The current landscape of the U.S. stock market is characterized by a complex interplay of rising interest rates and shifting investor sentiment, particularly affecting emerging technologies. As central banks globally tighten monetary policy to combat inflation, the cost of capital has surged, leading to a reevaluation of growth prospects across various sectors. This analysis aims to provide institutional investors with insights into how these dynamics are reshaping asset allocation strategies and influencing sector rotations.

Interest Rates and Valuation Sensitivity

The Federal Reserve’s aggressive rate hikes have significantly impacted equity valuations, especially in high-growth sectors such as technology. Historically, tech stocks have been sensitive to changes in interest rates due to their reliance on future earnings growth. As rates rise, the present value of these future cash flows diminishes, leading to compressed price-to-earnings ratios. According to Bloomberg, many tech companies are now facing increased scrutiny from investors who are recalibrating their risk appetite amid higher borrowing costs.

This shift is evident in the performance divergence between growth and value stocks. While traditional value sectors like energy and utilities have benefited from rising commodity prices and stable demand, tech stocks have struggled under the weight of elevated discount rates. Institutional investors are thus compelled to reassess their exposure to these sectors, weighing potential returns against heightened risks associated with prolonged high-interest environments.

Risk Appetite and Sector Rotation

The current macroeconomic backdrop has led to a notable shift in risk appetite among institutional investors. With uncertainty surrounding economic growth prospects, there is an observable rotation towards defensive sectors that offer more stability during turbulent times. Sectors such as consumer staples and healthcare are gaining traction as they tend to perform better during economic slowdowns.

Conversely, cyclical sectors like industrials may face headwinds as demand forecasts become less optimistic amidst tightening financial conditions. The implications for asset allocation are clear: institutions must navigate this evolving landscape by balancing exposure between defensive plays and selective opportunities within cyclicals that could benefit from any potential recovery in economic activity.

Cross-Asset Pricing Dynamics

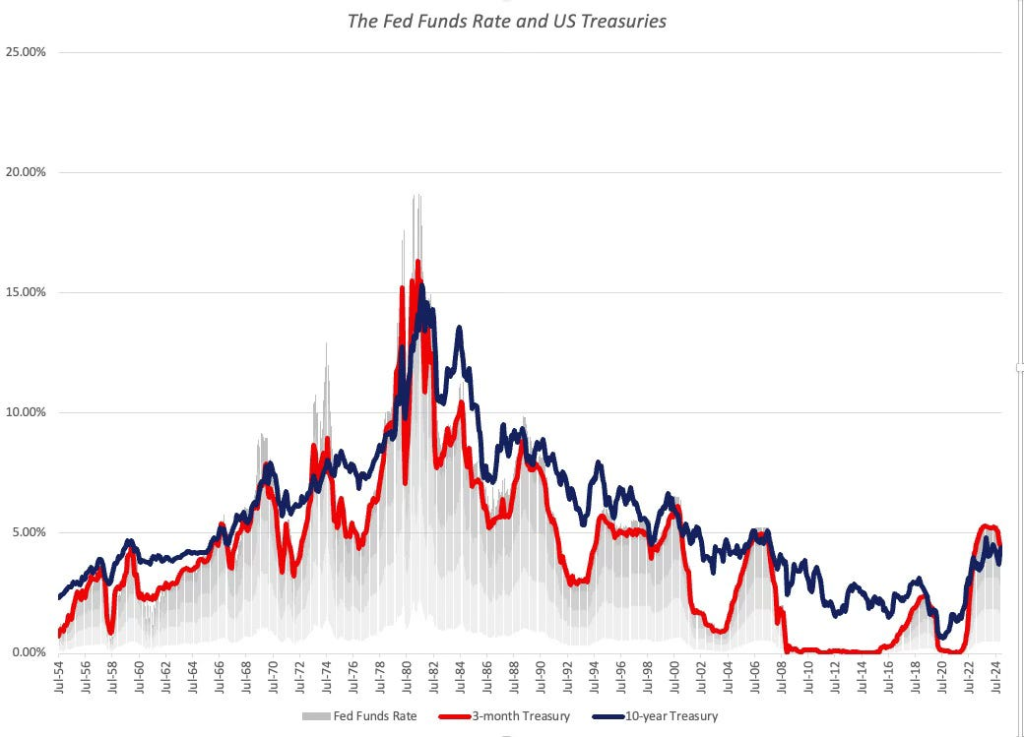

The interplay between equities and fixed income markets further complicates investment decisions for asset managers. As yields on government bonds rise, fixed income becomes increasingly attractive relative to equities, prompting a reallocation of capital away from riskier assets towards safer havens. This trend is underscored by recent reports from CNBC, highlighting how bond yields have reached levels not seen since before the pandemic.

This cross-asset pricing dynamic necessitates a careful evaluation of portfolio duration preferences among institutional investors. With longer-duration assets becoming more sensitive to interest rate fluctuations, there is an increasing focus on managing duration risk while seeking yield through shorter-duration securities or floating-rate instruments that can mitigate interest rate exposure.

Structural Opportunities Amidst Challenges

<pDespite the challenges posed by high rates, certain structural opportunities remain within emerging technologies that warrant attention from savvy investors. For instance, advancements in artificial intelligence (AI) continue to attract significant capital inflows despite broader market volatility. Companies at the forefront of AI innovation may still command premium valuations if they demonstrate robust revenue growth potential backed by tangible applications across various industries.

Moreover, energy transition technologies present another compelling area for investment consideration as global efforts toward sustainability gain momentum. The intersection of technology with renewable energy solutions offers unique avenues for growth that align with both institutional mandates for ESG (Environmental, Social, Governance) investing and long-term profitability goals.

Conclusion: Navigating Uncertainty with Strategic Insight

The current environment presents both challenges and opportunities for institutional investors navigating the complexities of high-interest rates impacting emerging technologies. A nuanced approach that considers cross-asset dynamics alongside sector-specific trends will be essential for optimizing portfolio allocations moving forward.

If you seek deeper insights into our strategic framework regarding asset allocation adjustments amidst evolving market conditions or wish to explore quarterly trends impacting your investment strategy further, please refer to this link.