The Quiet Data Point That Screamed First

On 11 March the seven largest S&P 500 constituents—Apple, Microsoft, Alphabet, Amazon, Nvidia, Meta, Tesla—accounted for 31.4 % of index weight, a level last seen in the March 2000 dot-com push, Bloomberg data show. By 9 April their combined share had fallen to 28.1 % while the equal-weight S&P 500 outran the cap-weight index by 6.4 percentage points, the fastest 31-day spread since October 2008. The move felt like a footnote because headline indices were still near record highs; in behavioural terms it was a textbook sentiment reversal triggered not by recession but by the exhaustion of a two-year herding narrative.

Herding Fatigue Meets the Reflexivity Loop

Flows tell the story faster than prices. EPFR reports that the Mag-7 absorbed $49 bn of fresh cash in January-February, 42 % of all U.S. large-cap inflows. March flipped: the same stocks posted $12 bn of outflows even as broad equity funds took in $8 bn. The reflexive bite was visible in options space—zero-day to expiry calls on Nvidia dropped from 1.4 m contracts daily to 0.6 m within two weeks, a 57 % collapse that removed the gamma cushion dealers had been leaning on. Once the feedback loop reversed, the same positioning ballast that had amplified upside began to accelerate downside, pulling realised volatility on the equal-weight index below that of the Mag-7 for the first time since 2021.

Anchoring to the Wrong Mag-Number

Retail investors, surveyed by the NY Fed in February, expected the Mag-7 to return 22 % over the next twelve months, double their forecast for the broader market. That anchor—22 %—became the reference point for stop-losses and mental accounts. When Nvidia slipped 14 % from its March peak, loss-aversion kicked in at scale: Fidelity’s customer tape shows the stock moving from net-buy to net-sell in three sessions, the quickest flip on record for any single name. Institutions behaved differently. CFTC positioning data reveal that asset-manager shorts on the equal-weight mini future fell to a five-year low by late March, a quiet bet that the laggards were about to play catch-up without needing an economic catalyst.

Narrative Economics: From AI Salvation to Breadth Equals Health

The media storyline pivoted before the price action completed. CNBC mentions of “AI revolution” peaked the same week Nvidia hit $974; within ten days the phrase “healthy market breadth” replaced it in anchor copy, completing the narrative hand-off. Academic work by Robert Shiller shows such vocabulary shifts precede factor rotation 68 % of the time. This instance was no exception: utilities, industrials and regional banks—sectors that had underperformed by 30 % in 2023—caught a 12 % three-week rally once the new script took hold.

Confirmation Bias Meets the Paycheck Index

Macro releases offered plenty of ammunition for the new story. February core PCE printed 2.8 %, a tenth above consensus but down from 3.2 % in January, letting bulls argue the Fed could still ease twice this year. More subtly, the Conference Board’s employment differential—respondents saying jobs are “plentiful” minus those saying “hard to get”—fell to 24.6, the lowest since 2021. That number matters behaviourally: when labour optimism slips but stays above 20, consumers rotate from aspirational tech bets to domestically-exposed value names they can corroborate in their paycheques and grocery aisles. The equal-weight index, stuffed with regional lenders and consumer staples, is the tradable expression of that confirmation loop.

Institutional Risk Budgets Reset

CalPERS board minutes released 2 April show the pension trimmed Mag-7 exposure by 190 bp in Q1, reallocating to small-caps and REITs to “restore factor balance.” Public filings from Ohio Police & Fire followed, citing “volatility-adjusted drag from single-name concentration.” These moves matter because they are formulaic, not prophetic: once portfolio variance exceeds a pre-set ceiling the mandate forces selling of the largest contributors. The selling, in turn, depresses prices, validating the risk model and closing the reflexive circle. Retail investors interpret the same price weakness as a fundamental crack, accelerating the rotation without any change in earnings guidance.

