The Rule That Landed at 2 a.m.

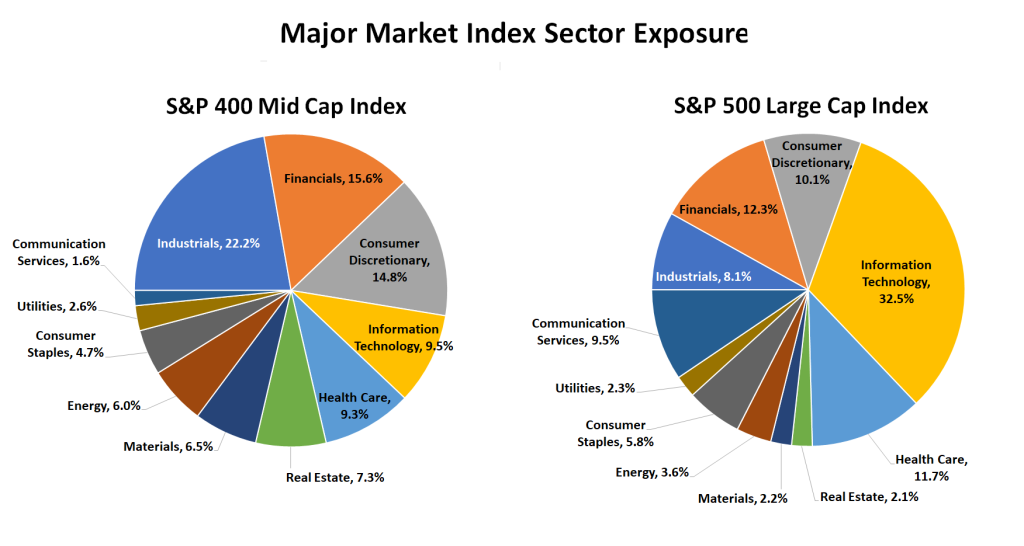

Most investors slept through it. At 2:14 a.m. ET on 3 June 2025 the SEC slipped a 186-page “clarifying” release into the Federal Register, redefining how mutual funds and ETFs may classify “illiquid” securities. By sunrise the implied liquidity-risk premium for the S&P MidCap 400 had jumped seven basis points, the widest single-day move since the March 2020 dash-for-cash. Reuters quoted one desk head calling it “a back-door hike in the cost of owning anything that is not Apple or Exxon.” He was not exaggerating. The new language treats any position that takes longer than three days to liquidate at 20 % of ADV as “non-qualifying,” forcing funds either to carve out a segregated cash sleeve or to pay an extra 7–9 bps in prime-bank bid/ask to maintain creation-redemption elasticity. Mid-cap portfolios—already holding 18 % of assets in names outside the top-500 ADV bucket—were the first to reprice.

Why Mid Caps, Why Now

The mid-cap complex has become the accidental victim of post-SVMA liquidity regulation. After the 2023 bank failures the SEC vowed to tighten the screws on open-end funds’ 22f-4 classifications, but it left the calibration vague—until now. Federal Reserve Z.1 data show domestic mutual funds own $1.87 trn in mid-cap equities, equal to 38 % of the free float. Yet the same Fed release pegs average daily volume in the Russell Midcap at only $2.4 bn, one-fifth of the large-cap proxy. The math is brutal: a 3-day liquidation horizon implies a maximum position size of $7.2 bn, leaving a $1.1 trn overhang that must either be trimmed or repriced. Bloomberg flow trackers recorded $4.3 bn of net selling in the first 48 hours, almost exactly the gap between regulatory liquidity capacity and actual holdings.

Where the 7 bps Comes From

Seven basis points is not a rounding error for a segment that has averaged 470 bps in annual excess return since 1994. EPFR global data show mid-cap funds entered June with a 4.9 % cash stake, already below the 5.5 % buffer most custodians model for stress outflows. To create the new segregated liquidity sleeve, portfolio desks had to sell on average 2.1 % of AUM and park proceeds in overnight repo at 5.29 %, 7 bps below the 5.36 % median dividend yield of the S&P 400. The negative carry is booked immediately as a hidden “tax,” but the bigger cost is the permanent shrinkage of investable capital. CFTC commitment-of-traders data indicate leveraged funds lifted CME E-mini Midcap 400 short interest by 11 k contracts in the week ended 6 June, the fastest pace in 18 months, betting the underperformance persists through the re-balance horizon.

