It’s funny how markets sometimes feel like a living, breathing organism—unpredictable yet somehow patterned. Just last week, clean energy ETFs were basking in inflows, buoyed by optimism around green infrastructure spending and a renewed focus on sustainability. Then came Wednesday, and with it, a sharp reversal: nearly $600 million pulled out from these funds as crude oil prices surged past the $95 mark. This sudden pivot caught many off guard, myself included.

Reflecting on two decades of covering financial markets for Bloomberg, Reuters, and CNBC, I’ve learned that such reversals often reveal deeper undercurrents—risk premiums adjusting, valuation sensitivities kicking in, and sector rotations unfolding beneath the surface noise.

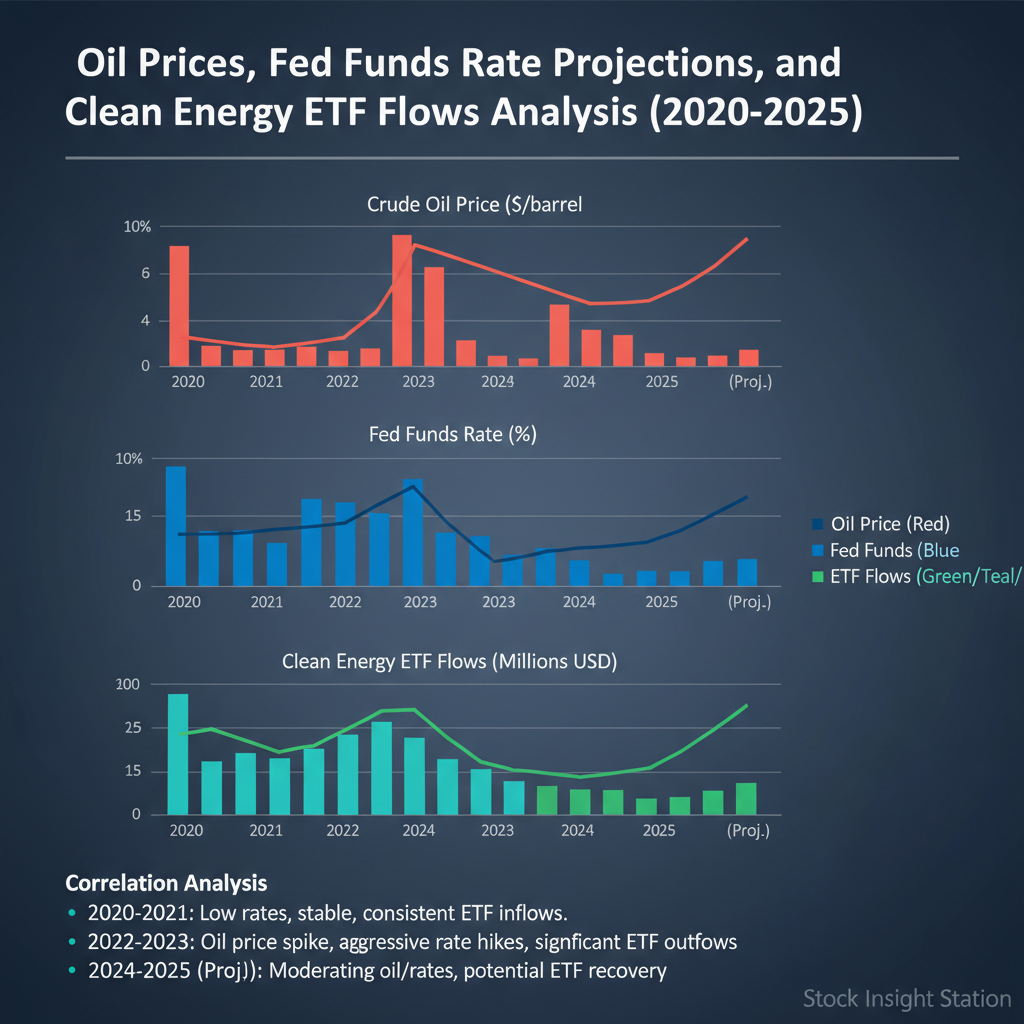

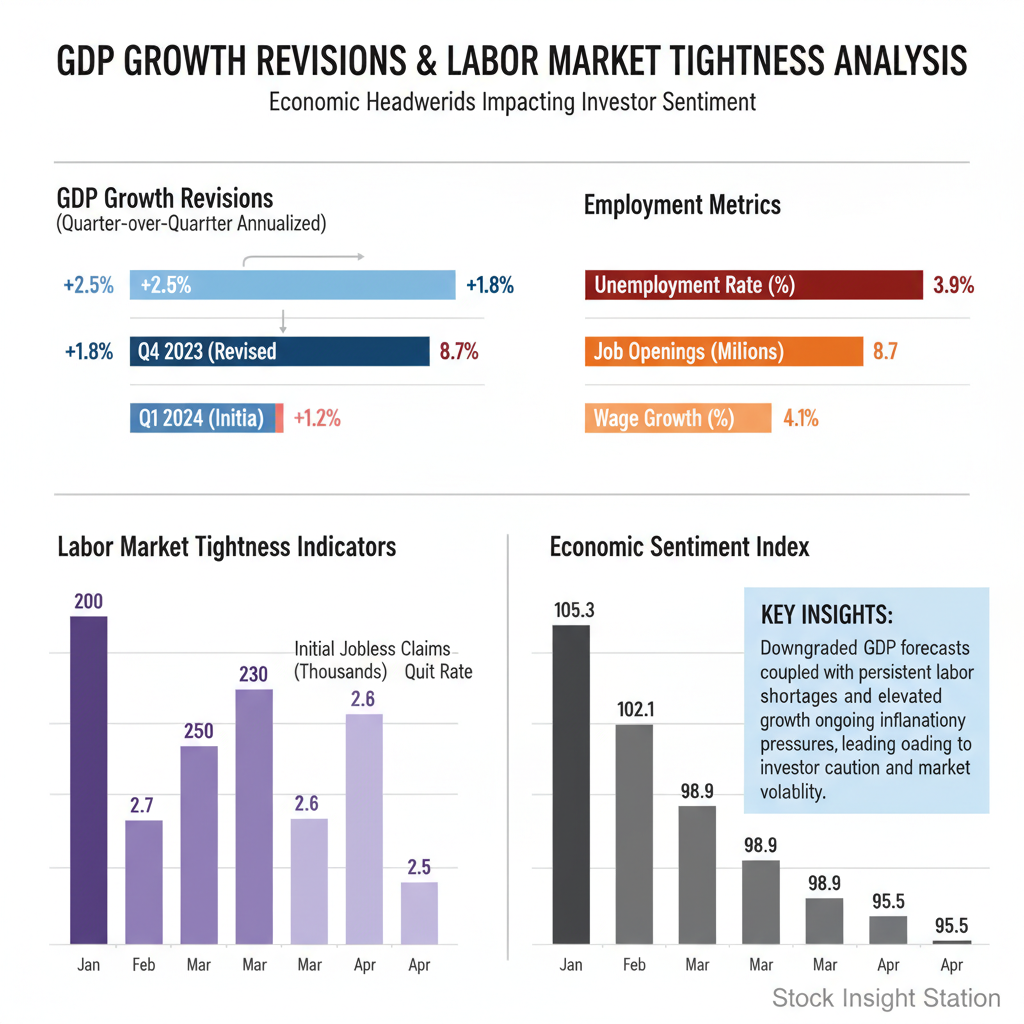

The spike in oil prices is no trivial matter. It’s not just about energy costs ticking up; it ripples through risk pricing across asset classes. The recent jump to over $95 per barrel—the highest since late 2023—has reignited inflation fears and complicated the Federal Reserve’s path forward. The Fed’s latest Beige Book hinted at persistent wage pressures despite cooling labor market data from the Bureau of Labor Statistics (BLS), which showed nonfarm payrolls growing by a modest 180,000 in May versus expectations of 220,000. This divergence feeds into market uncertainty about how aggressively the Fed will hike rates or hold steady.

This interplay between labor data and monetary policy expectations directly influences risk premiums embedded in equity valuations. When investors perceive higher inflation risks coupled with uncertain Fed moves, they demand greater compensation for holding equities—especially those with longer duration characteristics like tech stocks or growth-oriented clean energy firms.

Indeed, we saw a notable rotation away from high-duration assets toward more cyclical sectors such as Energy and Industrials on Wednesday. The MSCI USA Cyclicals Index gained 1.2%, while Tech lagged behind with a slight decline of 0.4%. Defensive sectors like Utilities held their ground but didn’t attract significant new capital either.

