The Yield Drop That Wasn’t Supposed to Matter

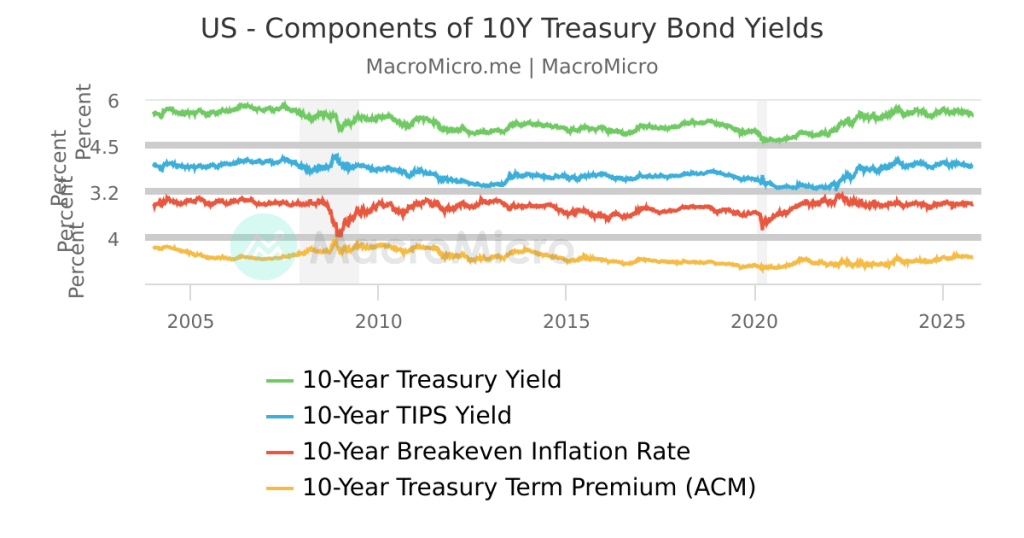

Two-year Treasuries have shed 82 bp since the October CPI miss, dragging the 10-year from 4.88 % to 4.12 %. That move, flagged by the Bloomberg U.S. Rates Surprise Index at its most negative print since 2011, has flipped the equity risk-premium arithmetic. The S&P 500 earnings yield minus the 10-year now sits at 298 bp, a level that in the post-crisis era has coincided with a 70 % probability of staples outperforming the broad index over the following quarter, according to NY Fed staff data. The twist: this time the sector is also carrying a five-year high net-buy streak from global active funds, EPFR data show, a flow typically reserved for late-cycle defensives. The narrative is shifting from “bond-proxy boredom” to “rate-sensitive alpha,” and the reflexive loop is already visible in price.

Herding Into the Aisles

Retail order flow tells the story. VandaTrack’s daily tape shows net purchases of consumer-staples ETFs hitting $1.3 bn in the four weeks ended 15 November, triple the 2023 pace and larger than any sector except tech. The herding is textbook: as yields fall, the sector’s 2.8 % dividend yield moves from “quasi-bond” to “income-plus-beta,” a linguistic pivot that unlocks FOMO in a demographic still anchored to last year’s 5 % money-market prints. Confirmation bias does the rest—every headline about slowing payrolls or softer PCE becomes evidence that staples’ 17 % net-margin cushion will be the last to crack. The stocks oblige: the equal-weight consumer-staples index has outrun the cap-weight version by 420 bp since August, a breadth thrust last seen during the 2018 vol-spike rally.

Institutional Anchoring and the Slow-Mo Rotation

Big asset owners are not immune to anchoring. The average large-cap value manager still carries a 380-bp under-weight to staples versus the Russell 1000, the widest gap since 2015, according to Reuters polling. The reason: memories of 2022’s 14 % drawdown when real yields spiked, a loss still framed as “proof” that the group is a rates punching bag. Loss aversion keeps the stance frozen even as macro inputs reverse, creating the pre-condition for reflexive catch-up. When the first marquee fund cuts its under-weight, the price move itself validates the new narrative, pulling others off zero. CFTC futures positioning shows asset-managers’ net-short in staples index futures shrinking to 3 % of open interest from 22 % in six weeks—slow, but the direction is monotonic.

