The electric vehicle (EV) revolution is not just a trend; it’s a fundamental shift in how we think about transportation and energy consumption. As the world transitions towards cleaner energy sources, investors in the U.S. stock market must consider the implications of this paradigm shift. With companies like Tesla, Rivian, and Lucid Motors leading the charge, the EV sector is set to reshape the investment landscape. But are investors fully aware of the opportunities and risks involved in this clean energy surge?

Understanding the Market Logic Behind the EV Movement

The U.S. stock market is currently experiencing a significant transformation, driven by technological advancements and increasing consumer demand for sustainable solutions. According to a report by Bloomberg, EV sales are projected to reach 20 million units annually by 2025, indicating a compound annual growth rate of over 20%. This rapid growth is fueled by government incentives, environmental regulations, and a shift in consumer preferences towards greener alternatives. For investors, understanding these dynamics is crucial for identifying potential investment opportunities.

Institutional Flows and Sector Rotation

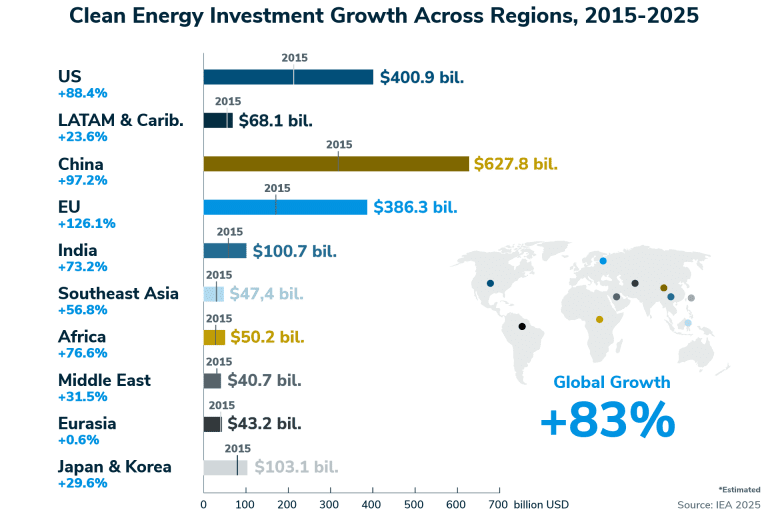

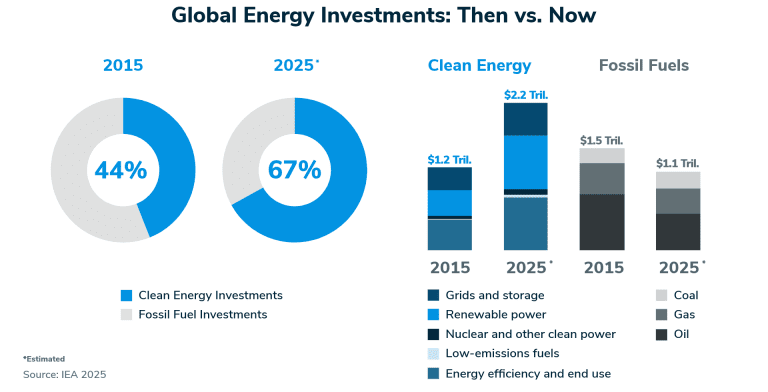

As institutional investors increasingly allocate funds towards clean energy sectors, there is a noticeable rotation from traditional fossil fuel investments to renewable energy and EV stocks. A recent analysis by Morgan Stanley highlights that the energy sector is expected to attract over $1 trillion in capital by 2030. This influx signifies a broader acceptance of clean energy as a viable investment avenue. Furthermore, ETFs focusing on renewable energy and EVs are gaining popularity among retail investors, providing an accessible entry point into this burgeoning market.

Identifying Key Investment Opportunities

Several stocks stand out in the clean energy surge, offering compelling investment cases for those willing to embrace this trend. Tesla remains a dominant player with its robust production capabilities and innovative technology. Additionally, new entrants like Rivian and Lucid Motors are attracting attention for their unique offerings and ambitious growth plans. Moreover, established automakers such as Ford and GM are pivoting towards electrification, further expanding the landscape of potential investments.

While the opportunities are promising, it’s essential to remain vigilant about the inherent risks. Market volatility, regulatory changes, and supply chain disruptions can pose challenges for investors. However, with careful analysis and strategic positioning, one can navigate these complexities effectively.

In conclusion, the EV revolution presents a transformative opportunity within the U.S. stock market that should not be underestimated. As institutional flows favor clean energy investments, retail investors can leverage this trend to potentially enhance their portfolios. This may very well be the next wave of capital flowing into our markets—don’t miss out on being part of it.

Don’t miss your chance to be part of this transformative investment journey! Join our community to stay ahead of market trends and gain exclusive insights. Click here to join now!