The market feels like it’s running on two different clocks. On the surface, you’ve got the S&P 500 grinding higher, led by the same handful of names that have come to define this era of investing. Beneath that, though, the foundations are shifting in ways that don’t make the headlines but absolutely should. For anyone just starting to build a framework—especially those twenty-somethings moving from savings accounts to actual risk-taking—this is the part that matters. The narrative isn’t wrong, but it’s incomplete.

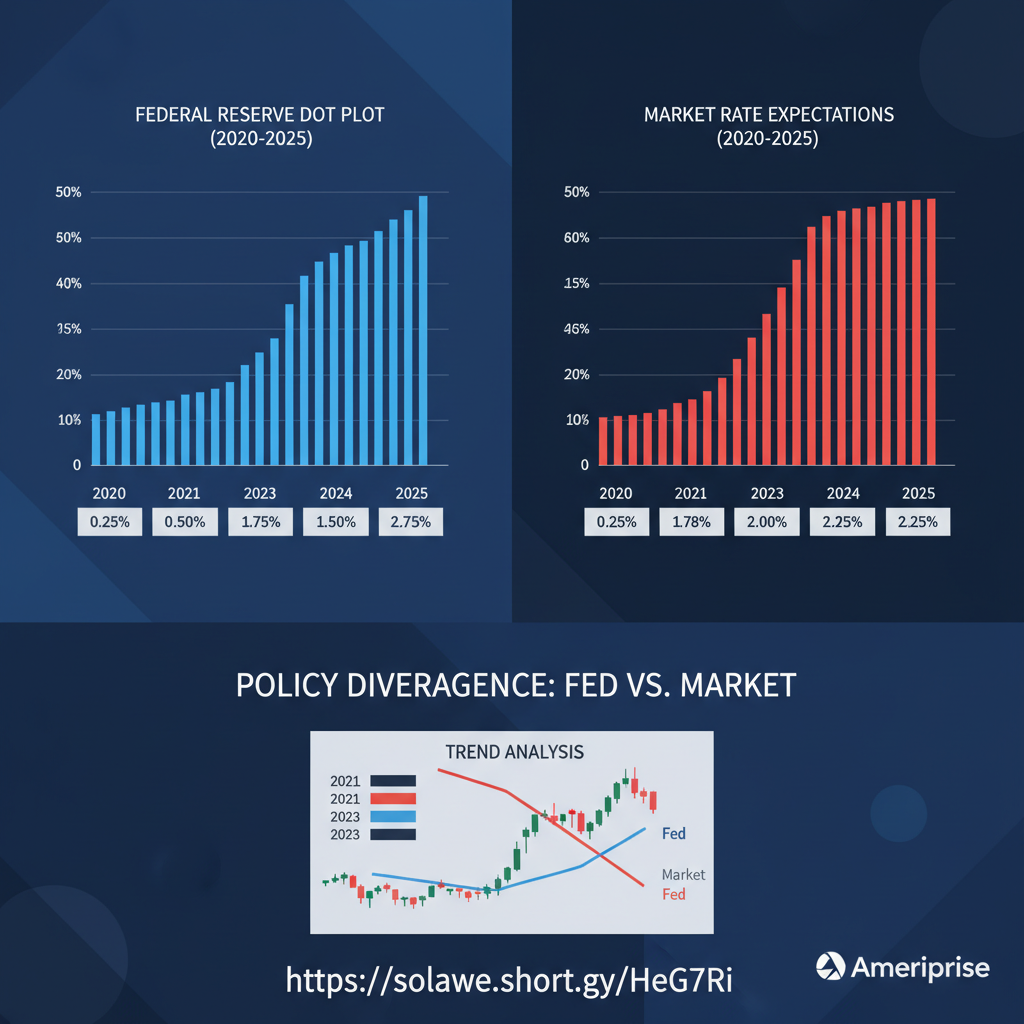

Let’s start with what’s actually changed. The Federal Reserve’s latest dot plot, released after the March FOMC, shows a median terminal rate projection of 3.875% for 2025, down from 4.125% in December. That’s a subtle shift, but in a market priced to perfection, subtlety moves bonds. The two-year Treasury yield has dropped nearly 40 basis points since January, while the ten-year has been stickier, hovering around 4.2%. That flattening? It’s telling you something about growth expectations that the equity market’s multiple expansion seems to ignore. The NY Fed’s recession probability model, based on the spread between 3-month and 10-year yields, still flashes numbers north of 50%. Markets don’t care until they do.