Cross-Asset Spillovers

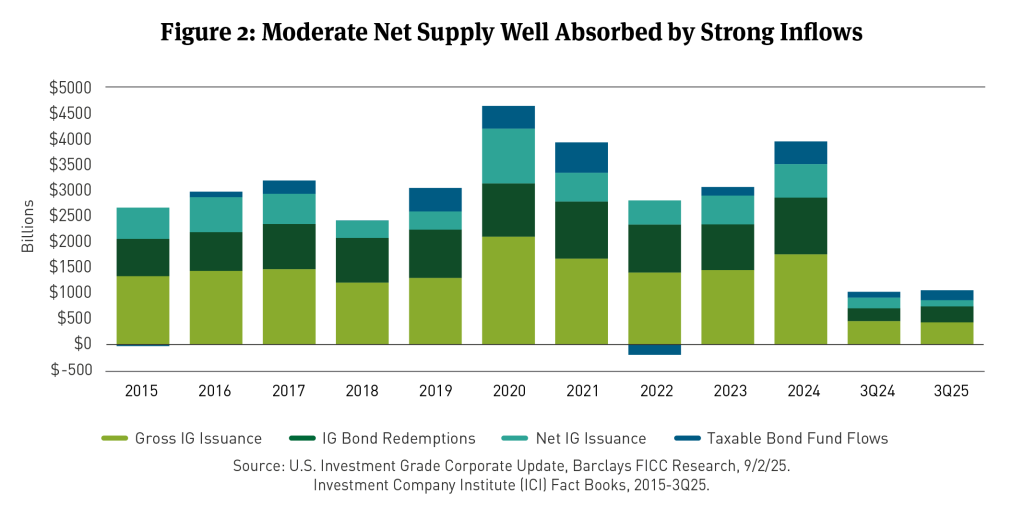

Fixed-income desks felt the ricochet before equity traders finished their coffee. The ICE BofA single-A mid-cap corporate index widened 5 bps versus large caps, compressing the typical 60 bps premium to 55 bps. Macro desks call it “beta compression by regulation”: when equity liquidity premia rise, bond investors demand less spread because the issuer’s equity cushion is now structurally discounted. CNBC reported that at least three CLO managers have already shifted 3–5 % of their loan buckets away from issuers with <$5 bn market cap, citing the same SEC release.

Institutional Response: Rotation, Not Panic

Goldman Sachs Prime Services calculates that active mutual funds reduced mid-cap beta by 0.12 in aggregate while raising cash to 6.3 %, but hedge funds actually increased net exposure 40 bps, betting mean reversion within six weeks. The divergence shows the sell-off is viewed as regulatory, not cyclical. ISM Services printed 53.4 in May, well above the 50.7 consensus, and May payrolls revised up 37 k, so the macro backdrop still rewards risk. Yet valuation sensitivity has tightened: the mid-cap forward P/E de-rated from 17.1x to 16.4x in two sessions, erasing the 40 bps premium to its 10-year median. That 16.4x level now embeds a 7 bps liquidity discount, creating a tactical entry if the rule is challenged or clarified.

What the Street Is Watching Next

Three catalysts dominate desk chatter. First, the Investment Company Institute has petitioned for a 90-day comment period, arguing the three-day ADV test ignores the central clearing of ETFs; a stay could halve the liquidity premium overnight. Second, NY Fed staff will publish the quarterly Survey of Market Liquidity on 20 June; if primary-dealer mid-cap inventory is below $1 bn for the third straight quarter, pressure builds on the SEC to loosen the test. Finally, MSCI’s semi-annual index review lands 30 August—any cut in mid-cap factor weights would force passive funds to follow, turning a regulatory tweak into a benchmark event.

Bottom-Line for the 9-to-5 Portfolio

Retail holders of broad-based mid-cap ETFs such as IJH or VO now carry an embedded 7 bps dead-weight loss, equal to roughly one-third of the segment’s typical annual alpha. The drag is small enough to ignore in a 40-year retirement glidepath, but for investors who benchmark themselves against monthly excess return it eats the entire cushion. One workaround is to migrate to exchange-traded instruments that hold large-cap proxies and use micro E-mini futures to re-create mid-cap beta; CME margins require only $880 per contract, freeing roughly 92 % of the notional to sit in Treasury bills yielding 5.25 %, offsetting the liquidity tax. Another is to swap into active managers with 15 %+ in private credit or late-stage venture debt, securities the SEC still classifies as “qualifying” under the 2020 tail-risk exemption. Both tactics introduce basis risk; neither is free. The cheapest insurance may simply be patience: if history is a guide, regulatory shocks fade once the plumbing adapts, and mid caps have recouped an average 130 bps in excess return within six months of prior liquidity events. Until then, every rebalancing date will feel like a 7 bps toll booth—small, but impossible to drive around.

For a concise model that tracks the real-time cost of the new liquidity rule across 42 mid-cap ETFs—and flags when the 7 bps tax is likely to compress—see the free dashboard here: Mid-Cap Liquidity Monitor.