The intersection of financial technology and traditional economic frameworks is poised to reshape the investment landscape significantly by 2025. As institutional investors navigate this evolving terrain, understanding the implications of these innovations on asset allocation strategies becomes paramount. The current macroeconomic environment, characterized by fluctuating interest rates and shifting risk appetites, necessitates a reevaluation of cross-asset pricing models and valuation sensitivities.

Recent trends indicate that fintech advancements are not merely enhancing operational efficiencies but are also altering investor behavior and capital flows. For instance, platforms that facilitate peer-to-peer lending or decentralized finance (DeFi) are attracting a new class of retail investors who prioritize liquidity and transparency. This shift could lead to a reallocation of funds traditionally held in more conventional assets such as bonds or blue-chip equities towards higher-yielding alternatives. According to Bloomberg, this trend has already begun influencing market dynamics, with increased volatility observed in sectors heavily impacted by technological disruption.

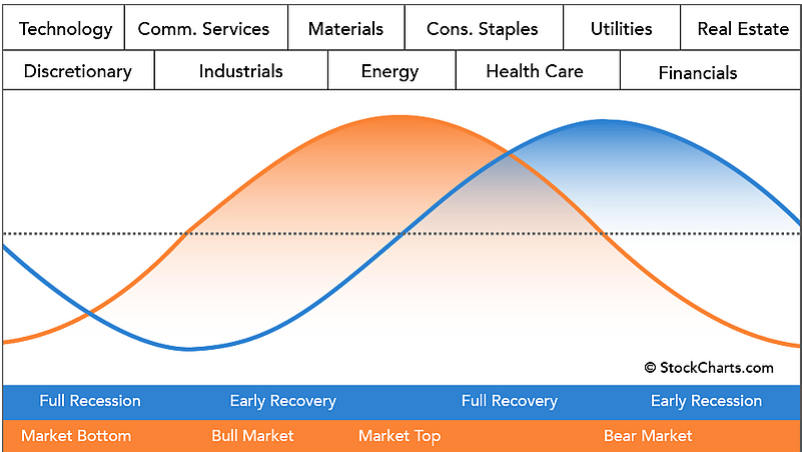

As we analyze the current state of the U.S. stock market, it is essential to consider how these fintech innovations interact with broader economic indicators such as inflation rates and employment figures. The Federal Reserve’s monetary policy remains a critical factor influencing investor sentiment; any signals regarding interest rate adjustments can lead to immediate shifts in risk premiums across various asset classes. For example, should inflationary pressures persist, we may see a rotation from growth-oriented sectors—such as technology—towards defensive stocks that offer stability during turbulent times.

The implications for institutional asset managers are profound. With an increasing focus on sustainable investing driven by fintech solutions that provide enhanced data analytics capabilities, there is potential for significant changes in portfolio construction methodologies. Managers must now incorporate environmental, social, and governance (ESG) factors into their valuation models while balancing traditional metrics like earnings growth and price-to-earnings ratios.

Moreover, the rise of algorithmic trading powered by artificial intelligence presents both opportunities and challenges for asset allocators. While AI can enhance decision-making processes through predictive analytics, it also introduces new risks associated with market timing and execution strategies. Institutions must remain vigilant about these developments to avoid unintended consequences stemming from over-reliance on automated systems.

In terms of sector performance, we observe distinct patterns emerging within cyclical versus defensive industries as investors recalibrate their expectations based on macroeconomic signals. Energy stocks have recently gained traction amid rising commodity prices driven by supply chain disruptions—a phenomenon exacerbated by geopolitical tensions highlighted in reports from Reuters. Conversely, tech stocks face headwinds as regulatory scrutiny increases alongside concerns about overvaluation relative to historical norms.

This environment underscores the importance of maintaining flexibility within investment portfolios. Institutional investors should consider implementing dynamic hedging strategies that allow for rapid adjustments in response to changing market conditions while preserving capital during downturns. Additionally, diversifying exposure across multiple asset classes—including real estate investment trusts (REITs) and commodities—can mitigate risks associated with concentrated positions in volatile sectors.

The interplay between fintech innovations and traditional financial markets will likely continue shaping investor behavior leading up to 2025. As family wealth managers assess their clients’ portfolios amidst these changes, they must prioritize education around emerging technologies while reinforcing foundational principles of risk management and diversification.

For readers seeking deeper insights into complex allocation frameworks or quarterly trends affecting their investments amidst this evolving landscape, further analysis is available via this link.