The Quiet Spreadsheet Rebellion

Inside the June Duke-CFO Global Business Outlook, 212 U.S. chief financial officers admitted what no earnings call dares to say: capital allocated to generative-AI projects is rising faster than the internal rate of return can justify. Sixty-two percent labeled the current burn rate “unsustainable,” yet the same sample expects AI budgets to grow another 19 % over the next twelve months. That gap—between stated risk and planned action—is where behavioral finance starts to breathe. The numbers feel abstract until you translate them into the language of career risk: no finance chief wants to be the first to throttle a marquee AI roll-out, because the board rarely remembers the cost of a project that kept pace with peers; it always remembers the revenue missed because the firm “fell behind on tech.”

Herding is usually caricatured as day-traders piling into meme stocks, but the same reflex lives inside the C-suite. When every competitor increases software cap-ex at double-digit rates, the safe move is to shadow the pack, even if the net-present-value model spits out red. The Federal Reserve’s latest Senior Loan Officer Opinion Survey shows corporate credit demand still soft outside of tech, so firms are borrowing less to expand factories and more to rent GPU time. The narrative—“AI or obsolescence”—has become the new anchor for valuation multiples, replacing the 2021 “story” of infinite software subscriptions.

Reflexivity in the Pricing Loop

Markets do not passively observe this cap-ex boom; they fund it. The top quintile of AI-revenue indexes trades at 9.2× sales, double the ten-year median, according to MSCI factor data through May. Elevated equity values, in turn, lower the cost of issuing stock or convertible debt, which makes the “unsustainable” budget appear sustainable. George Soros called this reflexivity—price can validate the narrative that drove it. The danger arrives when feedback runs in reverse: if a single high-profile cancellation triggers a re-rating, the same cheap capital disappears overnight and the IRR math collapses. No CFO wants to be first, but no CFO wants to be second either.

EPFR Global flow data show U.S. growth funds absorbed $38 bn of new money in the first five months of 2024, the fastest start since 2020’s vaccine sprint. Yet the same category delivered a negative 190 basis-point excess return versus value. Loss-aversion theory predicts investors would recalibrate; instead they doubled down, confirming the “prospect theory” finding that people take more risk to avoid locking in a paper loss. Institutions are not immune. Public pension funds raised their strategic allocation to private tech partnerships from 6 % to 9 % last year, Bloomberg reports, even as their actuarial discount rate stayed anchored at 7 %—a nostalgia figure in a 5 % risk-free world.

