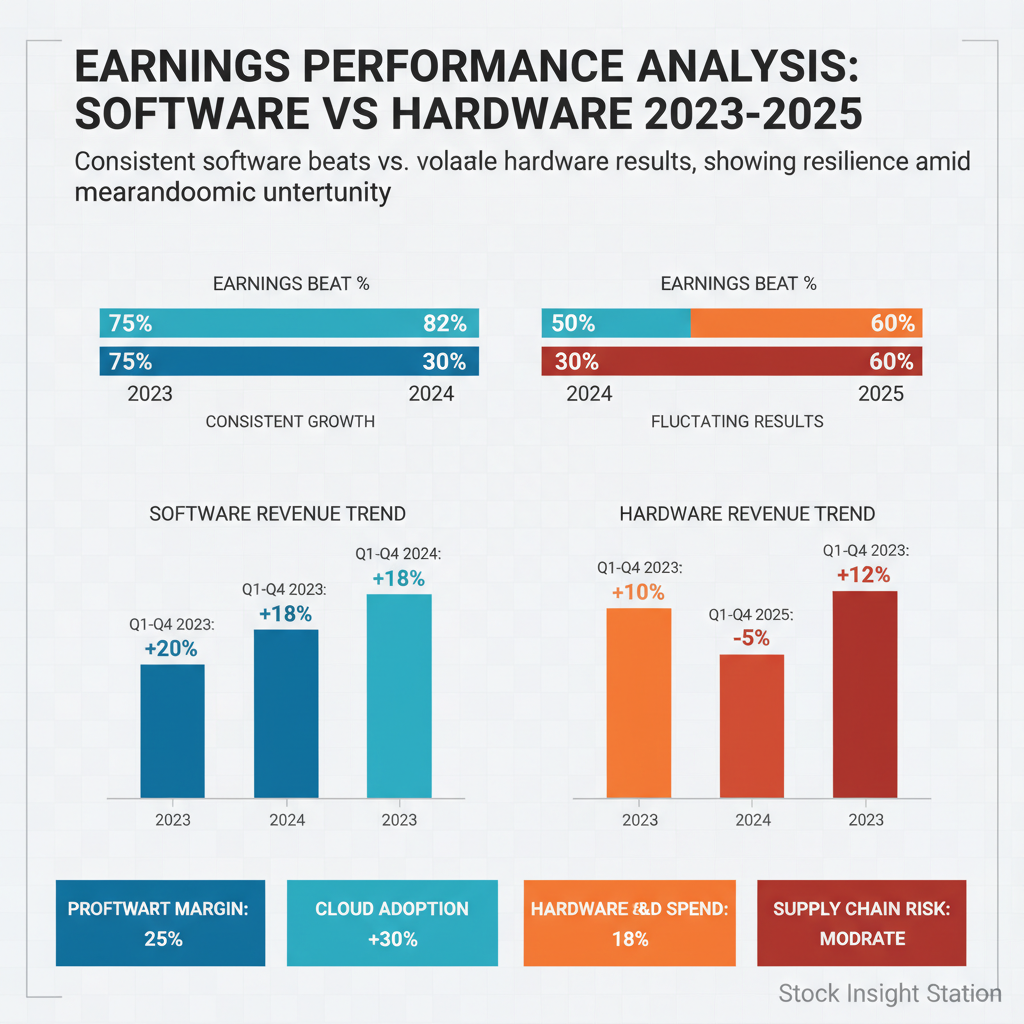

There’s a certain exhaustion in the air as we wade through yet another cycle of market euphoria centered on hardware—specifically GPUs. The narrative is familiar: shiny chips, AI breakthroughs, and sky-high valuations. But beneath this surface glitter lies a quieter, more consistent story that rarely makes headlines. Software vendors, those less glamorous but indispensable players behind the curtain, have been quietly outperforming expectations with an 80% beat rate over recent quarters. It’s a nuance worth unpacking because it challenges some of our ingrained biases about where value and risk truly reside in today’s tech-driven markets.

Let’s start by acknowledging the obvious: hardware is sexy. It’s tangible, visible in every data center upgrade and consumer device launch. Yet, from a valuation sensitivity standpoint, software firms often exhibit lower duration risk compared to their hardware counterparts. They tend to have recurring revenue models that cushion them against abrupt shifts in Fed policy or dollar strength—two factors that have roiled markets repeatedly since 2022.

The Federal Reserve’s path remains anything but linear. Recent Bloomberg reports highlight how the Fed’s cautious pivot has injected volatility into growth-sensitive sectors like semiconductors and energy equipment manufacturers. Meanwhile, software companies’ earnings streams appear more insulated from such macro shocks due to their subscription-based models and sticky customer relationships.

Digging deeper into cross-asset pricing dynamics reveals something intriguing about sector rotation patterns lately. Tech-heavy indices have seen bouts of underperformance relative to energy and cyclical sectors during periods of rising bond yields—a classic sign of increasing risk premia compressing valuations on longer-duration assets like growth stocks.

