The landscape of the U.S. stock market is continuously evolving, influenced by technological advancements and macroeconomic factors. As we look toward 2025, artificial intelligence (AI) is poised to play a pivotal role in shaping market dynamics, offering unique investment opportunities for retail investors. In this article, we will explore how AI may transform the investment landscape and what it means for investors looking to capitalize on these changes.

The Current Market Logic: Understanding the Role of AI

As we move closer to 2025, the integration of AI into trading strategies is becoming more prevalent. Major financial institutions are leveraging AI algorithms to analyze vast amounts of data, enabling them to make faster and more informed decisions. According to a recent report from Bloomberg, AI-driven trading strategies have outperformed traditional methods, indicating a shift in market dynamics. This trend raises important questions for retail investors: How can they harness the power of AI to identify investment opportunities?

Identifying Investment Opportunities in AI

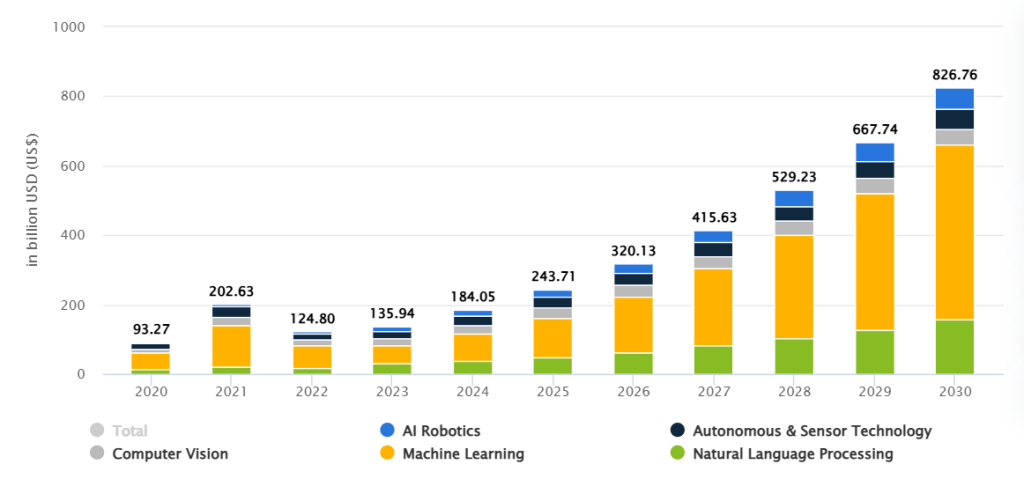

Retail investors should focus on sectors that are likely to benefit from AI advancements. For instance, tech stocks are expected to remain at the forefront of this evolution, particularly companies involved in cloud computing, machine learning, and data analytics. In addition, the energy sector is also ripe for disruption, with AI playing a crucial role in optimizing resource management and enhancing efficiency.

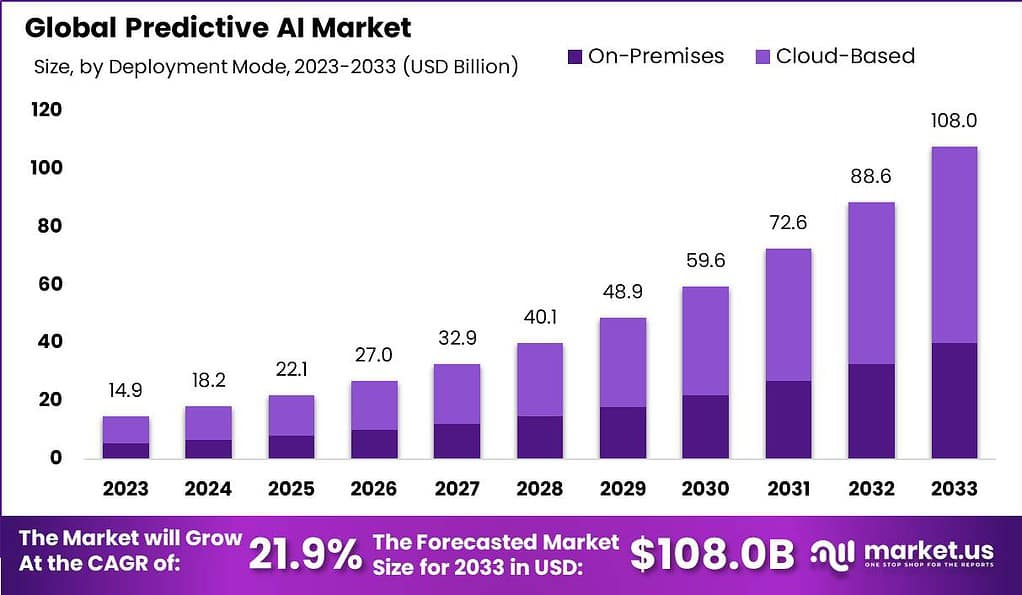

Furthermore, ETFs and index funds that focus on AI-related companies could provide a diversified approach for investors. With institutional flows increasingly favoring these assets, understanding their performance metrics will be vital. An analysis from Reuters suggests that by 2025, AI-powered ETFs could attract billions in investments as more retail investors seek exposure to this technology-driven paradigm shift.

Macroeconomic Factors: The Influence of Monetary Policy

The Federal Reserve’s monetary policy will also significantly influence market dynamics as we approach 2025. With discussions surrounding potential interest rate cuts gaining momentum, the liquidity in the market could increase, benefiting growth stocks and sectors tied to AI innovations. Monitoring these macroeconomic indicators will be essential for investors aiming to navigate the evolving landscape effectively.

In conclusion, the integration of AI into the financial ecosystem presents both opportunities and challenges for retail investors. As we look forward to 2025, staying informed about market trends and being proactive in adapting investment strategies will be key. Embracing AI not only allows investors to tap into emerging sectors but also enhances their ability to make data-driven decisions.

Don’t miss out on exclusive insights that can enhance your investment strategies! Join our community today for real-time discussions and expert analysis that can help you navigate the evolving market landscape effectively. Click here to become part of our investment community now: Join Now!