The recent surge in electric vehicle (EV) stocks has captivated investors, particularly those within the middle-income bracket who are keen on capitalizing on macroeconomic trends. Companies like Tesla and Rivian have seen their market valuations soar, spurred by a combination of technological advancements, government incentives, and a growing consumer preference for sustainable energy solutions. However, as the market heats up, questions arise: Is this a sustainable trend or merely a bubble waiting to burst?

Current Market Dynamics

As of late 2023, the U.S. stock market is navigating a complex landscape shaped by fluctuating inflation rates and interest rate policies from the Federal Reserve. With inflation showing signs of moderation, albeit still above target levels, the Fed’s approach to interest rates will be pivotal in determining market sentiment. According to Bloomberg, the central bank is expected to maintain a cautious stance as it balances economic growth against inflationary pressures.

The dollar index remains strong, which can affect foreign investments in U.S. equities. This strength could dampen enthusiasm for EV stocks as international buyers face higher costs when investing in American companies. Furthermore, employment figures indicate a resilient labor market; however, wage growth is slowing, which could impact consumer spending power—a critical factor for EV manufacturers relying on discretionary income.

Industry Shifts and Structural Changes

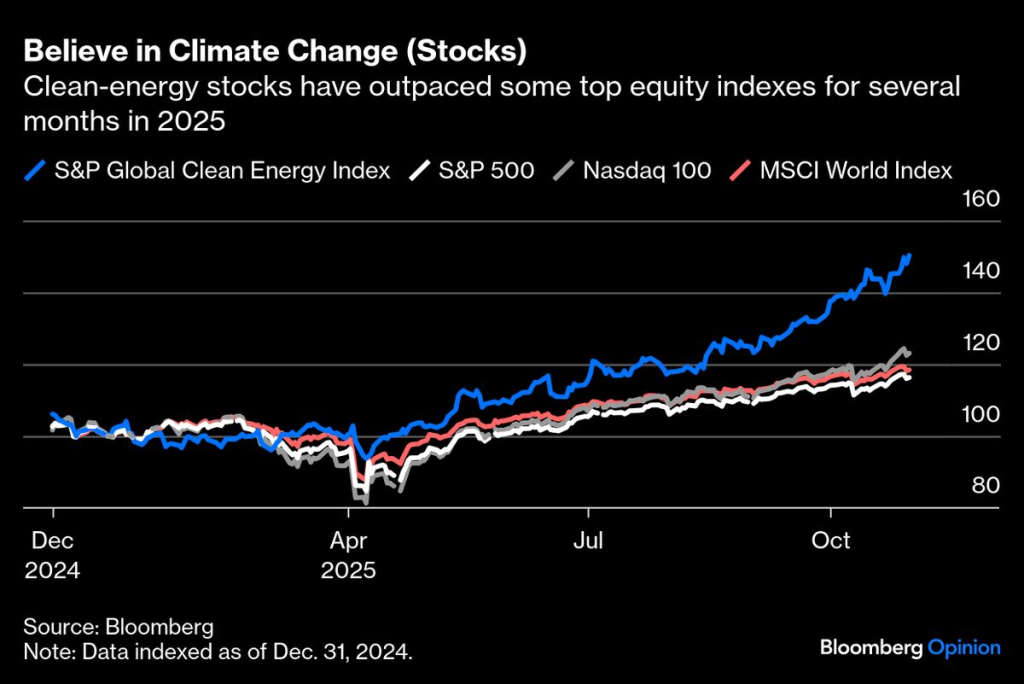

The clean energy sector is undergoing significant structural changes. The transition from fossil fuels to renewable energy sources is not just an environmental imperative but also an economic opportunity. Major players in the energy sector are pivoting towards electric mobility and renewable technologies. According to Reuters, investments in EV infrastructure are projected to exceed $100 billion over the next five years as companies race to capture market share.

This shift has led to increased competition among traditional automakers entering the EV space alongside established tech firms venturing into automotive manufacturing. For instance, Ford and General Motors have announced substantial investments in EV production facilities aimed at increasing their market presence against stalwarts like Tesla.

Institutional Perspectives

Institutional investors are closely monitoring these developments. High-profile firms such as Goldman Sachs and Morgan Stanley have expressed caution regarding overvaluation in the clean energy sector. They highlight that while growth potential exists, current valuations may not reflect underlying fundamentals accurately. A report from CNBC indicates that many analysts believe that while some companies possess robust growth trajectories, others may be riding speculative waves driven by investor enthusiasm rather than solid financial performance.

Investment Opportunities Amidst Risks

For seasoned investors looking for opportunities within this volatile environment, several strategies can be employed. Diversifying through Exchange-Traded Funds (ETFs) focused on clean energy can provide exposure without the risks associated with individual stocks. Additionally, focusing on established companies with solid balance sheets and a clear path toward profitability may mitigate risks associated with speculative investments.

Moreover, sectors adjacent to electric vehicles—such as battery technology and renewable energy infrastructure—offer promising investment avenues. As demand for EVs grows, so too will the need for efficient charging solutions and advanced battery technologies.

Risks on the Horizon

However, potential pitfalls remain evident. Regulatory changes could alter incentives for EV adoption or impose stricter guidelines on emissions that may affect manufacturers’ operational costs. Furthermore, supply chain disruptions continue to pose challenges; recent geopolitical tensions have exacerbated shortages of critical materials required for battery production.

The looming threat of rising interest rates poses another risk factor that could stifle consumer financing options for vehicle purchases—an essential component of EV sales growth.

A Balanced Perspective Moving Forward

The current landscape of U.S. stock markets reflects both opportunity and uncertainty within the clean energy sector. Investors must weigh potential gains against inherent risks while staying informed about macroeconomic indicators influencing market trends. As we move forward into 2024 and beyond, maintaining a vigilant approach will be crucial for navigating these turbulent waters.

Ultimately, while EV stocks continue to soar amidst heightened interest in clean energy solutions, prudent investment strategies rooted in thorough analysis will be essential for those seeking sustainable returns without succumbing to speculative bubbles.