The U.S. stock market is currently navigating a complex landscape shaped by rising inflation and fluctuating interest rates. As ESG investors, your focus on sustainable development and corporate responsibility places you in a unique position to assess how these macroeconomic factors could influence your investment strategies. Recent data indicates that inflation has remained stubbornly high, with the Consumer Price Index (CPI) showing an annual increase of 6.4% as of January 2023, according to Bloomberg. This persistent inflationary pressure is prompting the Federal Reserve to adopt a more aggressive stance on interest rates, which could have far-reaching implications for various sectors.

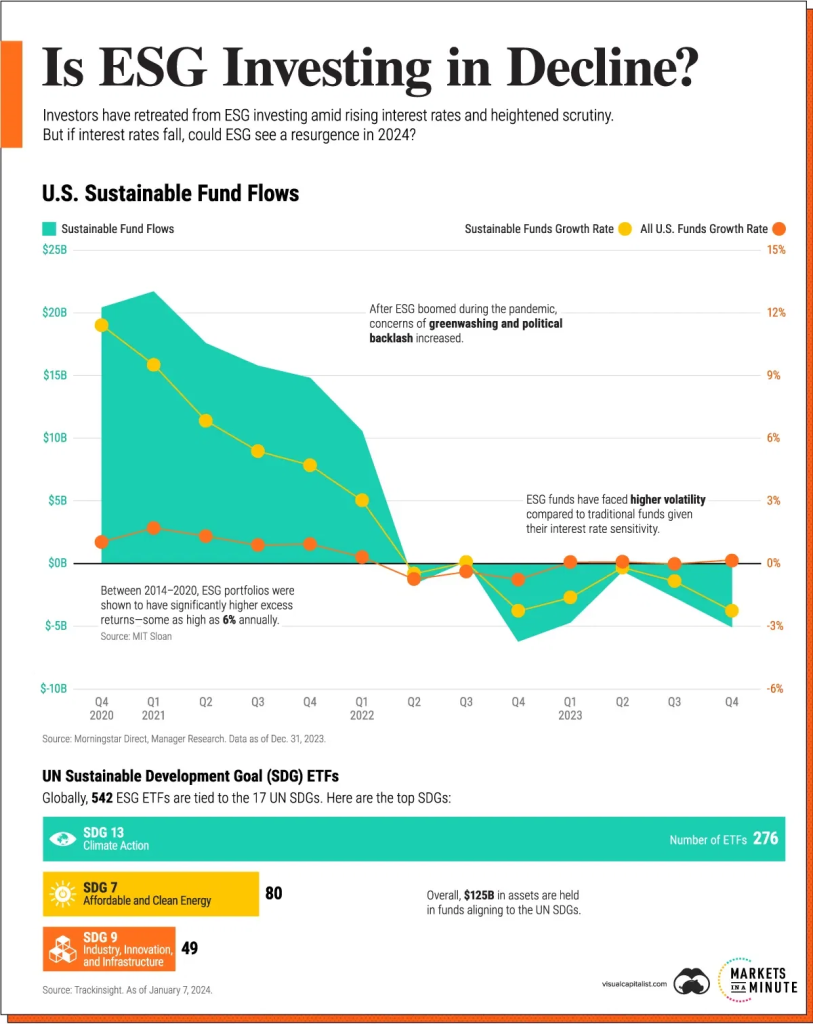

Interest rates are expected to rise further as the Fed aims to combat inflation, potentially reaching levels not seen since before the pandemic. The current benchmark rate stands at 4.75%, with projections suggesting it may climb above 5% by mid-2023. Such increases will likely impact borrowing costs across the board, affecting everything from consumer spending to corporate investments. For ESG investors, this environment necessitates a careful reevaluation of portfolio allocations, particularly in sectors sensitive to interest rate changes.

Sector Implications: Technology and Energy

The technology sector has been one of the primary beneficiaries of low-interest rates over the past decade, with companies leveraging cheap capital for growth initiatives. However, as borrowing costs rise, we may see a shift in investor sentiment towards more stable and cash-generating businesses. High-growth tech stocks could face increased scrutiny regarding their valuations; many are trading at multiples that assume continued low rates indefinitely.

Conversely, the energy sector presents intriguing opportunities amid this backdrop of rising rates and inflation. With global energy demand rebounding post-pandemic and geopolitical tensions influencing supply chains, companies focused on renewable energy sources are well-positioned for growth. The International Energy Agency (IEA) projects that renewable energy capacity will grow by over 50% between now and 2025, driven by government policies aimed at reducing carbon emissions.

Investment Strategies: Navigating Uncertainty

As you consider how best to position your portfolio in light of these developments, it’s essential to remain cognizant of both risks and opportunities inherent in this evolving landscape. One strategy might involve increasing exposure to sectors that align with long-term sustainability goals while also providing resilience against economic headwinds. For instance, investing in green bonds or ETFs focused on clean technology can offer both financial returns and contribute positively toward environmental objectives.

Moreover, diversifying into commodities such as gold or agricultural products may serve as a hedge against inflationary pressures while aligning with ESG principles through sustainable sourcing practices. According to CNBC, commodity prices have surged recently due to supply chain disruptions exacerbated by geopolitical tensions—an indication that these assets could play a crucial role in safeguarding portfolios during turbulent times.

The Role of Policy Trends

Policy trends will undoubtedly shape investment landscapes moving forward; thus staying informed about legislative developments is critical for ESG investors seeking long-term growth opportunities. The Biden administration’s commitment to addressing climate change through infrastructure investments signals potential windfalls for companies engaged in sustainable practices.Reuters reports that proposed legislation includes significant funding for clean energy projects aimed at achieving net-zero emissions by 2050.

This policy direction not only aligns with broader societal goals but also presents tangible investment opportunities within sectors poised for expansion due to favorable regulatory environments. Companies actively pursuing sustainability initiatives may find themselves better positioned than their competitors who lag behind in adapting their business models accordingly.

A Cautious Outlook Amidst Opportunities

The current market dynamics present both challenges and opportunities for ESG investors navigating an uncertain economic environment marked by rising inflation and interest rates. While some sectors may experience volatility due to changing monetary policies, others stand ready to capitalize on emerging trends driven by sustainability imperatives.

I’ve observed phases where investors hesitate despite rising liquidity; however, those who strategically align their portfolios with long-term growth narratives centered around sustainability are likely better equipped for whatever storms lie ahead.

For further market commentary on how these trends might affect your investment decisions moving forward, please visit this link.