The latest data from the NY Fed shows that real yields climbed above 1% for the first time since early 2022 last quarter—a subtle but meaningful shift signaling tighter financial conditions ahead. This environment tends to favor defensive sectors and software firms with predictable cash flows over capital-intensive hardware producers exposed to supply chain disruptions and inventory gluts.

Meanwhile, labor market metrics continue adding layers of complexity to this narrative. The Bureau of Labor Statistics (BLS) reported wage growth moderating slightly in Q1 2025 after an extended period of tightness—a development that could ease cost pressures for software companies reliant on high-skilled talent pools while simultaneously dampening discretionary spending impacting hardware sales cycles.

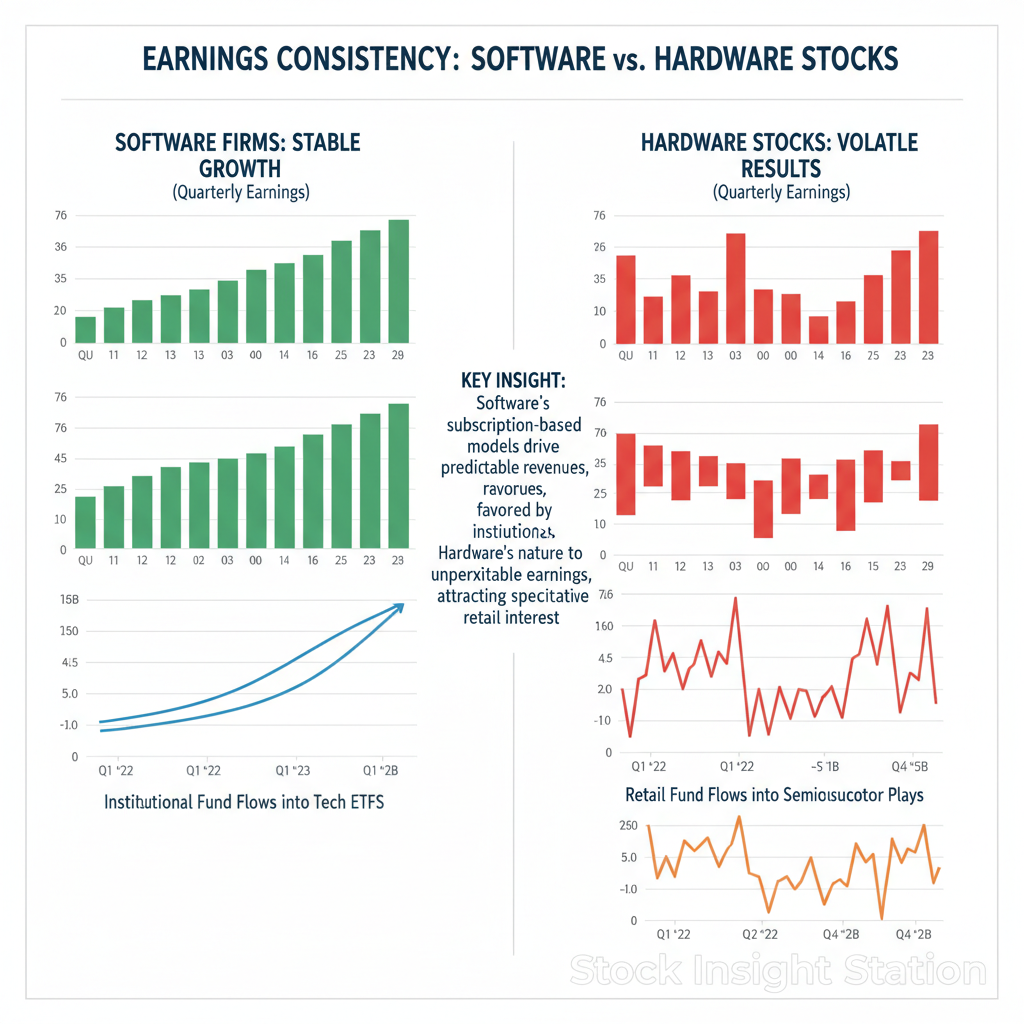

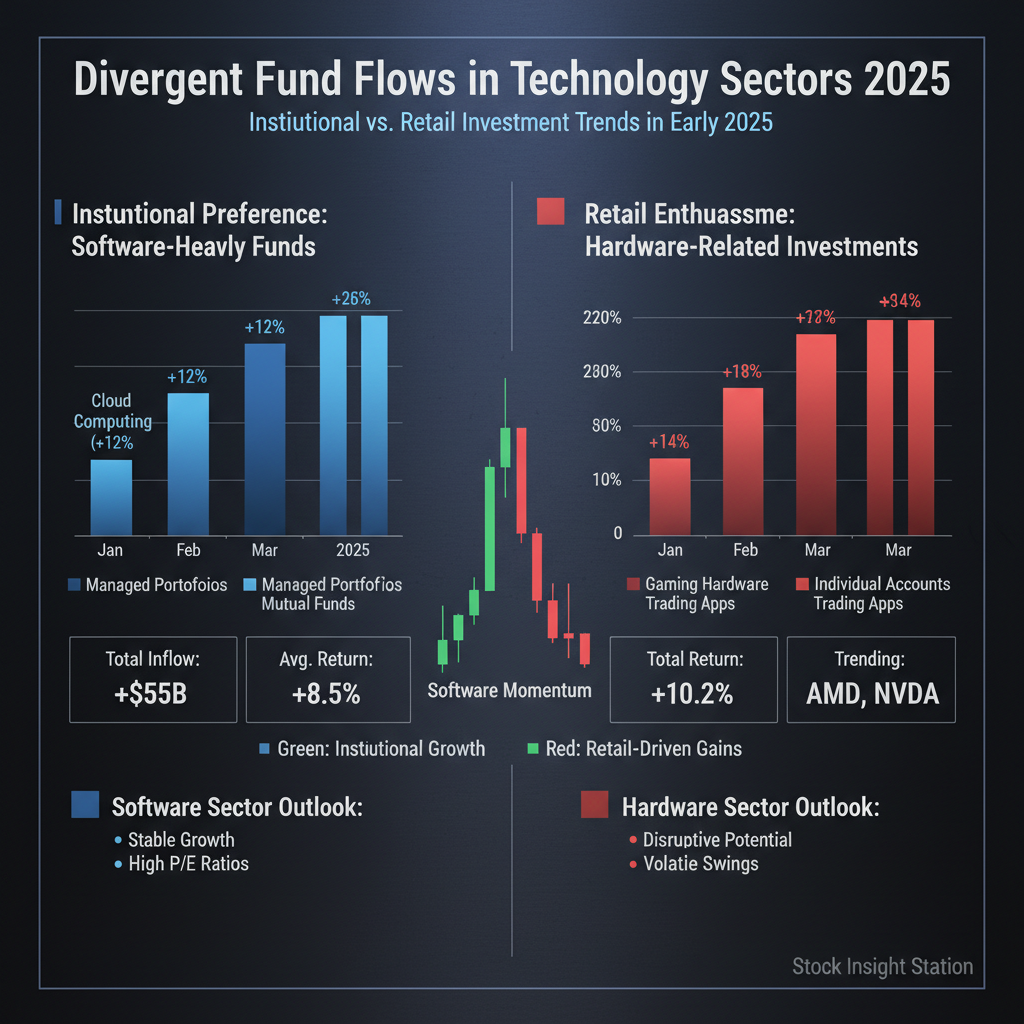

The interplay between institutional versus retail sentiment also colors these dynamics vividly. According to EPFR data analyzed by Reuters, inflows into technology-focused mutual funds skew heavily toward software-centric strategies this year—reflecting institutional investors’ preference for quality earnings amid uncertain macro backdrops.

Retail investors meanwhile remain captivated by headline-grabbing GPU launches and speculative bets on semiconductor startups despite mixed fundamental signals—a divergence reminiscent of past tech cycles where hype outpaced sustainable value creation.

CFTC positioning data further underscores this bifurcation; net long positions in semiconductor futures contracts have flattened even as options volumes spike—suggesting growing hedging activity rather than outright bullish conviction among professional traders.

