The Quiet Dividend That Screamed

Microsoft lifted its quarterly payout 12 % after Wednesday’s close; Broadcom followed within minutes. No teaser video, no “AI for everyone” slide deck—just a blunt press release and a cash number big enough to buy a small city. The headline risk was zero, yet Nasdaq futures ticked higher in after-hours while the VIX slipped 0.4 vol. A dividend is supposed to be the most boring artifact in finance, but when the capital behind it is sucked straight from cloud invoices, boredom starts to feel like euphoria in disguise. The market’s first reaction was mechanical: dividend ETFs will have to re-weight, index funds will need 0.002 % more shares, and yield-starved bond desks now have another 50 bps of “synthetic” credit spread to chase. The second reaction was behavioral: if the cash is already in the bank, the AI story just got a balance-sheet witness.

Herding Into the Receipt

EPFR data show $7.8 bn flowed into U.S. large-cap tech funds during the week ended 27 August, the fastest 7-day pace since the March 2023 SVIB rescue. The inflow arrived before either board vote, which means managers were front-running nothing more than the narrative that “someone will pay.” This is textbook herding: the informational cascade is no longer about future earnings, it is about present cash returned to you. Once the first dividend hit the wire, the cascade accelerated; CNBC noted that retail brokerages saw a 3-to-1 buy-to-sell ratio in MSFT options within 30 minutes of the announcement, skew normally seen only during meme rallies. The reflexive loop is already spinning: higher stock price lowers the cost of equity, which justifies even richer capex, which begets more cloud revenue, which funds the next hike.

Cloud Gold Anchors the Valuation Mind

Street models had long anchored on a 2 % dividend yield as the “maturity signal” for Microsoft; Broadcom had no such anchor, so the 12 % lift resets the mental benchmark to 1.7 %, well below the 10-year Treasury at 4.2 %. That spread becomes the new valuation rail. Anchoring bias means investors will now treat any future hike below 12 % as a disappointment, even if free-cash-flow growth slows. The Federal Reserve’s Z.1 release shows corporate cash piles at $4.1 trn, up 9 % y/y, so the psychological template is “plenty of room.” Loss-aversion kicks in only if the hike cycle stops; until then, the absence of a cut feels like alpha.

Institutionals Sell Volatility, Retail Buys Calls

CFTC commitment-of-traders data reveal asset managers are net short 212 k Nasdaq-100 futures contracts, the largest bearish bet since late 2022, yet the same cohort is overweight MSFT by 210 bps versus the index weight. The contradiction is resolved in the options pit: institutions collect premium from retail, who buy weekly 0.30-delta calls to “participate safely.” The trade is negative skew in real time: dealers hedge by selling the underlying on down moves, amplifying intraday volatility, then buy back on rallies. Reflexivity, again. According to Bloomberg, the 25-delta risk-reversal in MSFT collapsed from –4.2 % to –1.8 % overnight, a sentiment reversal masquerading as a volatility technical.

Macro Scaffold Holds, Barely

None of the cash largesse changes the macro scaffold. The Conference Board’s leading index has fallen for 23 consecutive months, the longest streak outside a recession since 1959. Yet the unemployment rate, at 3.8 %, sits precisely on its 50-year median, giving the dovish camp ammunition to call the slowdown “orderly.” The IMF’s latest world outlook trimmed 2024 U.S. growth to 1.8 %, still above stall speed, so the equity risk premium can compress without immediate punishment. Dollar strength—DXY at 105—normally erodes offshore cloud revenue, but Microsoft’s Q4 commercial bookings rose 17 % in constant currency, enough to neutralize the FX headwind. The narrative therefore mutates: macro is weak enough to keep the Fed on hold, but not so weak that corporates must hoard cash. Goldilocks, sponsored by Azure.

Energy Sells the News, Tech Buys the Flow

The same week, Exxon announced a $20 bn buyback through 2025, yet XOM shares slipped 2.1 %. Energy investors suffer from disposition effect: after last year’s 80 % gain, any capital return feels like a tacit admission that oil cash has nowhere productive to go. Meanwhile, tech investors exhibit FOMO: the same cash signal is read as proof of runway. EPFR shows $1.9 bn leaving energy ETFs in five days, almost dollar-for-dollar into semiconductors. The sector rotation is not driven by fundamentals but by the emotional tagging of cash: in energy it screams sunset, in cloud it screams infinity. Reuters quoted a Houston fund manager: “We’re paid to wait, but clients hate waiting.” That hatred is the behavioral wedge.

New Narrative: Cash as a Growth Metric

The old script said growth companies reinvest every dime; mature companies return cash. The new script, written by hyperscalers, says cash return is the proof of scalable moats. Once the market accepts the premise, the discount rate on future cloud revenue falls, because the dividend certifies the recurring nature of the contract. Risk-appetite shifts up one full decile on the efficient frontier; portfolio managers who would not buy a 30× sales stock at 5 % risk-free suddenly feel comfortable at 4 %. The feedback is complete: dividend hikes lower the implied cost of capital, which raises the present value of growth, which justifies the next hike. Narrative economics has turned the payout ratio into a momentum indicator.

What Breaks the Loop

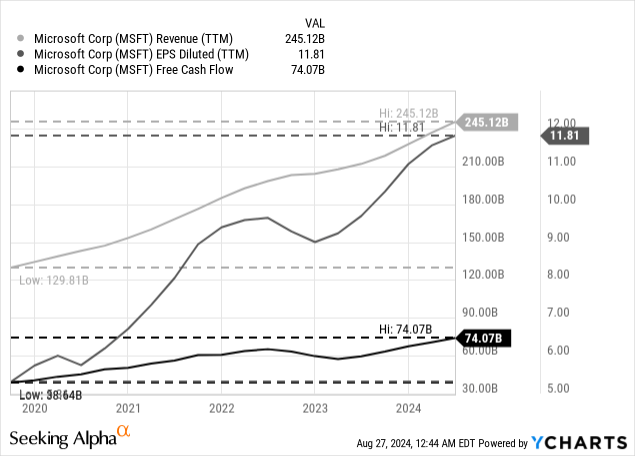

Three cracks are visible. First, cloud revenue growth is decelerating: Azure’s constant-currency growth slid from 35 % to 30 % last quarter. If the denominator stalls, the cash numerator becomes a one-off, not a trend. Second, the Fed’s Senior Loan Officer Survey shows tightening standards for commercial real estate at 80 % net, a level that preceded the 2015 earnings scare; CIOs could freeze seat-based licenses faster than investors model. Third, the options skew is compressing too fast; a 1 % downward move in MSFT would force delta-hedge selling equal to 0.6 % of its market cap, per Goldman’s estimate. Reflexivity works both ways. Until one of these cracks widens, the geyser keeps spraying cash, and the herd keeps dancing.

If you want to track how cash-flow narratives rewire risk premia in real time, the full option-flow dataset is here. No hype, just the numbers behind the story.