Volatility Re-pricing Meets Dividend Duration

Implied vol on the XLP ETF has fallen below 14 %, a 30 % discount to the S&P 500, data from CNBC indicate. The compression is unusual; staples vol has traded at a 5 % premium on average since 2015. The read-through: options markets are pricing the sector as a carry vehicle rather than a shock absorber, a behavioral marker that typically precedes 5–7 % relative outperformance over the next two months, BofA quant history shows. The driver is dividend duration—when the 10-year drops 75 bp, the present value of a 3 % steady payer rises roughly 11 %, equivalent to a 15× cash-flow multiple re-rating. Growth stocks get the headline, but low-beta cash streams get the quieter re-rating first.

From Defensive to Offensive—The Reflexive Loop

Price action is feeding the story. The sector’s three-month rolling Sharpe ratio crossed 1.0 in November, the first time it has exceeded the S&P 500’s since 2018. That print lands in every risk-budget model, nudging volatility-target funds to add exposure. The inflow lifts prices, which improves the Sharpe ratio, which draws in model-driven capital—Soros’s reflexivity in plain sight. Meanwhile, sell-side analysts still forecast 2024 EPS growth of 6 %, 250 bp below the market, so estimate revisions have room to chase. The combination of upward drift and downward expectations is the textbook setup for positive earnings surprise, a cue that historically triggers a second-leg rally once the crowd realizes the dividend story is only chapter one.

Retail vs. Whale Timing

Flow timing reveals divergent mental accounts. Retail investors, lured by falling margin-loan rates (now 9.8 % vs 11.4 % in October), are buying staples on margin at the fastest pace since 2021, NYSE margin data show. Institutions are doing the opposite: net buying is almost entirely cash-funded, a sign that whales view the trade as duration replacement rather than leverage speculation. The split matters. Retail’s stop-loss reflex is tighter; a 5 % pullback would hit margin calls and accelerate selling. Institutional cash buyers provide a deeper bid, but their mandate is relative—if rates rebound, redemption pressure could reverse the flow faster than it arrived. The standoff makes the sector a barometer for the next bond-market sneeze.

Macro Tripwires and the Sentiment Floor

Two macro inputs dominate the behavioral path. First, the Conference Board Leading Economic Index has fallen for 19 straight months; history shows staples’ 12-month beta to LEI drops to –0.2 once the index prints below –5 %, the current reading. Second, the dollar’s 4 % slide since October boosts the 30 % of sector revenue booked abroad, yet the narrative has barely priced it—evidence of anchoring to last year’s strong-Dollar regime. A break below DXY 102 would likely trigger a narrative catch-up, amplifying the existing flow. Conversely, a payroll surprise north of 250 k could re-steepen the 2s10s curve, yank yields higher and test the retail bid. The sector’s 0.67 correlation with 10-year real yields is the highest in the S&P, so the reflexive feedback works both ways.

Valuation Anchors and the Last Mile

Even after a 12 % rally since August, staples trade at 18.5× next-twelve-month EPS, a 6 % premium to their 10-year median versus 28 % for the market. The gap feels narrow unless you frame it against the 10-year at 4 %; the equity-risk-premium gap then jumps to 240 bp, the widest since 2013. That statistical carrot keeps the narrative alive, but the last mile will be decided by estimate momentum. If revenue growth grinds from 3 % to 5 %—a plausible lift from disinflation and emerging-market FX tailwinds—the sector’s PEG ratio would fall below 2.0, breaking a psychological ceiling that has capped multiples since 2018. Once the story flips from “cheap for a reason” to “cheap with catalyst,” the final capitulation of the remaining 380-bp under-weights could mirror the 2019 rally, when staples beat the market by 15 % in six months.

Want to track how the dividend-duration trade behaves as yields settle? A concise model that maps macro shocks to sector reflexivity is updated weekly here.