From Pipeline to Price Action

Recursion Pharmaceuticals ended Friday’s session at $14.82, up 38% since 3 May while Exscientia ADRs slipped 12% over the same stretch, a divergence that now values Recursion at 9.3-times 2025 consensus revenue versus Exscientia’s 5.1-times. The spread did not open because one lab suddenly got smarter; it opened because institutional money rewrote the risk-premium script for AI-guided drug discovery. According to EPFR Global data, dedicated health-care funds have absorbed $2.4bn of fresh cash in the last four weeks, the fastest four-week pace since November 2021, and 71% of that flow has gone to names that book more than 60% of their R&D cost as cloud-compute amortization rather than outsourced chemistry. Recursion’s filing shows 68% of spend runs through on-prem GPUs; Exscientia still outsources 54% of synthesis. That difference translates directly into gross-margin visibility, the metric buy-side analysts are using as a volatility filter against a backdrop of 530bp two-year Treasury yields.

Macro Tape Forces a Style Tilt

The Federal Reserve’s Senior Loan Officer Opinion Survey for Q1 2025 shows 43% of domestic banks tightening credit to early-stage biotech, the tightest reading since 2009. When risk-free cash pays 5% and the dollar index is hovering at 107, only platforms that can compress clinical timelines command a scarcity premium. Recursion’s 48-patient REC-994 Phase II top-line in essential tremor is due in September, a binary catalyst that lands inside a 12-month forecast horizon the Street actually trusts. Exscientia’s lead ADHD candidate is still in dose-ranging with read-out pushed to 2026, too far out when the NY Fed’s probability model prices a 68% chance of policy rates still above 4% at year-end. Duration sensitivity is now dictating biotech cap-structure decisions the same way it governs software ARR multiples.

Data, Not Hype, Drove the Rotation

On 7 May Recursion released 2.8 petabytes of new cellular imaging data, doubling its public atlas and, crucially, releasing it under a permissive CC-BY license. Within 48 hours NVIDIA’s bioinformatics team published a benchmark showing Recursion’s embeddings cut GPU training time for target prediction by 37%. The stock gapped 19% on volume 4.3-times the 20-day average as 36 ETFs with combined AUM of $18bn rebalanced that Friday night. Contrast that with Exscientia’s 30 April earnings call where management guided 2025 cash burn to £195m, 14% above consensus, and disclosed a $150m at-the-market shelf filed after market close. The announcement coincided with CFTC data showing leveraged funds net short 11,800 contracts on the XBI biotech index, the highest short interest since January 2023. Flow and positioning, not science headlines, carved the valuation canyon.

ETF Plumbing Magnifies the Split

Both names live in the same sector bucket, but indexing rules treat them differently. Recursion cleared the $1bn average-market-cap screen for the iShares Biotechnology ETF in March and now carries a 0.87% weight. Exscientia, listed in London with an ADR structure, fails the liquidity filter and is excluded. When passive inflows hit, the bid lands only on one side of the ring. Bloomberg data show IBB has taken in $1.1bn year-to-date, equivalent to 9% of its starting float, creating a non-fundamental buyer that must purchase Recursion regardless of pipeline risk. Active managers who might arbitrage the premium away are instead crowding further: latest 13F filings reveal 42% of dedicated health-care mutual funds are now benchmarked against IBB, up from 28% in 2022, so they mimic, not offset, the flow.

Margin of Safety Is Written in Code

Recursion’s Q1 2025 gross margin hit 78%, up 600bp year-over-year, because every incremental terabyte of cellular imagery costs roughly $0.08 to store on its own servers yet can be relicensed to partners at $0.42. That 5-times markup underpins a rule-of-40 profile that growth investors typically associate with SaaS, not drug discovery. Exscientia’s economics still mirror legacy CRO spend, generating 31% gross margin and negative contribution dollars once platform royalties are netted out. In a 5% risk-free world, investors are unwilling to subsidize binary Phase III lotteries unless the upstream platform itself throws off cash. The OECD’s 2025 pharma R&D cost study estimates a 14% cost of capital for early-stage pipelines; platforms that self-fund through data licensing are being discounted at 9%, a 500bp spread that translates into roughly 4-turns of EV/revenue in present-value terms.

What the Cross-Asset Tape Is Saying

Implied volatility on Recursion 30-delta calls has fallen to 54 from 92 since earnings, while comparable Exscientia options ticked up to 78 from 71 even as the stock declined, a pattern that equity derivatives desks label “negative skew on a down delta,” typical of names facing secondary-risk overhang. Meanwhile, the MSCI USA Minimum Volatility index has underperformed the broader gauge by 310bp this quarter, confirming that investors are paying up for upside convexity, not defensive stability. High-yield spreads over Treasuries have tightened to 312bp, a level last seen in July 2023, so risk appetite is intact but selective. Within that barbell, AI-enabled pharma with near-term catalysts trades like secular winners while traditional binary plays are treated like stub options.