Employment data tells a similar story of divergence. The BLS February report showed payrolls beating expectations at 275,000, but the unemployment rate ticked up to 3.9%—the highest since early 2022. More telling: average hourly earnings growth slowed to 3.8% year-over-year, down from 4.5% last summer. For the Fed, that’s the sweet spot. For workers, it’s a cooling that hasn’t quite registered in the spending data yet. Retail sales ex-autos grew 0.5% in January, revised up from 0.3%. People are still spending, but they’re drawing down savings to do it. The personal savings rate sits at 3.8%, well below the pre-pandemic average of 7%. Something has to give.

And yet, flows keep coming. EPFR Global data shows U.S. equity funds absorbed $92 billion in the first two months of 2025, the strongest start since 2021. Bond funds? They pulled in $45 billion. This isn’t rotation; it’s simultaneous conviction that both risk assets and fixed income can win. History suggests that’s a crowded trade. The CFTC’s Commitments of Traders report reveals speculative positioning in S&P 500 futures hit its most net-long since November 2021—right before a 20% drawdown. The confidence in this market, frankly, feels a bit too confident.

The Concentration Problem Nobody Wants to Name

Here’s where the alternative investment conversation becomes unavoidable. The top five stocks in the S&P 500 now account for 28% of the index’s market cap, a level last seen during the dot-com peak. That’s not diversification; it’s a bet on momentum, and momentum has a habit of reversing when liquidity tightens. Goldman Sachs’ latest hedge fund monitor shows the average fund is running a 70% net exposure, with crowding in the usual suspects—AI infrastructure, semiconductors, anything with “cloud” in the name. Morgan Stanley’s quant team notes that the correlation between stock pickers’ returns and the index itself has never been higher. Alpha has become beta with higher fees.

