In recent months, rising bond yields have become a hot topic among American investors, particularly those navigating the complexities of the U.S. stock market. As the Federal Reserve continues its tightening stance, many are left wondering whether this signals the end of the easy money era that has characterized much of the post-pandemic recovery. For middle-class investors aged 28-45, with a few years of experience under their belts, understanding these shifts is crucial for making informed investment decisions.

Market Phenomenon Review: Current Landscape

The U.S. stock market has seen significant volatility over the past year, with inflation concerns and subsequent interest rate hikes leading to a reevaluation of asset valuations. Bond yields, which have been on an upward trajectory, directly impact borrowing costs and investor sentiment across equities and other asset classes. As of now, the 10-year Treasury yield has reached levels not seen since early 2020, significantly influencing market dynamics. Investors are now faced with tough decisions: Should they continue to invest heavily in stocks or start shifting towards safer assets like bonds?

Macro, Policy, Industry, and Fundamental Drivers

The primary driver behind the rising bond yields is the Federal Reserve’s policy adjustment aimed at curbing inflation. After a prolonged period of near-zero interest rates designed to stimulate economic recovery during the pandemic, the Fed has signaled its intent to raise rates to combat inflationary pressures. According to Bloomberg, the Fed’s hawkish outlook has resulted in a shift in investor expectations regarding future economic growth and corporate earnings.

Additionally, factors such as geopolitical tensions and supply chain disruptions have added layers of complexity to market conditions. Energy prices have surged due to global demand recovery, further exacerbating inflation concerns. This mix of macroeconomic indicators suggests a potential slowdown in growth, making high-yield sectors like technology and consumer discretionary stocks more vulnerable.

Decomposing Market Structure and Industry Logic

As bond yields rise, certain sectors may experience varying degrees of impact. Historically, sectors such as utilities and consumer staples tend to perform better in high-yield environments due to their stable cash flows and dividends. In contrast, growth-oriented sectors like technology may face headwinds as future cash flows are discounted more heavily.

Investors should also consider sector rotation strategies as capital flows shift in response to changing interest rates. The energy sector has recently gained traction due to rising oil prices, while high-growth tech stocks may see a pullback as valuations become more sensitive to rate changes.

Citing Key Data, News, and Institutional Perspectives

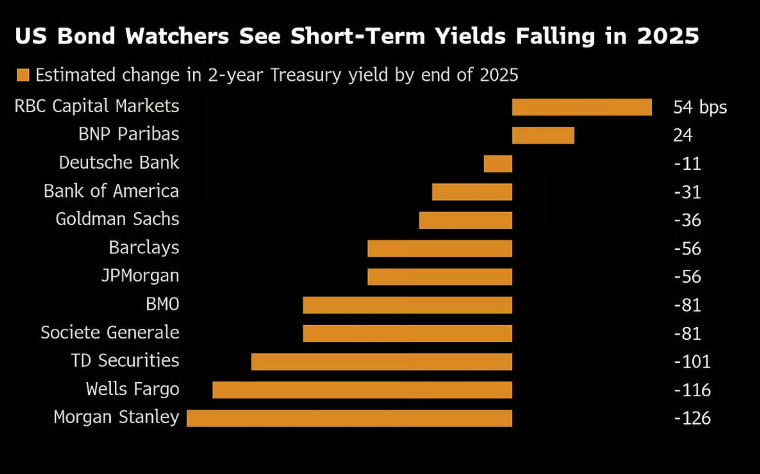

According to CNBC, institutional investors are increasingly diversifying their portfolios in anticipation of a prolonged period of higher interest rates. Analysts from major firms like Goldman Sachs have indicated that investors should be prepared for a “new normal” where traditional asset classes do not behave as expected. This shift necessitates a rethinking of investment strategies across all sectors.

Identifying Specific Trend Opportunities and Directions

For middle-class investors looking for opportunities amidst these changes, sectors such as renewable energy and financials could present interesting prospects. The transition towards sustainable energy is not only supported by governmental policies but also aligns with changing consumer preferences. Financial institutions, on the other hand, may benefit from higher interest margins as rates rise.

Assessing Potential Risk Factors

However, along with these opportunities come inherent risks. Rising bond yields can lead to increased borrowing costs for consumers and businesses alike, potentially slowing down economic growth. Moreover, any missteps by the Fed could trigger market corrections, especially in overvalued sectors. Investors must remain vigilant and ready to pivot if market conditions worsen.

Extending Market Structure and Micro-Logic for Professional Insight

A deeper dive into the current market structure reveals that liquidity conditions are tightening as monetary policy shifts. This transition could impact not just equity valuations but also corporate financing and M&A activity. Investors should closely monitor credit spreads and corporate earnings reports for signs of stress in leveraged sectors.

Providing Unique Professional Judgments and Logical Chains

Ultimately, the key takeaway for investors navigating this landscape is to adopt a balanced approach. Diversification remains critical, particularly in uncertain times. While chasing high returns is tempting, a focus on risk management through stable sectors could provide a safety net during turbulent periods.

This may be the right time to reassess your portfolio allocation and consider how bond yields will affect your investments moving forward. Are you prepared for a shift in market dynamics?