The Allure of Mutual Funds

Mutual funds have long been a staple in the investment portfolios of both retail and institutional investors. These funds pool money from multiple investors to purchase a diversified portfolio of stocks, bonds, and other securities. The appeal is clear: mutual funds offer a way to diversify risk and gain exposure to a wide range of assets without the need for extensive research or large initial investments. However, beneath this veneer of accessibility and safety, there are hidden costs and potential pitfalls that can significantly impact your returns.

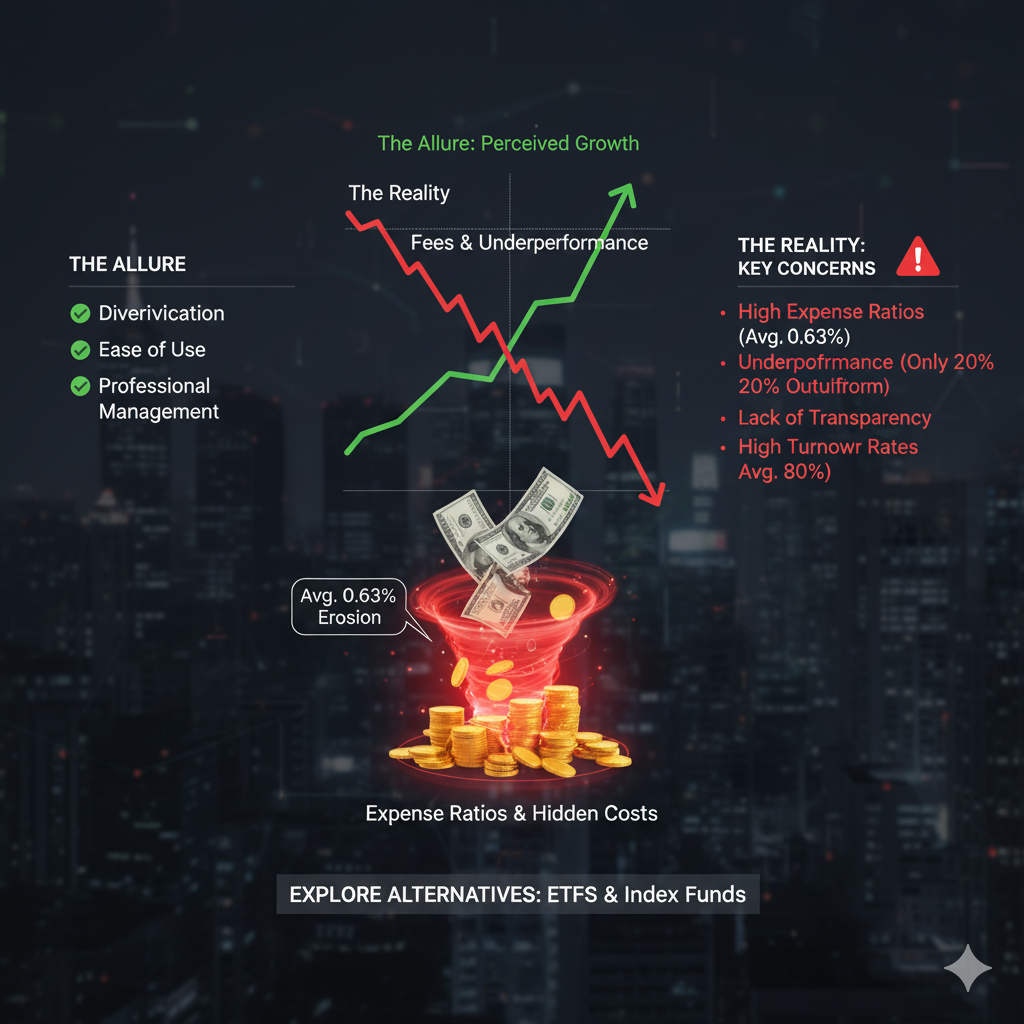

The Hidden Costs of Mutual Funds

One of the most significant issues with mutual funds is the fees. Management fees, administrative fees, and other expenses can add up quickly, often eating into your returns without you even realizing it. According to a report by Morningstar, the average expense ratio for mutual funds is around 0.63%. While this may seem small, over time, it can have a substantial impact on your investment growth. For example, a $10,000 investment in a mutual fund with a 0.63% expense ratio over 30 years would result in nearly $2,000 in fees, assuming a 7% annual return.