What does all this mean for asset allocation? Risk premia are clearly elevated for hardware stocks given their higher beta exposure to economic cycles and Fed tightening trajectories. In contrast, software vendors offer a compelling blend of moderate duration risk with robust earnings visibility—attributes increasingly prized as volatility persists across global markets.

This nuanced view aligns well with MSCI sector performance trends over recent months where defensive tech segments outperformed cyclical peers amid choppy equity markets driven by geopolitical uncertainties and fluctuating commodity prices.

Of course, no analysis would be complete without acknowledging reflexivity—the feedback loops between price action and investor behavior that can amplify both exuberance and panic unpredictably. The current environment feels particularly prone to such swings given persistent questions around AI adoption curves versus realistic implementation timelines within enterprise IT budgets.

CNBC recently highlighted how some large-cap software firms are tempering guidance despite strong backlog numbers—a reminder that even “safe” bets carry execution risks when macro headwinds persist.

In sum: while GPUs grab headlines as symbols of technological progress (and speculative excess), savvy strategists should look beyond the noise at underlying fundamentals driving durable outperformance among select software vendors boasting an impressive track record of beating consensus estimates nearly four out of five times recently.

This isn’t just about picking winners; it’s about understanding how valuation sensitivities interact with evolving risk premia across sectors—and how those forces shape portfolio construction decisions amidst ongoing uncertainty around monetary policy paths, currency fluctuations, labor market tightness, and shifting investor sentiment globally.