Exchange-Traded Funds (ETFs) and index funds have become increasingly popular among investors due to their low costs, diversification, and ease of use. ETFs are investment funds that trade on stock exchanges, much like individual stocks, and are designed to track the performance of a specific index, commodity, or basket of assets. Index funds, on the other hand, are mutual funds that aim to replicate the performance of a particular market index, such as the S&P 500. Both investment vehicles offer a way to gain exposure to a wide range of assets without the need for extensive research or management fees.

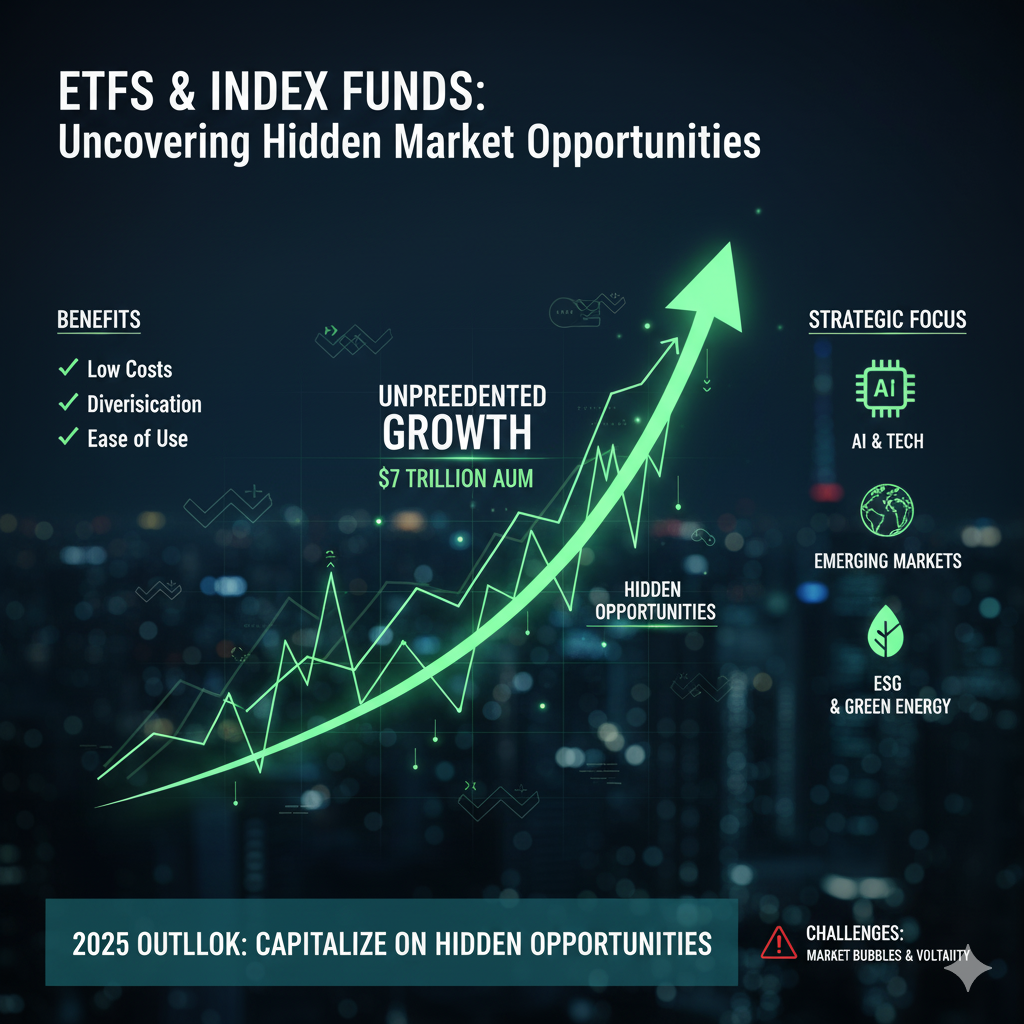

According to a report by Morningstar, ETFs and index funds have seen a significant increase in assets under management (AUM) over the past decade. This growth is driven by their ability to provide investors with a cost-effective and transparent way to participate in the market. In 2023, the total AUM for ETFs and index funds reached over $7 trillion, highlighting their importance in the investment landscape.

The Benefits of ETFs and Index Funds

One of the primary advantages of ETFs and index funds is their low expense ratio. Unlike actively managed funds, which often charge higher fees to cover the costs of research and trading, ETFs and index funds typically have lower management fees. For example, the average expense ratio for an ETF is around 0.44%, while the average for an index fund is about 0.57%, according to Investopedia. These lower fees can significantly enhance long-term returns, especially for investors with a buy-and-hold strategy.