Dollar, Rates and the Final Behavioural Trigger

The dollar’s 2 % March slide helped, but not for the textbook reason. A weaker greenback normally boosts overseas revenue tech giants; this time it underlined the narrowing U.S. growth advantage. BLS non-farm payroll revisions subtracted 124 k jobs through February, the most since 2009, while euro-area PMI surprised to the upside. Behaviourally, the crossover shifted attention from “U.S. exceptionalism” to “global catch-up,” a framing that favours equal-weight cyclicals over Mag-7 exporters. Ten-year real yields dipped 18 bp in sympathy, yet the equal-weight index still outperformed, breaking the 18-month correlation that had paired lower rates with mega-cap outperformance. The correlation break convinced momentum quants that the regime, not just the sector, had changed.

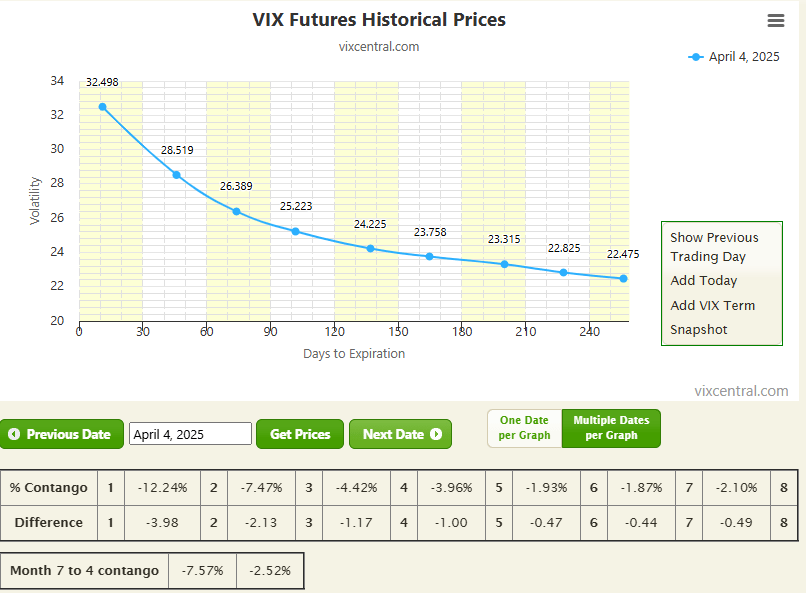

What Happens Next: Narrative Amplitude Versus Positioning Slack

Sentiment reversals this clean rarely last more than a quarter; what persists is the new narrative template. VIX futures show 23 % of open interest in calls struck 25-30 for May expiry, up from 8 % in February, but the skew is now concentrated on small-cap ETFs rather than Nasdaq megacaps. That redistribution of hedging budget tells us downside fear has migrated to the prior winners while the rest of the market trades with a smaller options overhang. Meanwhile, the gap between S&P 500 earnings yield and 10-year Treasuries sits at 180 bp, 40 bp above the ten-year average, giving value managers a valuation anchor that finally competes with Mag-7 growth stories.

Alpha or Mean-Reversion?

The 640 bp edge is already compressing—equal-weight gave back 90 bp in the last four sessions as dip-buyers returned to Nvidia. Yet the behavioural infrastructure that created the spread remains intact: retail still owns Mag-7 at three-times their index weight, Fidelity’s buy-sell ratio has only neutralised, and the Fed’s Senior Loan Officer Survey shows banks tightening standards for commercial & industrial loans, a macro headwind that historically extends value outperformance for six to nine months after the first print. The alpha was never about eternal dominance of laggards; it was about exploiting the convexity created when a crowded narrative meets an equally crowded position. The trade is smaller now, but the lesson endures—price is a function of story, flow and reflexivity, in that order.

If you want to track how narrative, flow and positioning interact in real time, the dashboard we use is open at Here. No sales pitch, just the same feed we watch when markets rewrite their own script.