In recent months, the U.S. dollar has demonstrated an unexpected strength amidst a backdrop of fluctuating economic indicators and geopolitical tensions. For seasoned investors, particularly those in the 50 to 70 age range, this resilience prompts a critical examination of its implications for portfolio management and long-term financial strategies. As we navigate through the complexities of inflation, interest rates, and global currency dynamics, understanding the dollar’s position becomes paramount.

Macro Economic Landscape

The U.S. economy is currently experiencing a delicate balancing act. Inflation rates have shown signs of moderation, yet remain elevated compared to historical norms. According to data from the Bureau of Labor Statistics, inflation was reported at 3.7% year-over-year as of September 2023. This persistent inflationary pressure has led to speculation about the Federal Reserve’s next moves regarding interest rates.

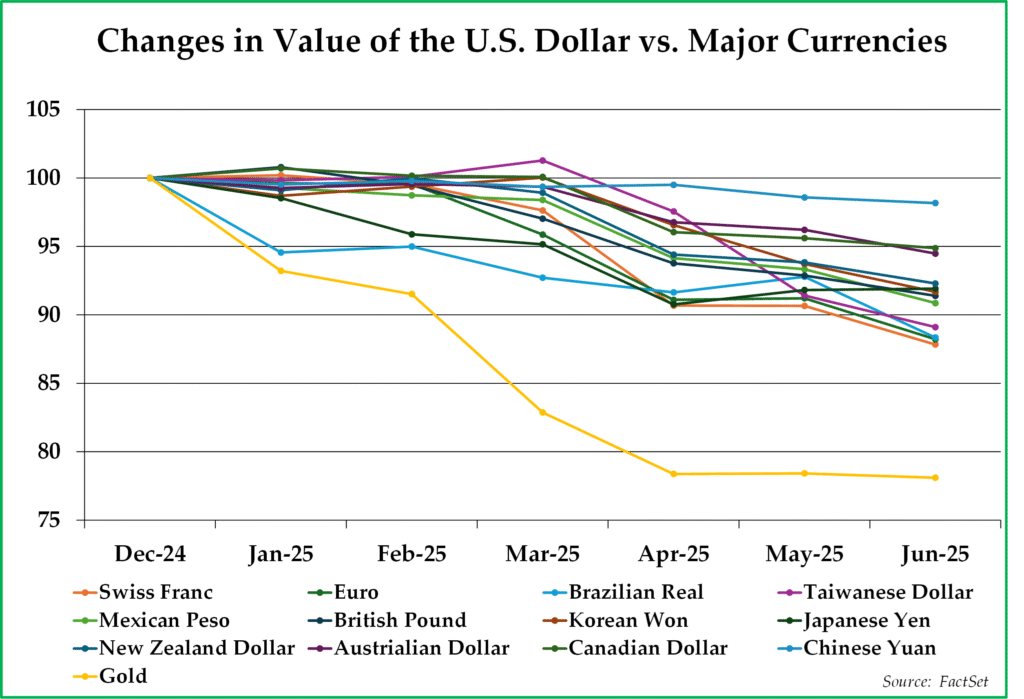

Despite these challenges, the dollar has maintained its strength against major currencies like the euro and yen. The DXY index, which measures the dollar against a basket of currencies, remains robust at around 103 points. Analysts from Bloomberg suggest that this resilience is partly driven by safe-haven demand amidst geopolitical uncertainties and economic slowdowns in other regions.

Interest Rates and Employment Trends

The Federal Reserve’s policies play a crucial role in shaping market dynamics. With interest rates hovering between 5% to 5.25%, investors are keenly aware of how these rates influence borrowing costs and consumer spending. A report from CNBC highlights that while higher interest rates can cool inflation, they also pose risks to economic growth if maintained for too long.

Employment figures have remained relatively stable, with unemployment rates around 4%. This stability supports consumer confidence but also complicates the Fed’s decision-making process regarding rate adjustments. As retirees focus on income generation from their investments, understanding these macroeconomic signals is essential for informed decision-making.

Sector Rotation and Structural Changes

The current market environment is witnessing significant sector rotation as investors reassess risk profiles amid rising interest rates and inflation concerns. Traditionally defensive sectors such as utilities and consumer staples have gained traction as investors seek stability in uncertain times.

However, technology stocks have also shown resilience due to ongoing advancements in artificial intelligence and digital transformation initiatives across industries. According to Morgan Stanley analysts, sectors that prioritize innovation may present attractive investment opportunities despite broader market volatility.

Investment Opportunities in Today’s Market

For retirees and conservative investors, focusing on dividend-paying stocks within stable sectors can provide reliable income streams while mitigating risks associated with market fluctuations. Additionally, exploring fixed-income securities such as Treasury Inflation-Protected Securities (TIPS) may offer protection against inflation while maintaining capital preservation.

Moreover, considering international diversification can be beneficial as currency valuations fluctuate globally. The potential for currency wars—where countries engage in competitive devaluations—could impact returns on foreign investments significantly.

Risk Factors Ahead

Despite the dollar’s current strength, risks loom large on the horizon. A potential escalation in geopolitical tensions or trade disputes could lead to sudden shifts in currency valuations. Furthermore, if inflation persists longer than anticipated or if economic growth falters significantly, we could see volatility return to financial markets.

As such, maintaining a diversified portfolio that includes a mix of equities, fixed income, and alternative assets will be crucial for navigating these uncertainties effectively.

A Look Ahead: Strategic Considerations

The outlook for the U.S. dollar remains complex as we approach year-end 2023. Investors should remain vigilant about macroeconomic indicators while keeping an eye on potential changes in Fed policy that could alter interest rate trajectories. With a focus on capital preservation and steady income generation being paramount for many retirees today, strategic asset allocation will be key to weathering any forthcoming storms.

In conclusion, while the dollar exhibits surprising resilience amid global uncertainties, prudent investment choices grounded in careful analysis will empower retirees to safeguard their financial futures effectively.