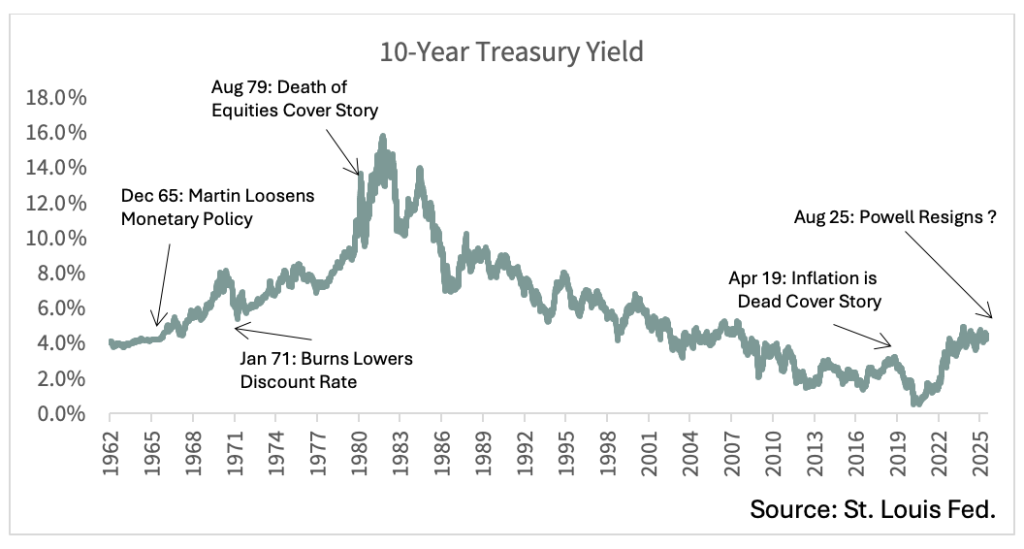

As inflation rates soar to levels not seen in decades, the traditional savings account is facing an existential crisis. For investors, particularly those new to the U.S. stock market, this financial landscape prompts a reevaluation of where and how to allocate capital. The Fed’s recent moves and rising interest rates have spurred conversations about liquidity, investment strategies, and the overall structure of the financial markets.

The Impact of Inflation on Savings Accounts

Traditionally, savings accounts have been viewed as a safe haven for cash reserves, offering modest interest rates to help mitigate inflation’s impact. However, with inflation currently outpacing these interest rates, the real value of money held in savings accounts is eroding. According to Bloomberg, inflation reached a staggering 8.6% year-over-year in May 2022, leading many to question the viability of traditional savings as a wealth-preservation tool. Instead, investors are shifting their focus towards more lucrative avenues such as stocks and ETFs.

Market Trends and Institutional Flows

As a result of these shifting dynamics, we are witnessing significant institutional flows towards sectors that are better positioned to weather inflationary pressures. Tech stocks and energy sector investments have become particularly attractive, with companies showing resilience amid rising costs. As reported by CNBC, major tech firms are still posting impressive earnings, which could lead to increased investment opportunities for retail investors looking to capitalize on this trend.

Investment Opportunities in a Changing Landscape

For those contemplating where to invest amidst rising inflation, consider diversifying into sectors like technology and energy. ETFs focused on these areas offer a balanced way to engage with the market while mitigating risks associated with individual stocks. Additionally, alternative investments, such as real estate and commodities, are gaining traction as hedge against inflation. This shift not only reflects a strategic pivot by institutional investors but also opens new doors for retail investors seeking to enhance their portfolios in a challenging economic environment.

As we navigate this landscape of rising inflation and evolving investment strategies, it’s essential to stay informed and proactive. The current market conditions may seem daunting, but they also present unique opportunities for savvy investors willing to adapt. Embracing these changes could very well be the key to long-term financial success.

Don’t miss out on exclusive insights and strategies tailored for today’s financial climate. Join our community of investors today for invaluable tips and discussions that could redefine your investment journey! Join Now!