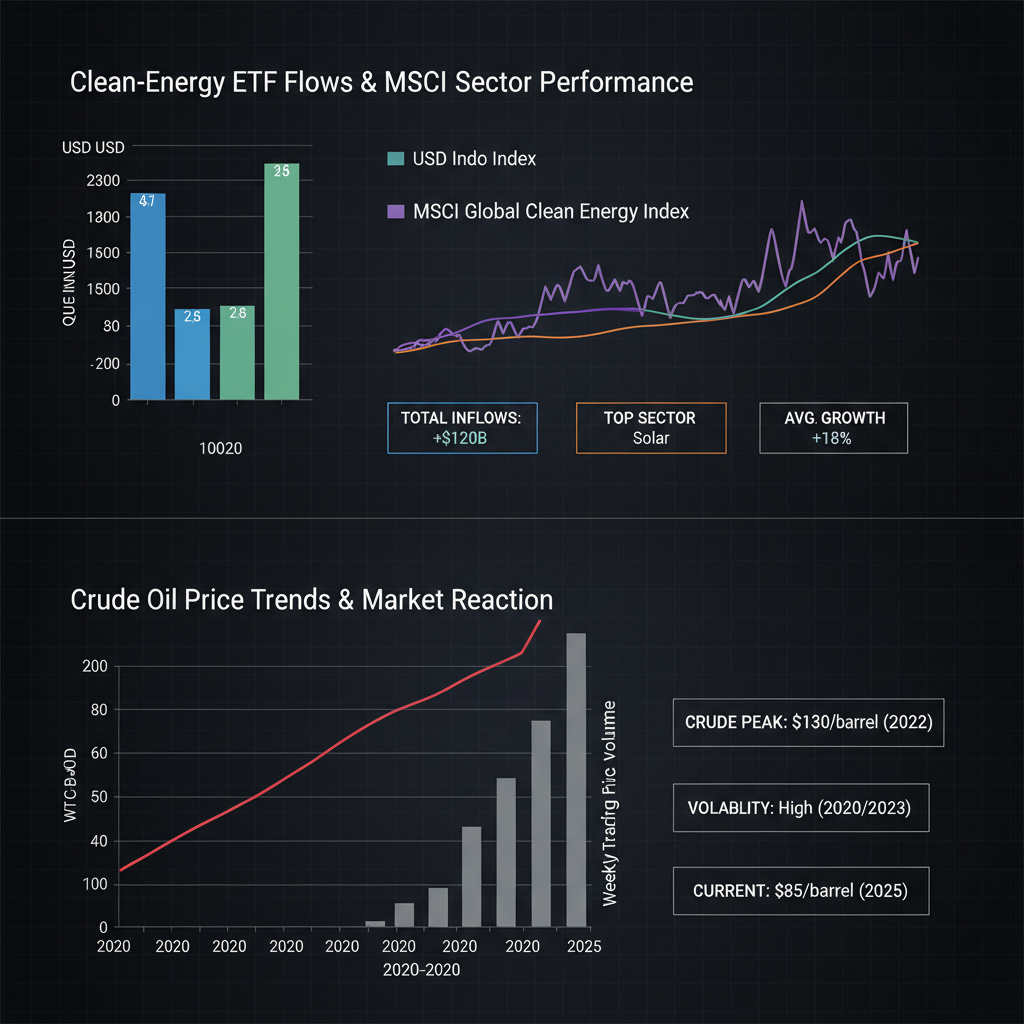

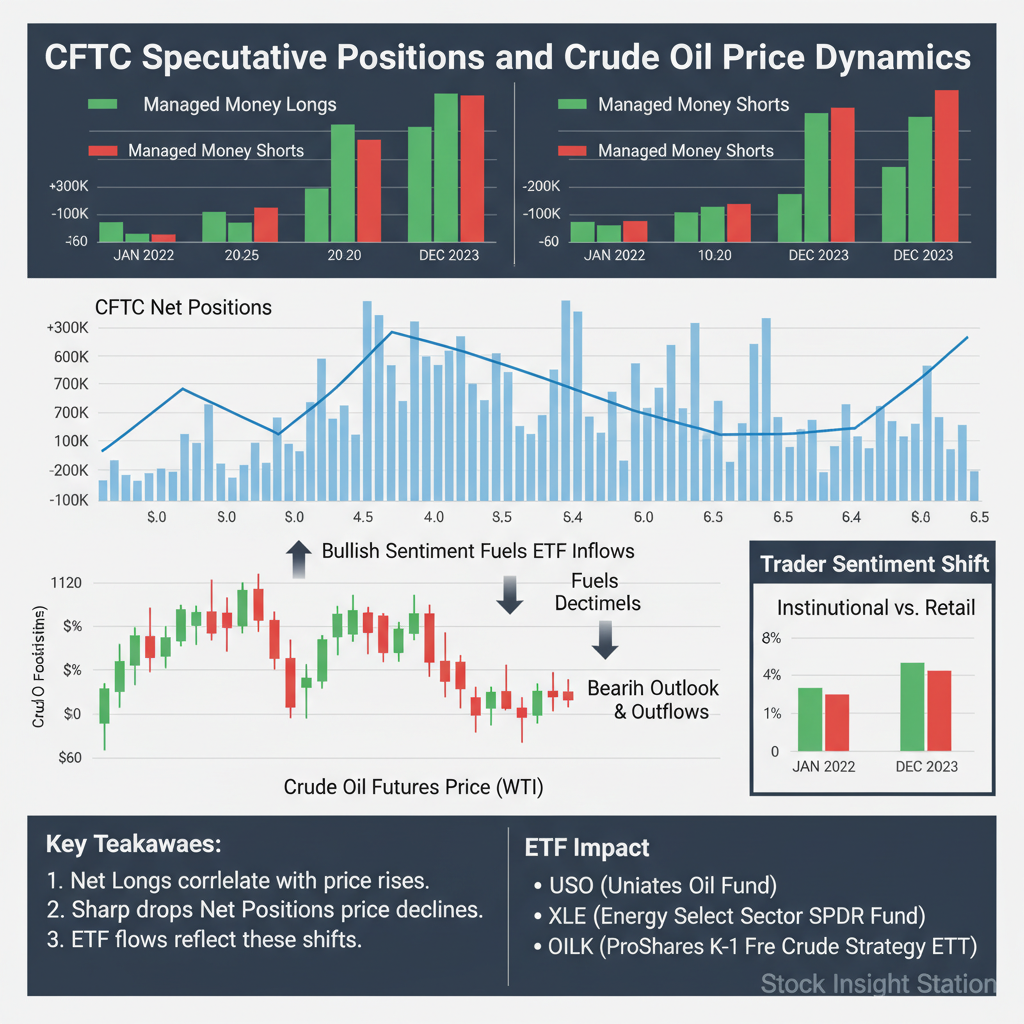

This sectoral shift aligns with what EPFR data revealed: net outflows from thematic clean energy funds contrasted sharply with inflows into traditional energy ETFs during the same period. Such cross-asset repricing underscores how sensitive valuations are to shifts in risk appetite amid evolving macroeconomic signals.

Another layer worth considering is currency dynamics—the US dollar index strengthened by roughly 0.6% midweek amid safe-haven demand triggered by geopolitical tensions and hawkish Fed rhetoric. A stronger dollar tends to weigh on commodities priced in dollars but paradoxically can amplify volatility when supply concerns dominate—as is currently the case with oil due to OPEC+ production cuts combined with lingering post-pandemic supply chain disruptions.

The Commodity Futures Trading Commission (CFTC) reports also show increased speculative positioning on crude futures this month—a sign that traders are bracing for further price swings rather than stability anytime soon.

Looking back at valuation metrics across sectors reveals heightened sensitivity to these developments. Clean energy stocks trade at elevated multiples relative to historical averages—reflecting long-term growth expectations but also exposing them to sharper corrections when discount rates rise or risk premiums widen abruptly.

The juxtaposition of rising oil prices against faltering clean energy fund inflows encapsulates this tension perfectly: investors recalibrating their portfolios amid an increasingly complex landscape where duration risk meets cyclical opportunity head-on.

From my vantage point writing through multiple market cycles—from dot-com busts to pandemic rebounds—the current environment feels reminiscent of periods where rapid shifts in macro drivers forced swift reallocations across sectors and asset classes alike.

One cannot ignore how these dynamics feed back into broader economic indicators too—the BEA recently revised Q1 GDP growth down slightly to an annualized rate of 2%, reflecting softer consumer spending partly attributed to higher fuel costs squeezing disposable incomes.

This slowdown dovetails uneasily with still-tight labor markets; job openings remain elevated according to NY Fed data even as quits rates have moderated—a sign that workers might be less confident about switching jobs amidst rising cost pressures.

All told, Wednesday’s $600 million withdrawal from clean ETFs isn’t merely a blip—it’s emblematic of broader recalibrations underway within global financial markets as participants wrestle with competing narratives around inflation persistence, monetary policy trajectories, commodity shocks, and sectoral rotations.

If there’s one takeaway after years covering these ebbs and flows—it’s that patience coupled with nuanced understanding trumps knee-jerk reactions every time. Markets will continue oscillating between fear-driven selloffs and opportunistic buying sprees until clearer signals emerge regarding inflation containment and sustainable growth paths ahead.