The recent surge in foreign capital flows into the U.S. markets has sparked a debate among investors and analysts alike. As global economic conditions evolve, particularly in light of rising inflation and fluctuating interest rates, the implications for sustainable investment strategies are profound. The question remains: Are these inflows indicative of a significant shift in market dynamics, or merely a temporary blip on the radar?

Data from Bloomberg indicates that foreign investments in U.S. equities have reached unprecedented levels, with net purchases surpassing $100 billion in the first half of 2023 alone. This influx is largely driven by institutional investors seeking refuge from geopolitical uncertainties and volatile markets elsewhere. However, it is essential to dissect whether this trend represents a long-term commitment to U.S. assets or if it is simply a reactionary measure.

In examining the macroeconomic backdrop, we see that inflation continues to be a pressing concern for policymakers and investors alike. The Federal Reserve’s aggressive rate hikes have created an environment where borrowing costs are elevated, yet many sectors remain resilient. For instance, technology stocks have shown remarkable strength despite these headwinds, buoyed by ongoing advancements in artificial intelligence and digital transformation initiatives.

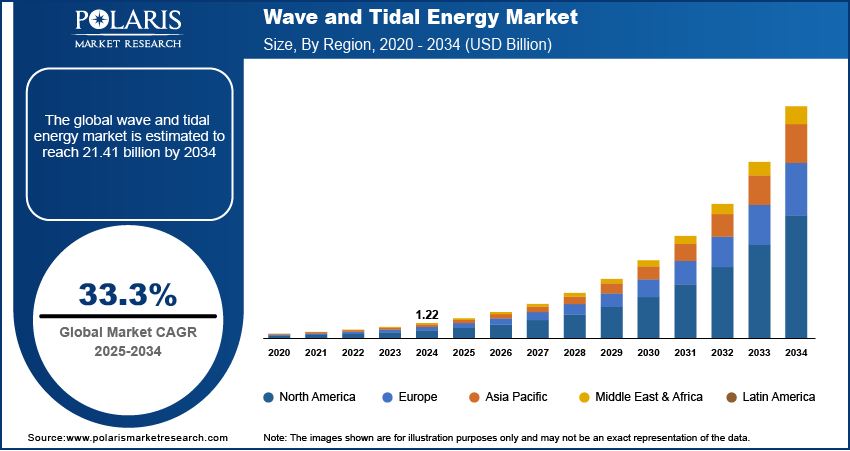

The energy sector also presents intriguing opportunities as global demand shifts towards cleaner alternatives amid increasing regulatory pressures for sustainability. Companies focusing on renewable energy sources are not only attracting domestic capital but also gaining traction among foreign investors who prioritize ESG (Environmental, Social, Governance) criteria in their portfolios.

Sector Rotation and Investment Opportunities

The current landscape suggests that sector rotation may be underway as investors reassess their allocations amidst changing economic indicators. High-profile firms like Morgan Stanley have noted that while traditional sectors such as utilities and consumer staples offer stability during turbulent times, growth-oriented sectors like technology and clean energy are poised for substantial gains as they align with long-term sustainability goals.

This sentiment is echoed by CNBC, which highlights how ESG-focused funds have outperformed traditional indices over the past year. Investors are increasingly recognizing that integrating sustainability into their investment strategies not only aligns with ethical considerations but can also yield competitive returns.

Moreover, the dollar’s strength plays a crucial role in shaping foreign capital flows into U.S. markets. As the dollar appreciates against other currencies, it makes U.S.-based assets more expensive for international buyers; however, it simultaneously enhances the purchasing power of those already invested here. This dynamic creates both challenges and opportunities for ESG investors looking to capitalize on emerging trends without being overly exposed to currency risk.

The Role of Policy Trends

Policy developments at both federal and state levels further complicate this landscape. Recent legislative efforts aimed at promoting green technologies through tax incentives could catalyze additional investments from abroad as companies seek to align with evolving regulations while enhancing their competitive edge globally.

As highlighted by Reuters, there is growing recognition among policymakers that fostering an environment conducive to sustainable business practices will not only benefit local economies but also attract foreign direct investment (FDI). This interplay between policy direction and market behavior underscores the importance of staying informed about regulatory changes when making investment decisions.

A Cautious Outlook Amidst Uncertainty

Despite these promising trends, caution is warranted as we navigate through uncertain waters marked by geopolitical tensions and potential economic slowdowns across various regions. It’s hard to ignore the unease spreading among traders regarding potential recessions fueled by high inflation rates coupled with tightening monetary policies worldwide.

I’ve seen phases where investors hesitate despite rising liquidity due to fears surrounding market corrections or unexpected policy shifts that could derail growth trajectories across key sectors like tech or energy.

Ultimately, while foreign capital flows into U.S. markets may appear robust at first glance—akin to a tidal wave—the underlying factors driving these movements suggest they could just be ripples influenced by broader economic currents rather than definitive signals of sustained momentum.

For further market commentary on how these trends might impact your investment strategy within sustainable frameworks, please visit our insights page here.