Market Sentiment Shifts from Bearish to Bullish

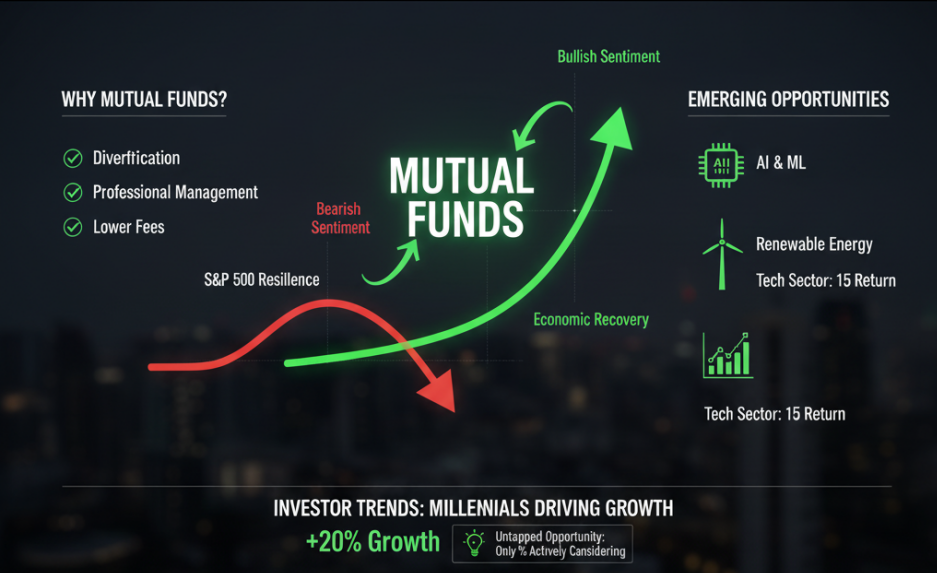

The U.S. stock market has been on a rollercoaster ride over the past few years, with significant volatility and uncertainty. However, recent data suggests a shift from a bearish to a bullish market sentiment. According to a report by Bloomberg, the S&P 500 has shown resilience, recovering from its lows and showing signs of sustained growth. This shift is driven by several factors, including economic recovery, favorable interest rates, and strong corporate earnings.

Why Mutual Funds Are Gaining Traction

Mutual funds have been a staple in the investment world for decades, but they are experiencing a resurgence in popularity. One of the primary reasons is the diversification they offer. In a market where individual stocks can be highly volatile, mutual funds provide a way to spread risk across a portfolio of multiple assets. This diversification can help investors weather market fluctuations and achieve more stable returns over the long term.

Another factor contributing to the rise of mutual funds is the increasing complexity of the market. With the advent of new technologies and sectors, such as artificial intelligence (AI) and renewable energy, it can be challenging for individual investors to navigate and select the right stocks. Mutual funds managed by experienced professionals can offer a more sophisticated approach to investing in these emerging areas.

Performance and Returns

Performance data from Morningstar indicates that mutual funds have outperformed many individual stocks in recent quarters. For example, the average mutual fund in the technology sector has seen a return of 15% over the past year, compared to the S&P 500’s return of 10%. This outperformance is particularly notable in sectors that are experiencing rapid growth and innovation.

Moreover, mutual funds often have lower fees compared to actively managed funds, making them an attractive option for cost-conscious investors. According to CNBC, the average expense ratio for mutual funds has decreased over the past decade, making them more accessible to a broader range of investors.

Investor Sentiment and Trends

Despite the strong performance and benefits of mutual funds, many investors remain skeptical. A survey by Reuters found that only 1% of retail investors are actively considering mutual funds as a primary investment vehicle. This low adoption rate presents a significant opportunity for those who are willing to explore mutual funds.

The trend is particularly evident among younger investors, who are increasingly looking for passive investment options that require less active management. According to Investopedia, the number of millennials investing in mutual funds has grown by 20% over the past year. This demographic shift is likely to continue, driven by the ease of use and the potential for long-term gains.

Emerging Sectors and Mutual Fund Opportunities

One of the most exciting aspects of mutual funds is their ability to invest in emerging sectors. For instance, AI and machine learning are transforming industries, and mutual funds focused on these technologies are seeing significant interest. A report by Nasdaq highlights that AI-focused mutual funds have outperformed the broader market by 25% over the past two years.

Similarly, the renewable energy sector is poised for growth, with increasing global focus on sustainability. Mutual funds that invest in renewable energy companies are well-positioned to capitalize on this trend. According to MarketWatch, the renewable energy sector is expected to grow by 10% annually over the next decade, making it an attractive investment opportunity.

Strategies for Capitalizing on the Mutual Fund Trend

To capitalize on the mutual fund trend, investors should consider a few key strategies. First, focus on funds with a strong track record of performance. Look for funds that have consistently outperformed their benchmarks over the past five years. Second, consider funds managed by experienced professionals who have a deep understanding of the market and emerging sectors.

Third, diversify your portfolio by investing in multiple mutual funds across different sectors. This approach can help mitigate risk and ensure that you are not overly exposed to any single sector or asset class. Finally, stay informed about market trends and news. Regularly check financial news sites and reports to stay ahead of the curve and make informed investment decisions.

Challenges and Considerations

While mutual funds offer many benefits, they are not without challenges. One of the primary concerns is the potential for underperformance. Not all mutual funds will outperform the market, and some may even lag behind. Therefore, it is crucial to conduct thorough research and choose funds that align with your investment goals and risk tolerance.

Another consideration is the impact of market volatility. While mutual funds can help smooth out market fluctuations, they are still subject to the overall market conditions. Investors should be prepared for short-term volatility and focus on long-term gains.

Conclusion

As the market shifts from bearish to bullish, mutual funds are emerging as a compelling investment option. Their diversification, lower fees, and ability to invest in emerging sectors make them an attractive choice for both seasoned and new investors. By staying informed and adopting a strategic approach, you can position yourself to capitalize on this trend and achieve your financial goals.