The rapid advancement of artificial intelligence (AI) is reshaping the landscape of the U.S. stock market, prompting investors to reassess their strategies. As we navigate through the complexities of this evolving environment, it becomes crucial to identify which sectors are poised for growth and which may face challenges. Recent data indicates that while tech stocks have surged, other sectors are experiencing a more nuanced impact.

Current Market Dynamics

In recent months, the U.S. stock market has shown resilience despite macroeconomic headwinds such as inflationary pressures and fluctuating interest rates. The Federal Reserve’s stance on monetary policy remains pivotal; with inflation still above target levels, any signals regarding interest rate hikes can significantly influence market sentiment. According to Bloomberg, consumer prices rose by 3.7% year-over-year in September 2023, indicating persistent inflationary trends that could affect spending patterns.

Moreover, liquidity in the markets has been a double-edged sword. While increased liquidity often supports asset prices, it also raises concerns about potential overheating in certain sectors—particularly technology and AI-related stocks. The dollar’s strength against other currencies adds another layer of complexity; a strong dollar can dampen exports but may also attract foreign investment into U.S.-based companies.

Sectors Set to Thrive

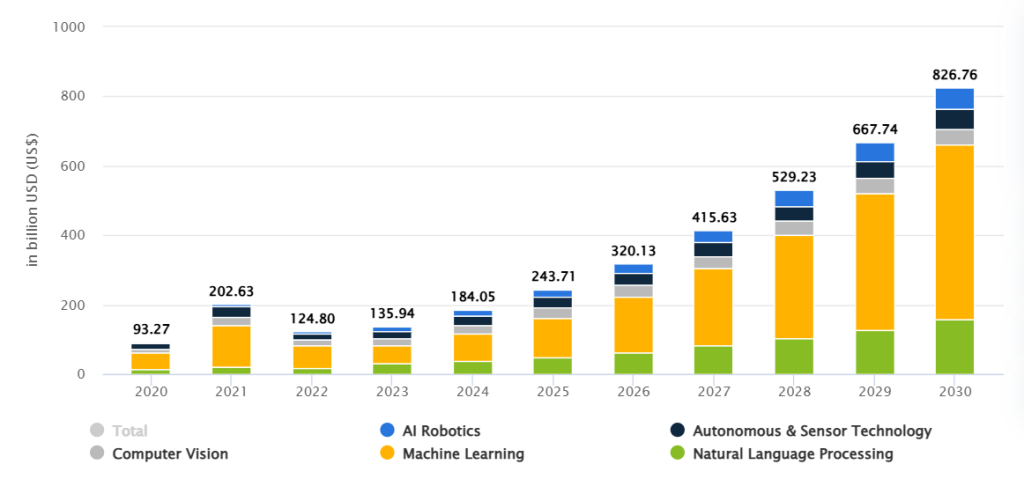

The technology sector stands out as a primary beneficiary of AI advancements. Companies specializing in machine learning, cloud computing, and data analytics are likely to see robust demand as businesses increasingly adopt these technologies to enhance efficiency and drive innovation. Major players like Microsoft and Google have already reported significant revenue growth attributed to their AI initiatives.

Furthermore, the healthcare sector is witnessing transformative changes due to AI applications in diagnostics and patient care management. As noted by CNBC, firms leveraging AI for drug discovery or personalized medicine are attracting substantial investments from venture capitalists eager to capitalize on this trend.

Sectors Facing Challenges

Conversely, traditional industries such as energy may encounter headwinds as the focus shifts towards sustainability and renewable energy sources. The ongoing transition away from fossil fuels poses risks for companies heavily invested in oil and gas extraction. According to Reuters, many energy firms are grappling with regulatory pressures aimed at reducing carbon emissions while simultaneously facing volatile commodity prices.

The financial sector also faces uncertainty amid rising interest rates that could squeeze profit margins on loans while increasing default risks among borrowers struggling with higher costs of living driven by inflation.

Investment Opportunities Amidst Uncertainty

For retail investors aged 25-45 with several years of experience under their belts, identifying opportunities amidst these shifting dynamics is essential. Exchange-traded funds (ETFs) focused on technology or healthcare innovation could provide diversified exposure without over-concentration in individual stocks prone to volatility.

Additionally, monitoring macroeconomic indicators such as employment rates will be crucial for gauging consumer confidence moving forward. A stable job market typically correlates with increased spending power among consumers—a vital component for sustaining economic growth.

The Road Ahead

As we look ahead into 2024 and beyond, understanding how AI will continue influencing various sectors is paramount for making informed investment decisions. While some areas may flourish under this technological revolution, others might struggle unless they adapt swiftly to changing consumer demands and regulatory landscapes.