Retail Optionality, Institutional Anxiety

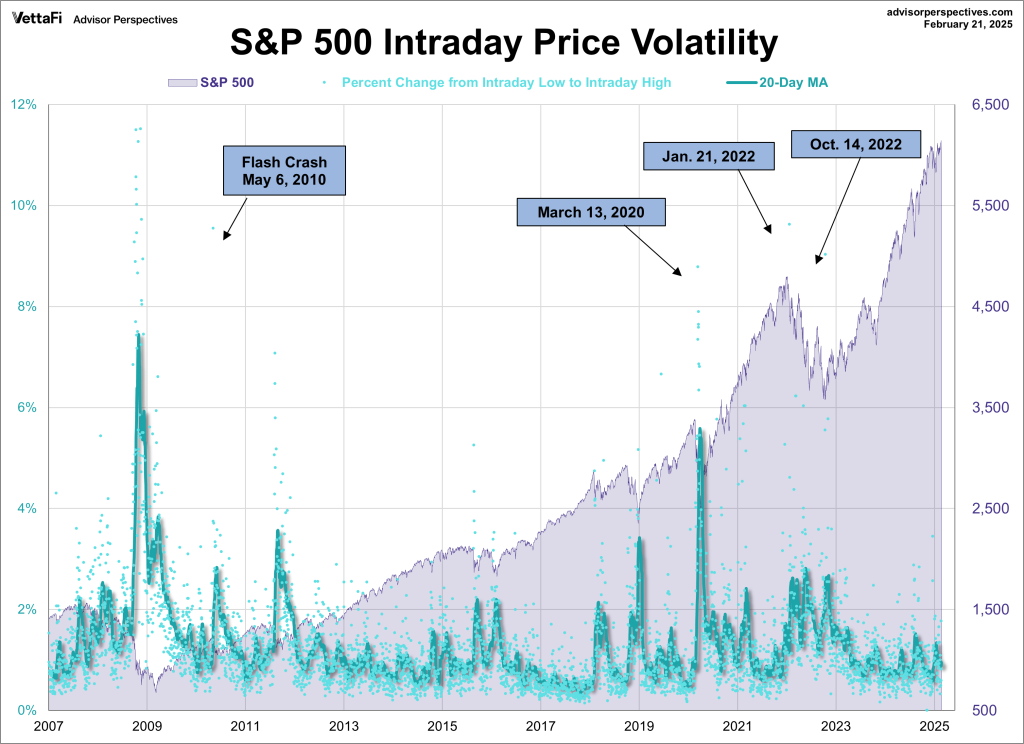

Zero-day-to-expiry options now represent 45 % of daily S&P 500 option volume, CNBC calculates, up from 21 % two years ago. The retail cohort uses these lottery tickets to surf AI earnings events; institutions sell the volatility to “harvest premium,” rationalizing that skew is rich. Both sides feel smart, but the equilibrium is fragile. A single guidance cut could gap the underlying while implied volatility explodes, forcing dealers to hedge into a falling market—classic reflexivity again. The CFTC’s commitment-of-traders report shows leveraged funds have been net short gamma since March, meaning they are structurally forced to sell dips and buy rallies, amplifying moves in either direction.

Where does the anchor sit? For many portfolio managers it is no longer 2021’s high, but last quarter’s low. The S&P 500 bottomed at 4 103 in April; since then every 2 % pullback has been bought before the close. That intraday memory creates a psychological magnet, reinforcing the belief that “someone else” will provide liquidity. Anchoring on a recent low works until the narrative fractures; then the same level becomes a trapdoor. The Conference Board’s consumer-confidence “present situation” index just printed its fifth consecutive decline, yet the expectations index rebounded. The split suggests households feel poorer today yet still believe the market will rescue them tomorrow—textbook disposition effect: hold the risky asset, sell the safe one.

Macro Scaffold Under the Narrative

None of this occurs in a vacuum. The three-month Treasury bill still yields 5.25 %, so every dollar funneled into AI cap-ex carries an explicit hurdle well above the pre-pandemic 2 %. The New York Fed’s probability model now prices a 68 % chance of recession within twelve months, the highest since 1982 outside of an actual downturn. Normally that would freeze spending, but CFOs are betting that AI-driven productivity will arrive before the macro storm, allowing them to cut labor faster than revenue falls. It is a temporal arbitrage: buy the option on efficiency today, exercise it when payroll must shrink. The gamble only works if the economy lands softly; otherwise revenue evaporates faster than cost savings materialize.

Energy analysts note a parallel tension. Oil demand forecasts for 2025 have been marked down by the IEA three times this year, yet U.S. shale firms increased rig counts for five straight weeks. The same herding impulse—keep drilling because the other guy will—shows up across sectors. Equity analysts have not cut S&P 500 earnings estimates for calendar 2024 despite macro indicators flashing amber; the reluctance illustrates confirmation bias: we overweight the evidence that fits the AI-productivity story and discard the rest. The result is a market priced for 12 % earnings growth with a macro backdrop consistent with flat to negative prints.

Who Blinks, and How to Watch

History says the first mover is usually a firm with a new CEO who can blame the predecessor. Watch appointment calendars; boards tend to rotate in outsiders when cap-ex velocity exceeds cash-flow coverage for two consecutive years. The second signal is the repo blackout. Companies that suspend buybacks to conserve cash rarely announce it loudly, but the change shows up in the daily Reuters issuance tables. A 30 % quarter-over-quarter drop in aggregate repurchase authorizations has preceded every cap-ex cycle unwind since 2008. Third, monitor employment data from niche labor markets. AI engineers in the Bay Area command $450 k median cash compensation, according to Glassdoor. When that figure plateaus, the marginal project is no longer profitable enough to compete for talent.

For investors, the takeaway is not to short every software name but to distinguish between price reflexivity and cash-flow durability. Firms that fund cap-ex from depreciating revenue should trade at a discount, yet many still fetch premium multiples because the narrative is sticky. A disciplined approach is to pair long positions in companies with positive free cash flow even after AI spend with shorts in businesses where stock-based compensation exceeds operating cash generation. The spread isolates the behavioral premium, not the technology itself.

The final irony: the longer no one blinks, the more violent the eventual synchronization. When the first credible cancellation arrives, the same herd that refused to lead will rush to follow. Equity supply will shrink overnight as shelf registrations are pulled, volatility will gap, and the narrative will flip from “AI everywhere” to “prove it works.” Until then, the unsustainable remains beautifully rational.

If you want to track real-time CFO sentiment signals—repo drops, hiring freezes, gamma flips—there is a quiet group sharing flow screenshots and survey leaks. No hype, just data. You can request access here.