Performance and the 1%

Despite the fees, mutual funds are often touted as a reliable investment vehicle. However, the performance of mutual funds is not always as stellar as advertised. A study by Bloomberg found that only about 20% of actively managed mutual funds outperform their benchmark indices over a 10-year period. This means that the majority of mutual fund investors are paying high fees for subpar performance.

The 1%, on the other hand, often have access to more sophisticated investment strategies and lower-cost options. They can afford to hire top-tier financial advisors and invest in hedge funds, private equity, and other alternative investments that are not available to the average retail investor. These strategies can offer higher returns and more flexibility, making mutual funds a less attractive option for the wealthy.

The Role of Expense Ratios

Expense ratios are a critical factor to consider when evaluating mutual funds. A higher expense ratio can significantly reduce your net returns. For instance, a fund with a 1.5% expense ratio will cost you $150 annually for every $10,000 invested. Over time, these costs can compound, leading to a substantial reduction in your investment’s growth potential.

Low-cost index funds, on the other hand, offer a more cost-effective alternative. According to Investopedia, index funds typically have expense ratios of 0.10% or less. This means that for a $10,000 investment, you would pay only $10 in annual fees, leaving more of your money to grow over time.

The Impact of Turnover Rates

Another often overlooked cost associated with mutual funds is the turnover rate. High turnover rates can lead to increased trading costs and capital gains taxes, which can further erode your returns. A fund with a high turnover rate is more likely to generate short-term capital gains, which are taxed at a higher rate than long-term gains.

According to CNBC, the average turnover rate for mutual funds is around 80%, meaning that 80% of the fund’s holdings are replaced each year. This high turnover can result in significant transaction costs and tax liabilities, which are ultimately borne by the investors.

The Importance of Transparency

Transparency is a key issue in the mutual fund industry. Many investors are not fully aware of the fees and costs they are paying, nor do they understand the investment strategies employed by the fund managers. This lack of transparency can lead to poor investment decisions and missed opportunities.

The Securities and Exchange Commission (SEC) has taken steps to improve transparency, but more needs to be done. According to the SEC, investors should carefully review the prospectus and other disclosure documents to understand the fees, risks, and performance of a mutual fund before investing.

Alternative Investment Strategies

For those looking to avoid the pitfalls of mutual funds, there are several alternative investment strategies to consider. Exchange-traded funds (ETFs) offer similar diversification benefits but with lower fees and more transparency. Robo-advisors can provide automated investment management at a fraction of the cost of traditional financial advisors. Additionally, direct investment in individual stocks or bonds can give you more control over your portfolio and potentially higher returns.

According to Reuters, ETFs have seen a surge in popularity in recent years, with assets under management growing from $1 trillion in 2008 to over $7 trillion in 2021. This growth is driven by the lower costs and greater flexibility offered by ETFs.

How to Make Informed Investment Decisions

Making informed investment decisions requires a thorough understanding of the costs and benefits associated with different investment vehicles. When considering mutual funds, it is essential to evaluate the expense ratio, turnover rate, and historical performance. Additionally, investors should consider their own risk tolerance and investment goals to determine if a mutual fund is the right choice for them.

For those who are new to investing, educational resources such as Investopedia and MarketWatch can provide valuable insights and guidance. These platforms offer a wealth of information on various investment strategies and can help you make more informed decisions.

The Future of Mutual Funds

The mutual fund industry is facing significant challenges. The rise of low-cost ETFs and robo-advisors is putting pressure on traditional mutual funds to reduce fees and improve performance. According to a report by Morningstar, the trend towards passive investing is likely to continue, with more investors opting for index funds and ETFs over actively managed mutual funds.

However, mutual funds are not going away anytime soon. They still offer a valuable service to many investors, particularly those who prefer a hands-off approach to investing. The key is to be aware of the costs and to choose funds that align with your investment goals and risk tolerance.

Conclusion

While mutual funds can be a useful tool in your investment arsenal, they are not without their drawbacks. High fees, poor performance, and lack of transparency can all cost you dearly over the long term. By understanding these issues and exploring alternative investment strategies, you can make more informed decisions and potentially achieve better returns.