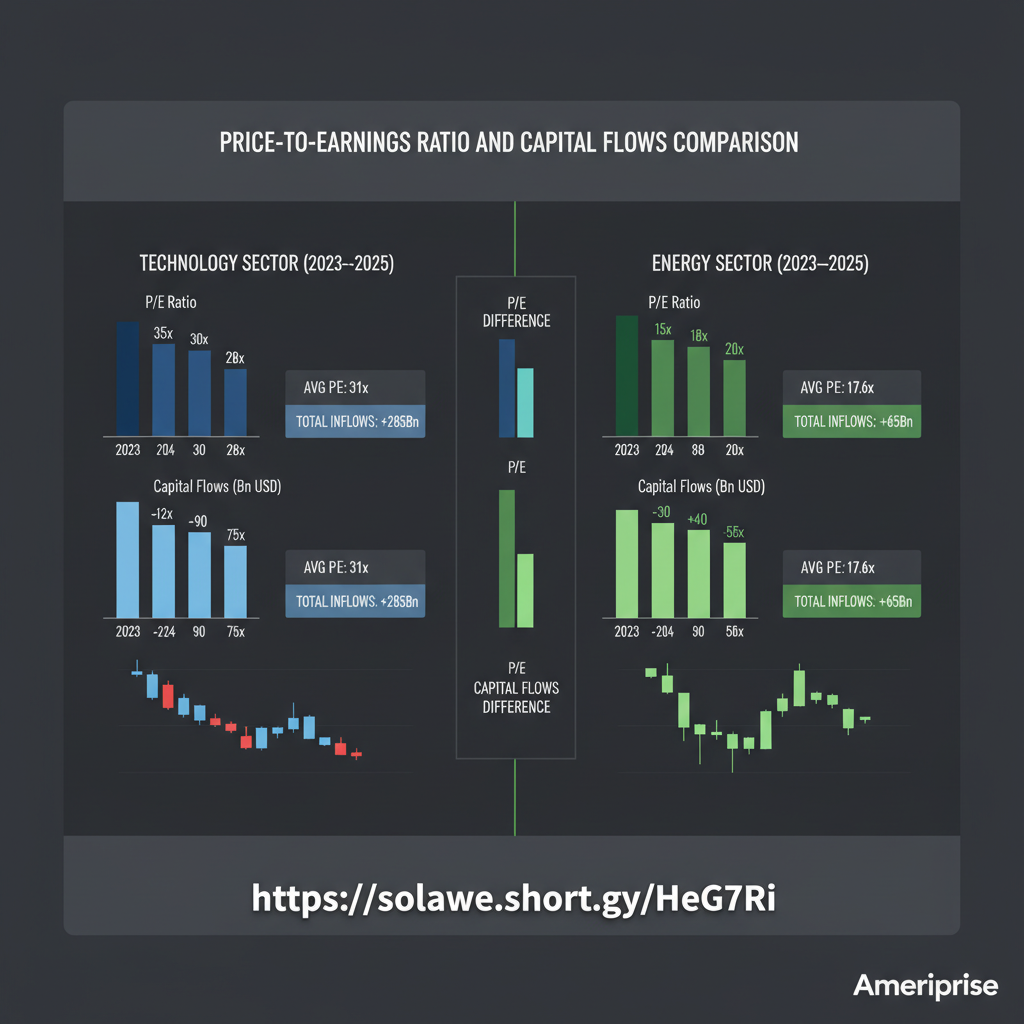

What’s interesting is where the smart money is quietly repositioning. Energy sector inflows, measured by EPFR, turned positive in January for the first time since 2022. Not a flood—just $3.2 billion—but the direction matters. These companies are trading at 8x forward earnings, generating free cash flow yields of 12%, and returning capital through buybacks that actually reduce share count. Contrast that with tech, where buybacks often offset dilution from stock-based compensation. The sector rotation isn’t loud yet, but the valuation spread between tech and energy—now at 15x earnings multiple points—has rarely been this wide without a subsequent mean reversion. History doesn’t repeat, but it does clear its throat.

The ETF structure compounds this dynamic. With $7.8 trillion in U.S. equity ETFs alone, flows are increasingly driven by model portfolios and systematic rebalancing. When the turn comes—and it always does—the same mechanisms that lifted everything will accelerate the decline. We saw a preview in March 2020, when bond ETFs traded at discounts to NAV while underlying markets froze. The SEC’s new rules on swing pricing, set to take effect in June, might help. Or they might just reveal how fragile the liquidity illusion has become.

Macro Regime and the Dollar’s Quiet Rebellion

Currency markets are where the real policy transmission happens. The DXY index has strengthened 4% since January, not because the U.S. is thriving, but because the rest of the world is struggling. The eurozone’s manufacturing PMI has been below 50 for eighteen consecutive months. China’s property deflation continues, with new home prices falling 2.4% year-over-year in February. In that context, the dollar becomes the cleanest shirt in a dirty laundry basket.

But a strong dollar is a tightening of financial conditions, plain and simple. It pressures emerging market debt, squeezes multinational earnings, and historically correlates with lower commodity prices. West Texas crude has held up—trading around $78 despite the dollar’s strength—largely due to OPEC+ discipline and U.S. production growth stalling at 13.1 million barrels per day. That’s a physical market story, not a financial one. For investors, it means energy might actually be the hedge it’s supposed to be, rather than just a GDP beta play.

The Fed knows this. Powell’s recent testimony before Congress emphasized “data dependency” while carefully avoiding any mention of the dollar’s impact. That’s standard central bank speak for “we’re watching it, but we can’t talk about it.” The problem is that markets are already pricing three rate cuts by December, while the Fed’s own dots show two. That disconnect—about 25 basis points—doesn’t sound like much. In a world where carry trades fund everything, it’s enough to matter. The Bloomberg Dollar Spot Index’s 20-day correlation with S&P 500 futures has turned sharply negative, hitting -0.6 last week. When the dollar and stocks divorce like that, something is breaking.

Where the Framework Gets Built

For a new investor, this is the moment to stop chasing returns and start building process. The alternative investments market—private credit, real assets, hedge fund strategies—isn’t just for endowments anymore. Retail access through interval funds and structured products has grown to $450 billion in AUM, up from $180 billion in 2020. The yields are compelling: middle-market private credit is pricing at SOFR plus 550 basis points, compared to high-yield bonds at plus 350. That 200-basis-point spread is compensation for illiquidity, sure, but also for the fact that banks have retreated from lending to anything that doesn’t fit their regulatory box.