Another key benefit is diversification. By investing in an ETF or index fund, you gain exposure to a broad range of assets, which can help reduce the risk associated with individual stock picking. For instance, the Vanguard Total Stock Market ETF (VTI) tracks the performance of the entire U.S. stock market, including large-cap, mid-cap, and small-cap stocks. This diversification can provide a more stable and predictable investment experience.

Hidden Opportunities in the Market

The stock market is constantly evolving, and hidden opportunities can emerge in various sectors and asset classes. ETFs and index funds can be particularly effective in capturing these opportunities due to their broad exposure and ability to track niche indices. For example, the rise of artificial intelligence (AI) and technology has created new investment themes. The Invesco QQQ Trust (QQQ) tracks the Nasdaq-100 Index, which includes leading technology companies like Apple, Microsoft, and Tesla. By investing in QQQ, you can gain exposure to these high-growth sectors without the need to pick individual stocks.

Similarly, the iShares MSCI Emerging Markets ETF (EEM) provides access to emerging market economies, which are often overlooked by retail investors. These markets can offer higher growth potential and diversification benefits, especially in a globalized investment environment. According to Bloomberg, emerging markets are expected to outperform developed markets in the coming years, driven by economic reforms and technological advancements.

Strategic Use of ETFs and Index Funds

To capitalize on hidden market opportunities, investors can use ETFs and index funds strategically. One approach is to combine broad market ETFs with sector-specific ETFs. For instance, you might invest a portion of your portfolio in a total market ETF like VTI and another portion in a technology ETF like QQQ. This strategy allows you to benefit from the overall market while also capturing the growth potential of specific sectors.

Another strategy is to use ETFs and index funds to gain exposure to thematic investments. Thematic ETFs focus on emerging trends and innovations, such as renewable energy, biotechnology, and cybersecurity. The Global X Cybersecurity ETF (BUG) and the iShares Global Clean Energy ETF (ICLN) are examples of thematic ETFs that can help you align your investments with long-term growth drivers.

Market Trends and Outlook for 2024

The investment landscape in 2024 is expected to be shaped by several key trends. One of the most significant is the continued shift towards passive investing. According to CNBC, passive funds have outperformed active funds in recent years, leading more investors to adopt a passive investment approach. ETFs and index funds are at the forefront of this trend, offering a simple and effective way to participate in the market.

Another trend is the increasing focus on environmental, social, and governance (ESG) factors. ESG investing has gained traction as more investors seek to align their investments with their values and long-term sustainability goals. The iShares ESG Aware MSCI USA ETF (ESGU) and the SPDR SSGA Gender Diversity Index ETF (SHE) are examples of ESG-focused ETFs that can help you build a socially responsible portfolio.

Challenges and Considerations

While ETFs and index funds offer numerous benefits, they are not without challenges. One of the main concerns is the potential for market bubbles. As more investors flock to popular ETFs and index funds, the underlying assets can become overvalued. It is crucial to conduct thorough research and monitor market conditions to avoid such risks.

Another consideration is the impact of market volatility. ETFs and index funds are subject to the same market fluctuations as individual stocks. During periods of high volatility, the value of these funds can fluctuate significantly. However, their diversification can help mitigate the impact of these fluctuations on your portfolio.

Case Studies and Examples

To illustrate the potential of ETFs and index funds, let’s look at a few case studies. In 2020, the Invesco QQQ Trust (QQQ) saw a significant increase in its value, driven by the strong performance of technology stocks. According to Reuters, QQQ gained over 30% in 2020, outperforming the broader market. This example highlights the importance of sector-specific ETFs in capturing growth opportunities.

Another example is the iShares MSCI Emerging Markets ETF (EEM). In 2021, EEM outperformed the S&P 500, driven by the economic recovery in emerging markets. According to Nasdaq, EEM gained over 18% in 2021, compared to a 27% gain for the S&P 500. This performance underscores the potential of emerging markets as a source of hidden opportunities.

Building a Diversified Portfolio

A well-diversified portfolio is essential for long-term success in the stock market. ETFs and index funds can play a crucial role in achieving this diversification. By combining different types of ETFs and index funds, you can create a portfolio that is balanced across various asset classes and sectors. For example, you might allocate a portion of your portfolio to a total market ETF, another portion to a technology ETF, and a third portion to an ESG-focused ETF.

This approach not only helps reduce risk but also increases the likelihood of capturing hidden opportunities. According to TradingView, a diversified portfolio can provide more stable returns and better risk-adjusted performance over time.

Conclusion and Next Steps

ETFs and index funds offer a powerful tool for investors to capitalize on hidden market opportunities. By understanding their benefits, strategic uses, and potential challenges, you can build a portfolio that is well-positioned for success in 2024 and beyond. Whether you are a seasoned investor or just starting out, these investment vehicles can help you navigate the complexities of the stock market and achieve your financial goals.