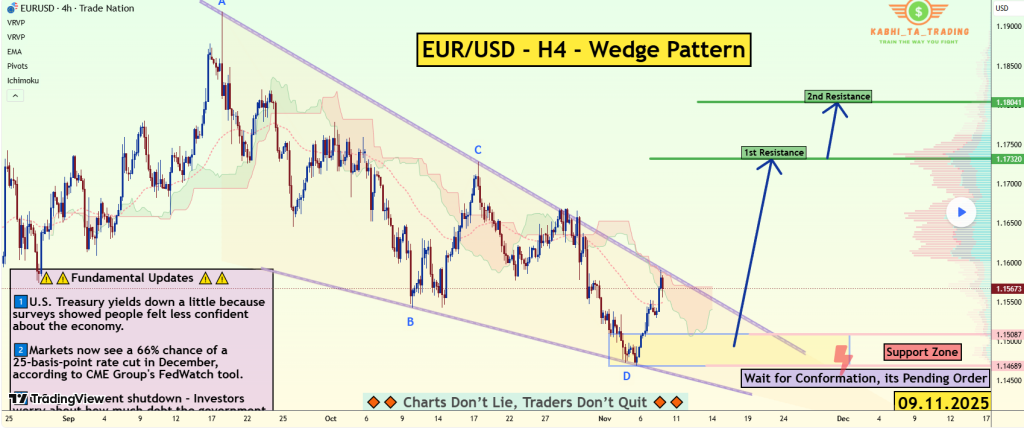

The EUR/USD currency pair is currently exhibiting a falling wedge pattern on the H4 chart, a bullish reversal structure that may signal a shift in momentum after an extended period of downward pressure. As this pair approaches the upper trendline of the wedge, traders are eagerly watching for a potential breakout. While confirmation remains essential, the implications of such a move could be significant for investors, particularly family finance enthusiasts looking to make informed decisions in today’s volatile market.

Recent economic indicators highlight a weakening U.S. dollar, primarily influenced by declining Treasury yields and diminishing consumer confidence. According to a recent survey, consumer sentiment has softened, which has contributed to the dollar’s declining strength. Furthermore, market participants are pricing in a 66% probability of a 25 basis point rate cut by the Federal Reserve in December. Such expectations can create uncertainty and impact investor sentiment significantly.

The concern regarding government funding has also resurfaced, as fears about a potential U.S. government shutdown loom over the market. This situation further constrains demand for the dollar, creating an environment ripe for EUR/USD rebounds if the currency pair manages to maintain momentum above the wedge.

As family financial managers consider their investment strategies, it is crucial to keep an eye on key technical levels. Should a confirmed breakout occur above the wedge and the cloud resistance zone, traders can anticipate movements towards 1.1730 as the first resistance level and 1.1800 as the second resistance level. Conversely, support levels sit around 1.1500 to 1.1470, indicating where price action may stabilize in case of downward movement.

It is essential for investors to approach this scenario with caution while remaining aware of potential market shifts. Staying informed about these technical indicators and fundamental developments will empower family finance managers to make sound investment choices.