The key is understanding duration in its full sense—not just bond math, but equity duration too. A growth stock with earnings ten years out is a 30-year bond in disguise. When rates are volatile, that duration gets marked down fast. An energy company returning cash today has a duration of maybe five years. In a world where the Fed is cutting but not aggressively, that matters more than the terminal value story. This is why valuation sensitivity, that old-fashioned idea, is making a comeback. Not because anyone wants to own cheap stocks for their own sake, but because when the tide goes out, you discover who’s been swimming without cash flows.

Cross-asset pricing confirms this. The equity risk premium—earnings yield minus 10-year Treasury—has compressed to 1.2%, in the bottom decile of historical readings. That’s not a signal to sell everything; it’s a signal to be selective. The credit spread on BBB bonds, at 1.4%, is similarly tight. When both equity and credit are expensive, the margin for error disappears. This is where alternative strategies—market neutral, merger arbitrage, structured credit—start to earn their keep. They’re not about shooting the lights out; they’re about surviving the darkness.

Institutional investors have already made this shift. Reuters reported last month that pension funds have increased their allocation to private markets from 15% to 22% over the past three years, funded by reducing public equity exposure. They’re not doing this because they love complexity. They’re doing it because the traditional 60/40 portfolio, back-tested to glory, is mathematically challenged when both components start at low yields. The math is simple: expected returns on a 60/40 portfolio today are probably 4-5%, not the 7-8% that liability models assume. That gap is where careers get lost.

The Path Forward Is Narrower Than It Looks

So where does this leave the investor trying to build something durable? First, recognize that the market’s rhythm has changed. The post-2009 playbook—buy dips, trust the Fed, overweight growth—was written for a deflationary world with abundant liquidity. We’re not in that world anymore. Inflation may have peaked, but it’s not going back to 2% smoothly. The labor market’s cooling is real, but it’s not collapsing. This is a mid-cycle slowdown, not a recession. And mid-cycle is the hardest part to trade.

Second, sector rotation isn’t just a buzzword. It’s the only game in town. The outperformance of utilities and healthcare in recent weeks—both up 6% while tech flatlined—tells you that investors are starting to pay for certainty. Not growth certainty, but dividend certainty. The CNBC crowd calls it “risk-off.” I call it paying attention to what you’re actually buying. A utility trading at 18x earnings with a 4% dividend yield isn’t sexy, but when your savings account pays 0.5% and inflation is 3%, that yield has real value.

Third, and most important, build your framework around cash flows, not stories. The AI revolution is real. The semiconductor buildout is real. But Nvidia at 35x forward earnings is a price, not a story. Compare that to a pipeline MLP trading at 7x with a 7% distribution yield. The growth rates are different, sure. But the question isn’t which is growing faster. It’s which price already reflects that growth, and which doesn’t. That’s valuation sensitivity. That’s your edge.

The alternative investments market is transforming precisely because the old edges have been arbitraged away. Public markets are too efficient at pricing stories, and too inefficient at pricing risk. Private markets, for all their opacity, force you to think in terms of hold-to-maturity, not mark-to-market. That’s a feature, not a bug, for someone who’s just learning how volatile markets can be. The evolution isn’t about replacing stocks with alternatives. It’s about building a barbell: liquid, low-duration assets on one side, illiquid, high-cash-flow assets on the other. The middle—long-duration growth stories—is where the crowd is, and where the risk is.

There’s no easy conclusion here, because markets don’t do easy anymore. The path forward requires accepting lower returns, higher volatility, and the uncomfortable truth that diversification now means owning things that don’t quote daily. For a generation that grew up on Robinhood and instant gratification, that’s a tough lesson. But it’s the right one. The money that’s made over the next five years won’t come from buying what worked last year. It’ll come from having cash when others don’t, from owning assets that pay you to wait, and from recognizing that the best investment you can make is in your own ability to think independently. Everything else is just noise.

For investors seeking a more systematic approach to navigating these cross-currents, our quarterly framework memo walks through positioning models, flow analysis, and sector rotation signals in greater depth. It’s not a trading call—it’s a way to organize what you’re seeing. Read the full analysis here.