In recent years, digital wallets have emerged as a crucial component of America’s financial ecosystem, reshaping consumer behavior and investment strategies. As ESG investors increasingly seek sustainable growth opportunities, understanding the implications of digital wallets on the U.S. stock market is paramount. These technologies are not only enhancing convenience but are also driving significant changes in market dynamics, presenting unique investment opportunities for those who recognize the trend.

The Rise of Digital Wallets and Market Trends

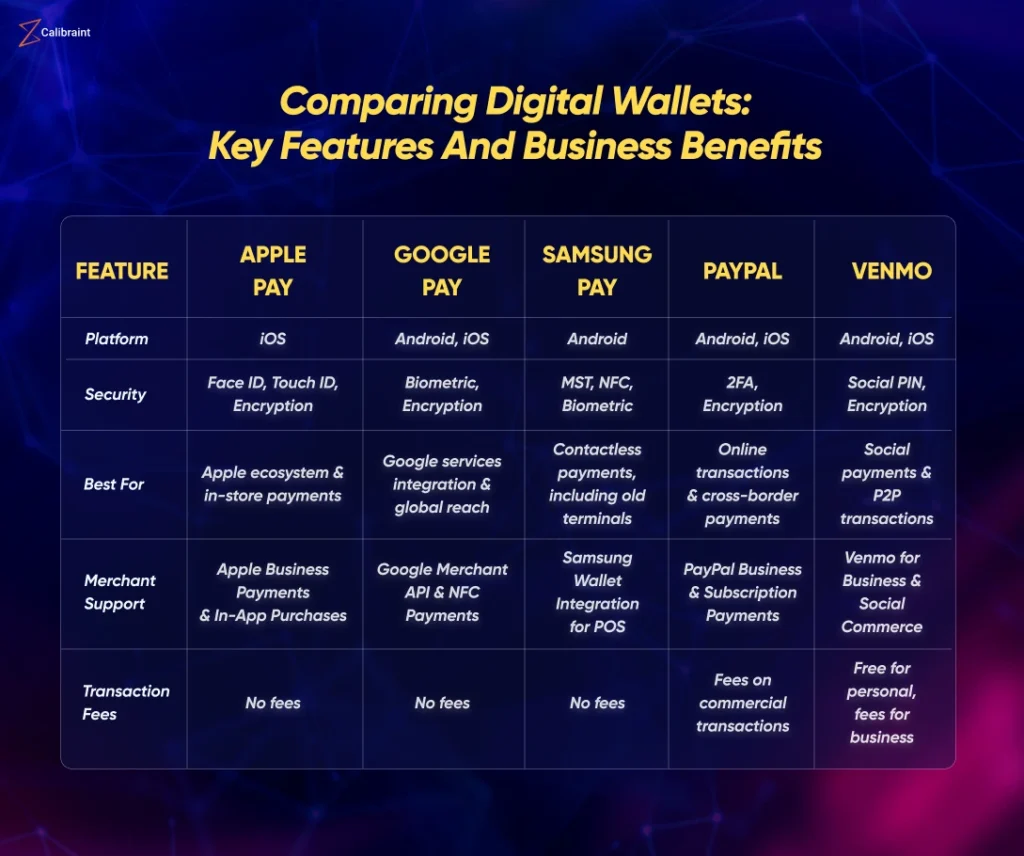

According to a report from Bloomberg, digital wallets are projected to account for over 50% of online payments by 2025, reflecting a shift in consumer preferences towards cashless transactions. This transformation is reshaping the financial landscape and prompting institutional investors to reevaluate their portfolios. Major players such as PayPal and Square are expanding their services, integrating features that promote sustainability and social responsibility. As a result, these companies are becoming attractive options for ESG-minded investors.

Investment Opportunities in the Digital Payment Sector

Investors should consider the implications of this shift towards digital wallets on various sectors, particularly technology and financial services. The energy sector, for instance, is witnessing a growing convergence with fintech innovations, as companies adopt digital payment solutions to facilitate renewable energy transactions. Institutions like Goldman Sachs and Morgan Stanley have begun to highlight these trends in their market analyses, indicating a potential surge in demand for companies that integrate sustainable practices with technological advancements.

Understanding the Regulatory Environment

The evolving regulatory landscape surrounding digital currencies and payment systems will also play a critical role in shaping investment strategies. The SEC has begun to engage with industry stakeholders to establish clearer guidelines, aiming to balance innovation with consumer protection. Investors should stay informed about these developments, as favorable regulations could enhance the growth prospects of leading digital wallet providers, making them lucrative investment opportunities.

Furthermore, as consumers increasingly demand transparency and ethical practices, companies that prioritize corporate social responsibility are likely to gain competitive advantages. This shift towards ethical consumption is reinforcing the importance of aligning investments with personal values and societal needs, driving demand for stocks that embody these principles.

Conclusion: Embracing Change in Investment Strategies

The rise of digital wallets signifies a profound shift in America’s financial landscape, creating new avenues for growth amidst an evolving market environment. For ESG investors, recognizing these trends and aligning portfolios accordingly is essential for capitalizing on emerging opportunities. As we navigate this transformation, it is crucial to remain vigilant about both technological advancements and regulatory changes that will shape the future of finance.

Don’t miss out on exclusive insights and community discussions on ESG investing! Join our vibrant community where like-minded investors share strategies and opportunities. Click here to connect with us: Join Now!