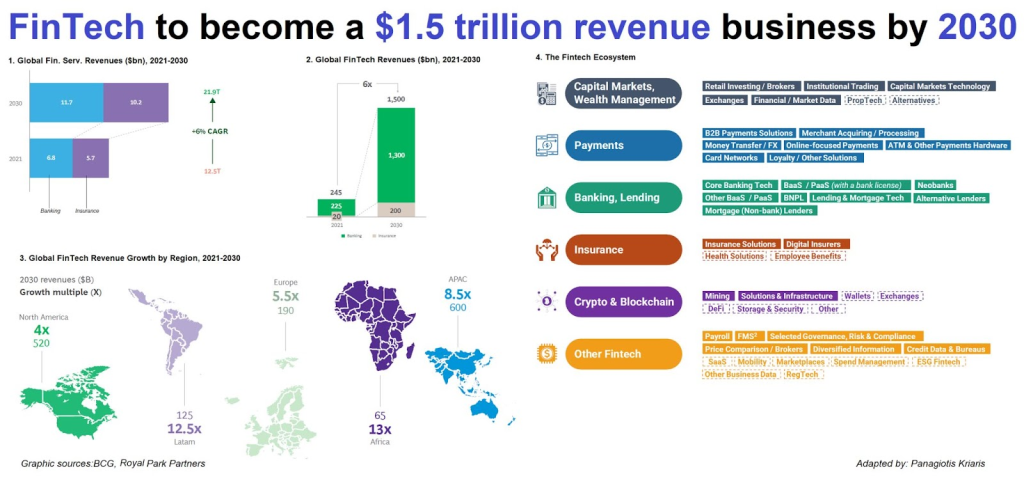

The digital banking landscape is undergoing a transformative shift, driven largely by the rapid evolution of financial technology (FinTech). As we approach a projected $1 trillion market for digital banking services, understanding the implications of this revolution is crucial for middle-class investors seeking to navigate the complexities of modern finance.

The Current U.S. Market Logic

In the current macroeconomic environment, characterized by fluctuating inflation rates and an uncertain interest rate trajectory, traditional banking models are increasingly being challenged. The Federal Reserve’s recent decisions have left many investors questioning the stability of conventional financial institutions. With inflationary pressures still prevalent and employment figures showing signs of resilience, consumers are shifting towards more agile and user-friendly digital banking solutions.

According to a report by Bloomberg, digital banking adoption surged during the pandemic, with many consumers preferring online services over traditional brick-and-mortar banks. This trend is expected to continue as younger generations prioritize convenience and accessibility in their financial transactions.

Industry Dynamics and Structural Changes

The FinTech sector has been at the forefront of this change, leveraging technology to enhance customer experience and streamline operations. Companies like Square and PayPal have redefined payment processing, while neobanks such as Chime and N26 offer fully digital banking experiences without the overhead costs associated with traditional banks. This shift is not merely a trend; it represents a fundamental restructuring of how financial services are delivered.

Investment opportunities in this space are abundant. Exchange-Traded Funds (ETFs) focused on FinTech companies provide a diversified approach for those looking to capitalize on this burgeoning sector. The Global X FinTech ETF (FINX), for instance, offers exposure to a wide range of companies innovating within this space.

Institutional Perspectives

Major financial institutions are also recognizing the potential of FinTech. A recent analysis from Reuters highlights that firms like Goldman Sachs and Morgan Stanley are investing heavily in technology-driven solutions to remain competitive. These institutions understand that adapting to digital trends is no longer optional but essential for survival in an increasingly tech-centric financial landscape.

Investment Opportunities and Risks

For seasoned investors, identifying key players in the FinTech arena can yield significant returns. AI stocks within this sector are particularly promising, as they leverage machine learning to improve customer service and operational efficiency. However, with opportunity comes risk; regulatory scrutiny surrounding data privacy and security remains a critical concern that could impact growth trajectories.

The energy sector also presents unique investment avenues as it increasingly integrates digital solutions to optimize operations and reduce costs. Companies embracing these technologies may find themselves at a competitive advantage as sustainability becomes paramount.

A Forward-Looking Perspective

As we look ahead, it is evident that adaptability will be crucial for both investors and financial institutions alike. The ongoing digital transformation presents not only challenges but also unprecedented opportunities for those willing to embrace change. Investors should remain vigilant about market trends while considering diversified portfolios that include both traditional assets and innovative FinTech solutions.

The integration of FinTech into everyday banking practices signals a paradigm shift that could redefine wealth management strategies for years to come. For middle-class investors balancing their professional lives with investment goals, staying informed about these developments will be key in making sound decisions that align with their long-term objectives.

If you’re ready to explore these opportunities further or want insights from industry experts on navigating this evolving landscape, consider joining our community where we share valuable resources tailored for discerning investors like you: Join our investment community today!