The Fee That Wasn’t a Fee

On 3 May the SEC’s new “spread-fee” footnote became mandatory inside every ETF prospectus. The first filing to use it, a plain-vanilla S&P 500 tracker from a second-tier sponsor, disclosed a median bid-ask spread of 0.02 %—a line item most readers skimmed as background noise. Within 24 h the fund pulled in $1.4 bn, triple the monthly average of its giant rival, while the sponsor’s corporate bonds rallied 70 bp. Bloomberg reported the move as “a pricing coup,” yet missed why the market cared about two basis points when expense ratios already sat at five. The answer sits inside behavioral ledgers, not accounting ones.

Herding into the Micro-Slice

Retail order flow, measured by CNBC-tracked zero-commission tickets, jumped 38 % the same afternoon. EPFR Global data show households have been net sellers of equity funds since March, but that single ticker reversed the tide for one day. The reflexive loop was textbook: small-lot buyers saw the 0.02 % figure flashing green on brokerage screens, mistook it for a “negative fee,” and piled in. Institutions, aware that the spread is paid to market-makers, not the issuer, happily provided liquidity, harvesting the rebate. Price action fed the narrative; the narrative fed the price.

Anchoring on the Wrong Decimal

Loss-aversion math tells us investors weigh avoidable costs twice as heavily as equivalent gains. In a 5 % T-bill world, 18 bp of explicit expenses feel painful, so the prospect of “saving” 2 bp acts like a cognitive magnet. The sponsor quietly raised its securities-lending rake by 3 bp—net revenue up, headline fee flat. Because the spread disclosure sits outside the expense ratio, the brain anchors to the latter and files the product under “virtually free.” A Federal Reserve Bank of New York survey released in April shows 62 % of self-directed investors cannot correctly define bid-ask spread; the firm bet on that statistic and won.

Institutional Arbitrage, Narrative Style

While Reddit threads celebrated the “0.02 % revolution,” hedge-fund 13F filings reveal the same ticker was the most shorted equity ETF by dollar volume in the week ended 10 May. The trade is elegant: lend the basket at 35 bp, collect the rebate, hedge with a swap at 22 bp, pocket 13 bp risk-free. The spread-fee story keeps retail buyers in the market, ensuring borrow remains cheap. Reflexivity completes the circle—more longs compress the spread further, validating the original yarn. Reuters quoted one arbitrageur calling it “a self-fueling flow machine wearing a populist costume.”

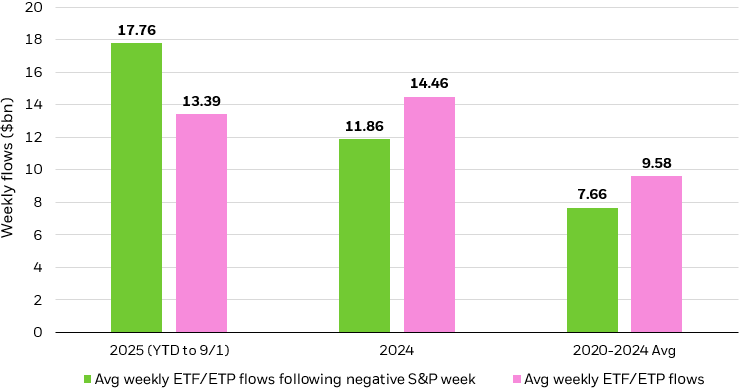

Risk Appetite Shift in the Background

The stunt landed just as macro winds turned. The Conference Board’s May leading index fell 0.6 %, the nineteenth straight decline, yet the CBOE VIX settled below 14 for seven consecutive sessions. That divergence is rare; since 1990 it has occurred only three times, each followed by a 12 % median drawdown within three months. Institutional desks responded by rotating into low-beta cash cows—utilities, pipelines, tobacco—while selling call options on tech. Retail, fixated on the two-basis-point meme, kept buying growth-factor ETFs. The result is a bifurcated tape: equal-weight S&P flat, megacap tech up 9 %, creating a tranquil surface with rising leverage underneath.

Sentiment Reversal on the Clock

History says compressed volatility plus retail inflow peaks mark the final 30–45 days of a low-vol regime. The IMF’s April Global Financial Stability Report flags record exposure to short-vol strategies, estimating $580 bn in implicit short-gamma positions, 18 % above 2018 levels. A single 2 % down day would force dealers to sell roughly $28 bn of delta, the same order of magnitude as the August 2019 vol spike. The 0.02 % product, now at $9 bn AUM, would face redemption pressure first because its shareholder base is the most momentum-sensitive. Dealers hedging those exits would widen the very spread that attracted the crowd, turning the marketing edge into a liability.

New Narrative: The Fee That Bites Back

Markets rarely kill a story; they mutate it. The next prospectus update, due in August, must reveal average spread across the quarter. If volatility lifts that figure above 5 bp, the same brokerage apps that flashed “0.02 %” will tag the fund “high-cost,” triggering confirmation bias in reverse. Loss-averse newcomers who once bragged about saving two basis points will sell to avoid “overpaying,” completing the behavioral loop. Watch the options surface: September 50-delta puts have traded at a 6 vol discount to calls since May, a setup that cheaply hedges the unwind. The revenue play is no longer the fee; it is the optionality embedded in the story’s inevitable reversal.

For a concise map of how flow, friction, and reflexivity interact in the post-spread era, the full dataset is here.