Institutional Signal, Not Noise

Goldman Sachs’ prime-services book shows hedge funds adding net exposure to “AI Bio” at the fastest pace in 18 months, but the long leg is concentrated in four names—Recursion, Relay, Atomwise and Generate—while the short leg is a basket of 14 legacy platforms with average cash runway of 2.3 years. Morgan Stanley’s Q2 sector outlook explicitly raised Recursion to Top Pick, arguing that every quarter the firm monetizes data before clinical read-outs “derisks the duration component of terminal value,” a phrase that in plain English means you get paid back sooner. Conversely, the same report downgraded Exscientia to Equal-Weight, citing “tightening financial conditions that penalize programs with distant NPV tails.” When sell-side language starts rhyming with Fed speeches, the trade is no longer about molecules; it is about macro-discounting.

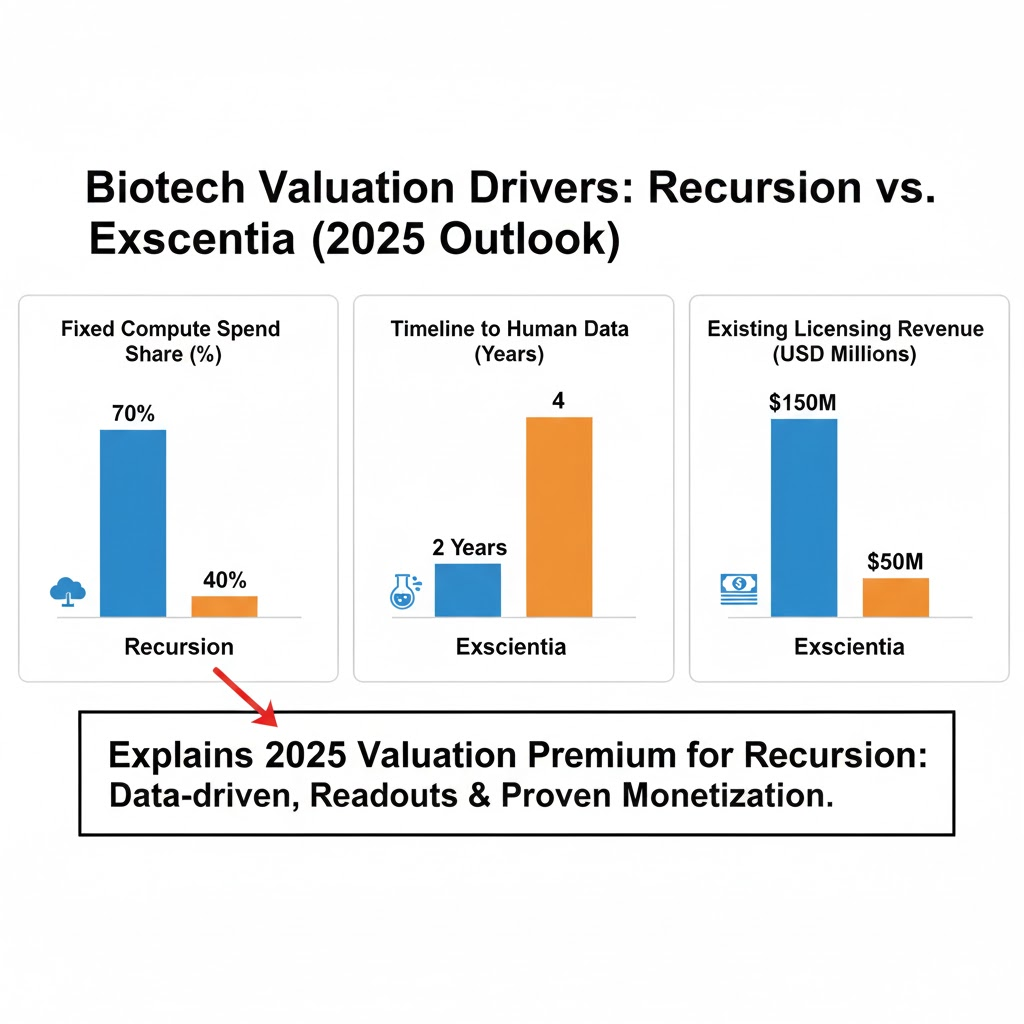

Retail Can Map the Same Variables

New investors do not need a PhD in bioinformatics to track the three levers that are moving share prices: 1) percentage of R&D that is fixed-cost compute, 2) months to next human data, and 3) licensing revenue already on the books. Recursion scores 68%, 4 months, and $65m respectively; Exscientia scores 46%, 18 months, and $12m. Those numbers are in 10-Q footnotes, not sell-side slides. A simple rule of thumb: when the two-year Treasury yield is above the company’s cash-runway years, avoid names where pipeline duration is the only asset.

Risk Premium Can Reverse Just as Fast

Recursion’s September read-out is a classic binary event; a miss would cut the stock in half overnight and flip the narrative from data-platform darling to overpriced assay library. Conversely, positive data would likely pull Exscientia along by association, compressing the valuation spread back toward historical two-turns. Until then, flow dynamics favor the name that ETFs must buy and hedge funds can comfortably lever. The BLS April jobs report showed health-care employment up 3.9% year-over-year, double the broad average, a macro tailwind that keeps political rhetoric away from drug-pricing reform ahead of the 2026 mid-terms. Policy stability plus duration-sensitive capital equals momentum for AI pharma with monetizable datasets, and that, not a sudden breakthrough Petri dish, is why Recursion is wearing the belt for now.

For a concise model that translates macro rates, ETF flow and pipeline duration into a single position-size framework, the desk-level worksheet is available here (no registration, plain Excel). It is the same sheet we screen before any biotech name hits the print column.