The U.S. stock market has witnessed significant fluctuations in recent years, influenced by numerous macroeconomic factors. Among these, unemployment rates have emerged as a crucial indicator that can shape investment strategies for both novice and experienced investors alike. Understanding the nuances behind unemployment statistics may provide valuable insights into market trends and potential investment opportunities.

Understanding Current Market Dynamics

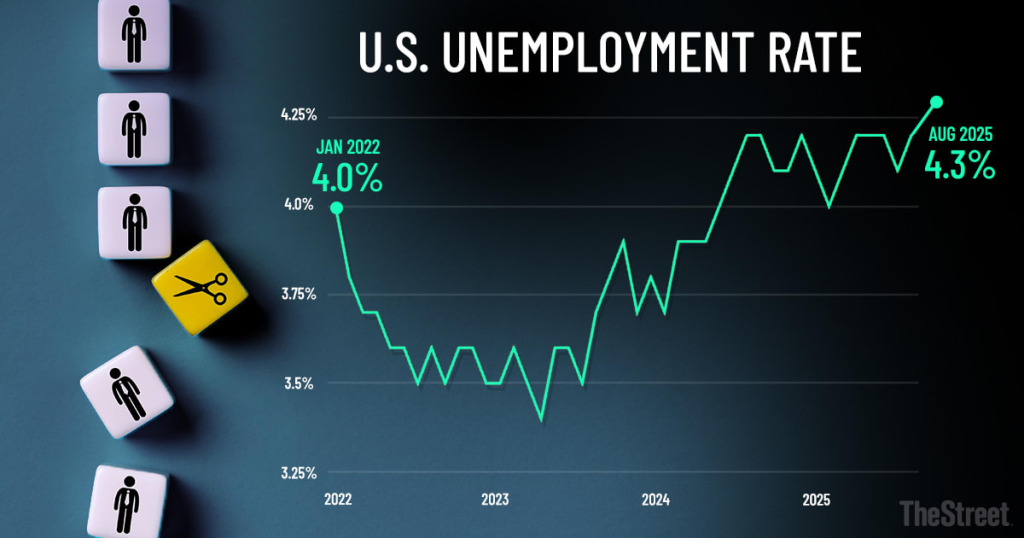

As of late 2023, the U.S. unemployment rate stands at around 3.8%, a figure that reflects a resilient labor market. However, this number is not just a standalone statistic; it’s part of a larger economic narrative that encompasses wage growth, inflation, and consumer spending. When unemployment rates are low, consumer confidence typically rises, leading to increased spending and, in turn, higher corporate earnings. This scenario often boosts stock prices and presents lucrative investment opportunities.

What Drives Unemployment Rates?

Unemployment rates are driven by a myriad of factors including economic policies, technological advancements, and global events. For instance, the Federal Reserve’s monetary policies can influence job creation by adjusting interest rates. A lower interest rate usually encourages borrowing and investment, thereby stimulating job growth. Conversely, higher rates can lead to slower growth and rising unemployment.

In addition to interest rates, labor market dynamics such as job openings versus available workers also play a critical role. The current labor shortage has led to wage inflation, which can impact consumer purchasing power and overall economic growth. Investors need to stay attuned to these changes as they can signal shifts in market sentiment.

Investment Opportunities in Light of Unemployment Data

Given the relationship between unemployment and economic performance, savvy investors can use unemployment data to inform their strategies. For example, sectors such as consumer discretionary tend to thrive when unemployment is low, as people have more disposable income to spend on non-essential goods. Conversely, during periods of rising unemployment, defensive sectors like utilities and healthcare often outperform as consumers prioritize essential services.

Exchange-Traded Funds (ETFs) focused on these sectors may present a strategic opportunity for investors looking to capitalize on economic cycles. Additionally, technology stocks that provide solutions for workforce optimization may see increased demand as companies adapt to labor shortages.

Risks Associated with Unemployment Trends

While understanding unemployment rates can provide insights into potential investment opportunities, it is essential to be aware of the risks involved. A sudden spike in unemployment can lead to market corrections and reduced consumer spending. Moreover, geopolitical tensions or unexpected economic events can further exacerbate these risks. Investors must remain vigilant and adaptive in their strategies to navigate these uncertainties.

Market Structure and Its Implications

The current market structure indicates a transition where institutional flows are increasingly favoring sectors that align with long-term growth trends such as renewable energy and technology. This shift is partly driven by a generational change in investor sentiment towards sustainability and innovation. Investors should consider diversifying their portfolios to include these high-growth areas while maintaining a foundation in stable sectors.

Conclusion: Formulating Your Investment Strategy

In summary, the interplay between unemployment rates and the broader economy provides vital insights for formulating effective investment strategies. By understanding how these rates influence various sectors, investors can better position themselves to capitalize on market trends. As we move forward into 2024 and beyond, keeping an eye on labor market indicators will be paramount for making informed decisions.

Investors should remain adaptable, continually reassessing their portfolios against changing economic conditions. This may well be the key to achieving robust returns while managing risk effectively.